Question

Please provide concise/brief answers to the following questions. a. [5] Why are corporate restructuring strategies like selling a put option? What does this imply for

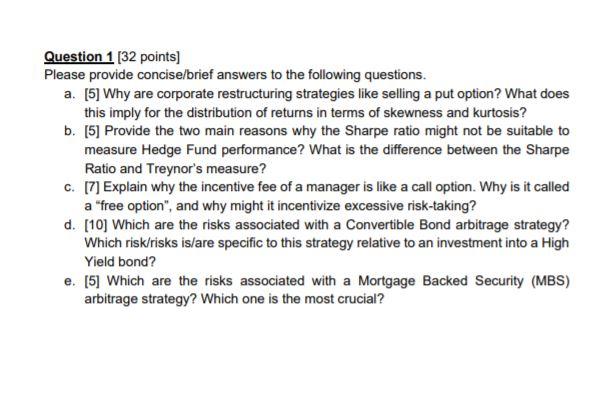

Please provide concise/brief answers to the following questions. a. [5] Why are corporate restructuring strategies like selling a put option? What does this imply for the distribution of returns in terms of skewness and kurtosis? b. [5] Provide the two main reasons why the Sharpe ratio might not be suitable to measure Hedge Fund performance? What is the difference between the Sharpe Ratio and Treynors measure? c. [7] Explain why the incentive fee of a manager is like a call option. Why is it called a free option, and why might it incentivize excessive risk-taking? d. [10] Which are the risks associated with a Convertible Bond arbitrage strategy? Which risk/risks is/are specific to this strategy relative to an investment into a High Yield bond? e. [5] Which are the risks associated with a Mortgage Backed Security (MBS) arbitrage strategy? Which one is the most crucial?

Please provide concise/brief answers to the following questions. a. [5] Why are corporate restructuring strategies like selling a put option? What does this imply for the distribution of returns in terms of skewness and kurtosis? b. [5] Provide the two main reasons why the Sharpe ratio might not be suitable to measure Hedge Fund performance? What is the difference between the Sharpe Ratio and Treynors measure? c. [7] Explain why the incentive fee of a manager is like a call option. Why is it called a free option, and why might it incentivize excessive risk-taking? d. [10] Which are the risks associated with a Convertible Bond arbitrage strategy? Which risk/risks is/are specific to this strategy relative to an investment into a High Yield bond? e. [5] Which are the risks associated with a Mortgage Backed Security (MBS) arbitrage strategy? Which one is the most crucial?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started