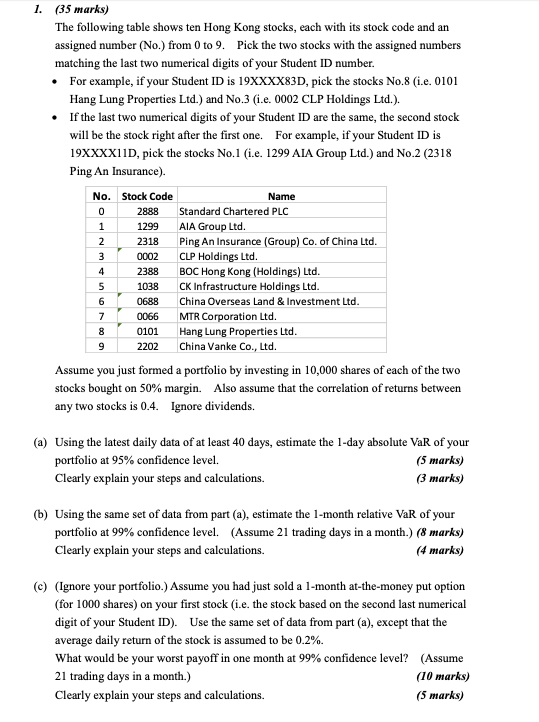

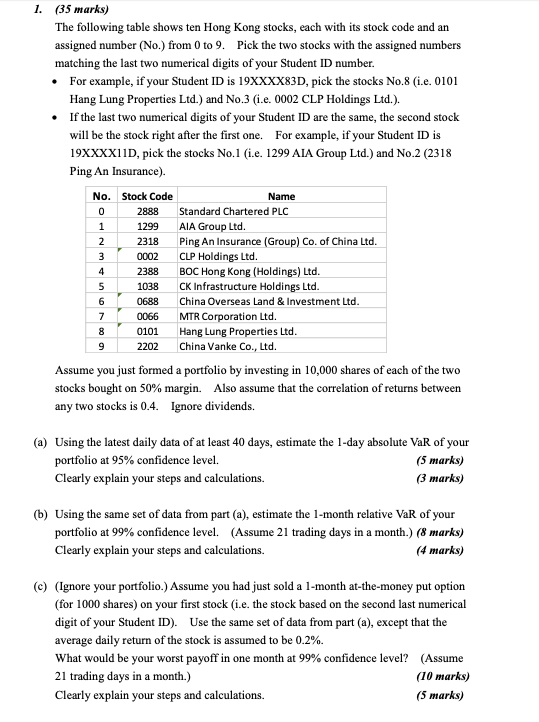

Please pick (2) and (4)

| 2 | 2318 | Ping An Insurance (Group) Co. of China Ltd. |

| 4 | 2388 | BOC Hong Kong (Holdings) Ltd. |

Assume you just formed a portfolio by investing in 10,000 shares of each of the two stocks bought on 50% margin. Also assume that the correlation of returns between any two stocks is 0.4. Ignore dividends.

#Please answer my question Please answer my Q before 5:00 pm really thanks!

#Please answer my question Please answer my Q before 5:00 pm really thanks!

1. (35 marks) The following table shows ten Hong Kong stocks, each with its stock code and an assigned number (No.) from 0 to 9. Pick the two stocks with the assigned numbers matching the last two numerical digits of your Student ID number. For example, if your Student ID is 19XXXX83D, pick the stocks No.8 (i.e. 0101 Hang Lung Properties Ltd.) and No.3 (1.e. 0002 CLP Holdings Ltd.). If the last two numerical digits of your Student ID are the same, the second stock will be the stock right after the first one. For example, if your Student ID is 19XXXX11D, pick the stocks No.1 (i.e. 1299 AIA Group Ltd.) and No.2 (2318 Ping An Insurance). No. Stock Code Name Standard Chartered PLC AIA Group Ltd. Ping An Insurance (Group) Co. of China Ltd. CLP Holdings Ltd. BOC Hong Kong (Holdings) Ltd. 5 1038 CK Infrastructure Holdings Ltd. China Overseas Land & Investment Ltd. MTR Corporation Ltd. 0101 Hang Lung Properties Ltd. 9 2202 China Vanke Co., Ltd. Assume you just formed a portfolio by investing in 10,000 shares of each of the two stocks bought on 50% margin. Also assume that the correlation of returns between any two stocks is 0.4. Ignore dividends. 0 1 2 2888 1299 2318 0002 2388 3 4 6 7 8 0688 0066 D 0 (a) Using the latest daily data of at least 40 days, estimate the 1-day absolute VaR of your portfolio at 95% confidence level. (5 marks) Clearly explain your steps and calculations. (3 marks) (b) Using the same set of data from part (a), estimate the 1-month relative VaR of your portfolio at 99% confidence level. (Assume 21 trading days in a month.) (8 marks) Clearly explain your steps and calculations. (4 marks) (c) (Ignore your portfolio.) Assume you had just sold a 1-month at-the-money put option (for 1000 shares) on your first stock (i.e. the stock based on the second last numerical digit of your Student ID). Use the same set of data from part (a), except that the average daily return of the stock is assumed to be 0.2%. What would be your worst payoff in one month at 99% confidence level? (Assume 21 trading days in a month.) (10 marks) Clearly explain your steps and calculations. (5 marks) 1. (35 marks) The following table shows ten Hong Kong stocks, each with its stock code and an assigned number (No.) from 0 to 9. Pick the two stocks with the assigned numbers matching the last two numerical digits of your Student ID number. For example, if your Student ID is 19XXXX83D, pick the stocks No.8 (i.e. 0101 Hang Lung Properties Ltd.) and No.3 (1.e. 0002 CLP Holdings Ltd.). If the last two numerical digits of your Student ID are the same, the second stock will be the stock right after the first one. For example, if your Student ID is 19XXXX11D, pick the stocks No.1 (i.e. 1299 AIA Group Ltd.) and No.2 (2318 Ping An Insurance). No. Stock Code Name Standard Chartered PLC AIA Group Ltd. Ping An Insurance (Group) Co. of China Ltd. CLP Holdings Ltd. BOC Hong Kong (Holdings) Ltd. 5 1038 CK Infrastructure Holdings Ltd. China Overseas Land & Investment Ltd. MTR Corporation Ltd. 0101 Hang Lung Properties Ltd. 9 2202 China Vanke Co., Ltd. Assume you just formed a portfolio by investing in 10,000 shares of each of the two stocks bought on 50% margin. Also assume that the correlation of returns between any two stocks is 0.4. Ignore dividends. 0 1 2 2888 1299 2318 0002 2388 3 4 6 7 8 0688 0066 D 0 (a) Using the latest daily data of at least 40 days, estimate the 1-day absolute VaR of your portfolio at 95% confidence level. (5 marks) Clearly explain your steps and calculations. (3 marks) (b) Using the same set of data from part (a), estimate the 1-month relative VaR of your portfolio at 99% confidence level. (Assume 21 trading days in a month.) (8 marks) Clearly explain your steps and calculations. (4 marks) (c) (Ignore your portfolio.) Assume you had just sold a 1-month at-the-money put option (for 1000 shares) on your first stock (i.e. the stock based on the second last numerical digit of your Student ID). Use the same set of data from part (a), except that the average daily return of the stock is assumed to be 0.2%. What would be your worst payoff in one month at 99% confidence level? (Assume 21 trading days in a month.) (10 marks) Clearly explain your steps and calculations

#Please answer my question Please answer my Q before 5:00 pm really thanks!

#Please answer my question Please answer my Q before 5:00 pm really thanks!