Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide formula, to better understand. Thank you! 2. The yield to maturity on a 3 year 6.75% annual coupon bond is 10.5% per year.

Please provide formula, to better understand. Thank you!

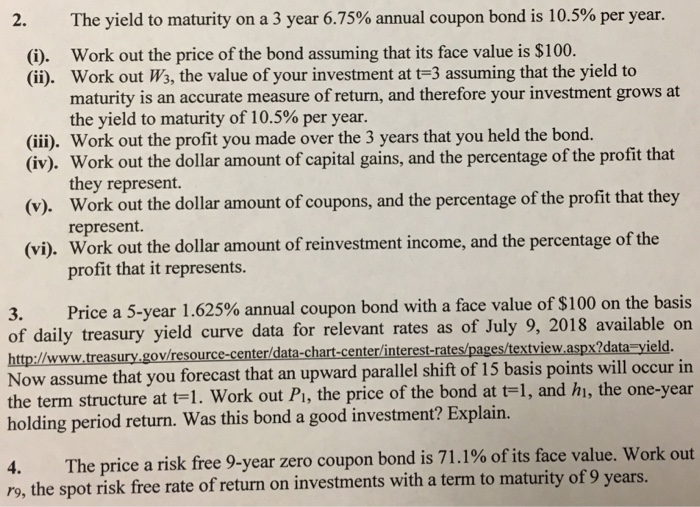

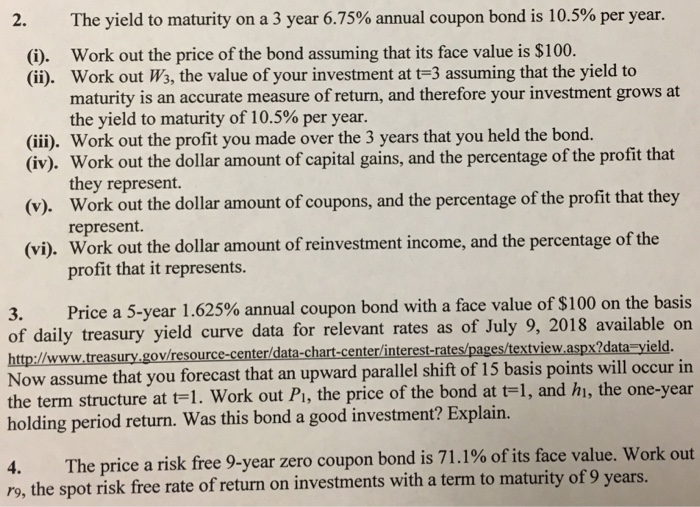

2. The yield to maturity on a 3 year 6.75% annual coupon bond is 10.5% per year. Work out the price of the bond assuming that its face value is $100. Work out Ws, the value of your investment at t-3 assuming that the yield to maturity is an accurate measure of return, and therefore your investment grows at the yield to maturity of 10.5% per year (i). (ii). (ii). Work out the profit you made over the 3 years that you held the bond. (iv). Work out the dollar amount of capital gains, and the percentage of the profit that (v). Work out the dollar amount of coupons, and the percentage of the profit that they (vi). Work out the dollar amount of reinvestment income, and the percentage of the they represent. represent. profit that it represents. Price a 5-year 1.625% annual coupon bond with a face value of $100 on the basis 3. of daily treasury yield curve data for relevant rates as of July 9, 2018 available on http://www.treasury,gov/resource-center/data-chart-center/interest-rates/pages/textview aspx2data yield. Now assume that you forecast that an upward parallel shift of 15 basis the term structure at t-1. Work out Pi, the price of the bond at t holding period return. Was this bond a good investment? Explain. points will occur in -1, and hi, the one-year The price a risk free 9-year zero coupon bond is 71.1% of its face value. Work out ro, the spot risk free rate of return on investments with a term to maturity of 9 years 2. The yield to maturity on a 3 year 6.75% annual coupon bond is 10.5% per year. Work out the price of the bond assuming that its face value is $100. Work out Ws, the value of your investment at t-3 assuming that the yield to maturity is an accurate measure of return, and therefore your investment grows at the yield to maturity of 10.5% per year (i). (ii). (ii). Work out the profit you made over the 3 years that you held the bond. (iv). Work out the dollar amount of capital gains, and the percentage of the profit that (v). Work out the dollar amount of coupons, and the percentage of the profit that they (vi). Work out the dollar amount of reinvestment income, and the percentage of the they represent. represent. profit that it represents. Price a 5-year 1.625% annual coupon bond with a face value of $100 on the basis 3. of daily treasury yield curve data for relevant rates as of July 9, 2018 available on http://www.treasury,gov/resource-center/data-chart-center/interest-rates/pages/textview aspx2data yield. Now assume that you forecast that an upward parallel shift of 15 basis the term structure at t-1. Work out Pi, the price of the bond at t holding period return. Was this bond a good investment? Explain. points will occur in -1, and hi, the one-year The price a risk free 9-year zero coupon bond is 71.1% of its face value. Work out ro, the spot risk free rate of return on investments with a term to maturity of 9 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started