Please solve ASAP..

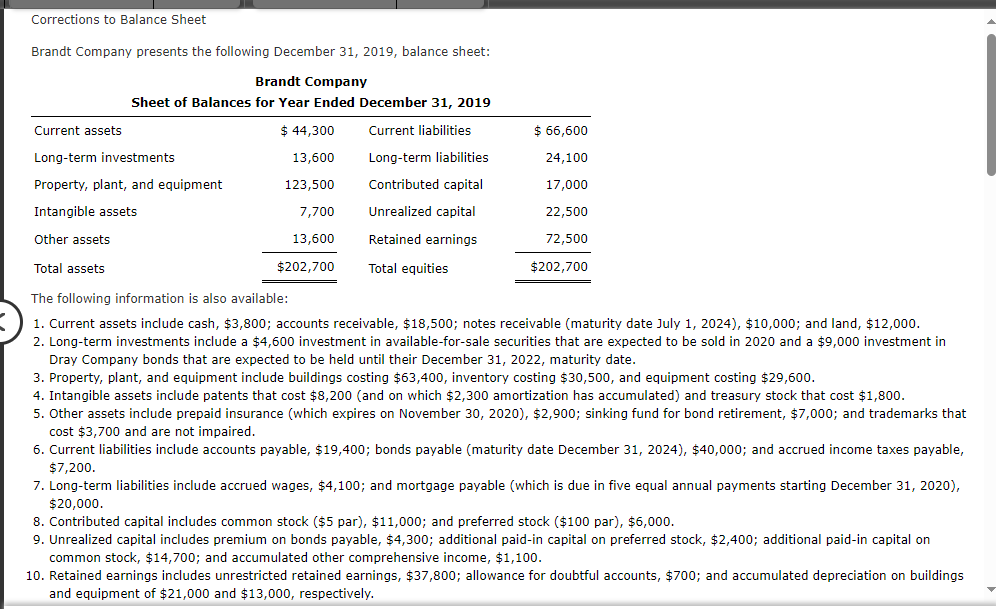

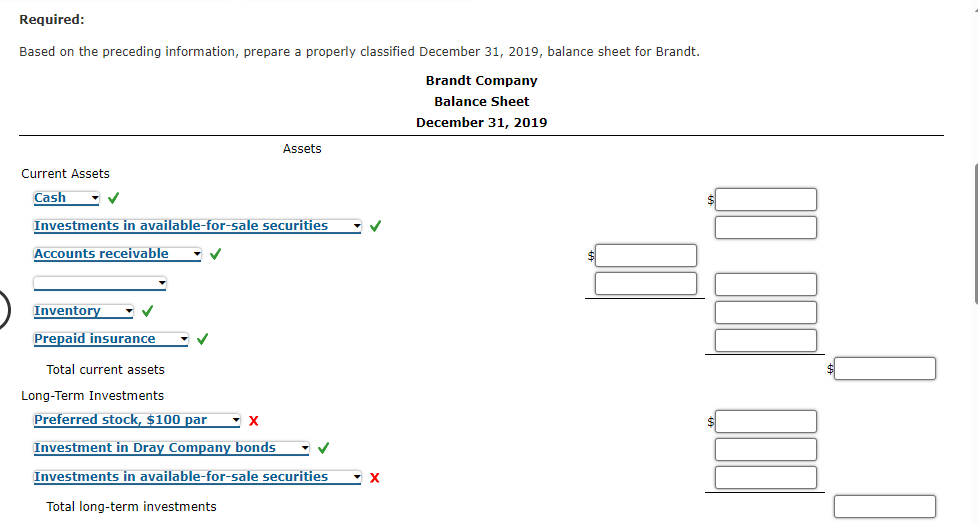

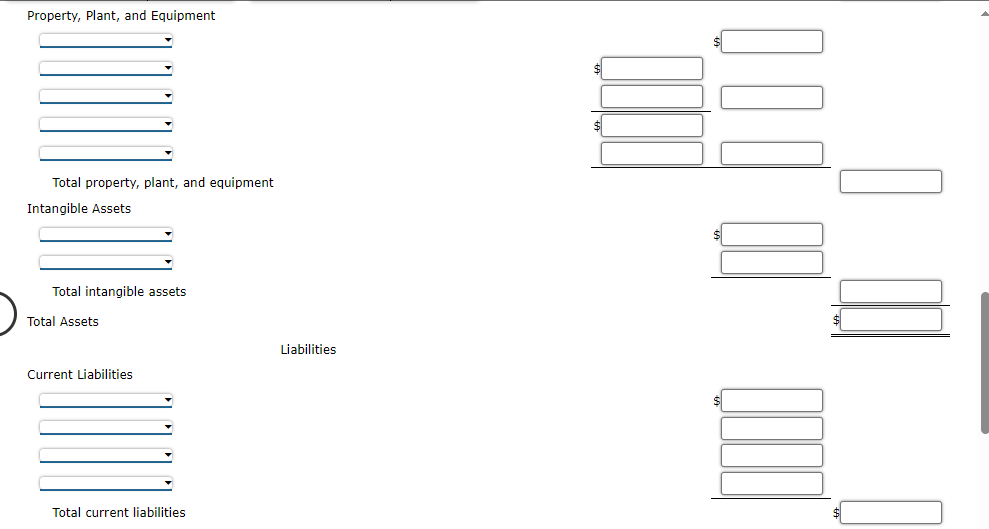

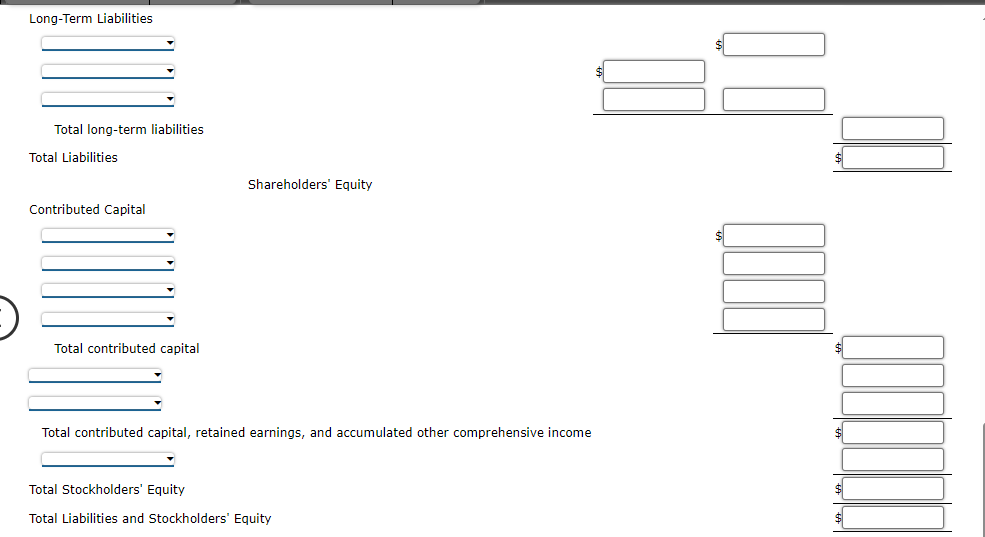

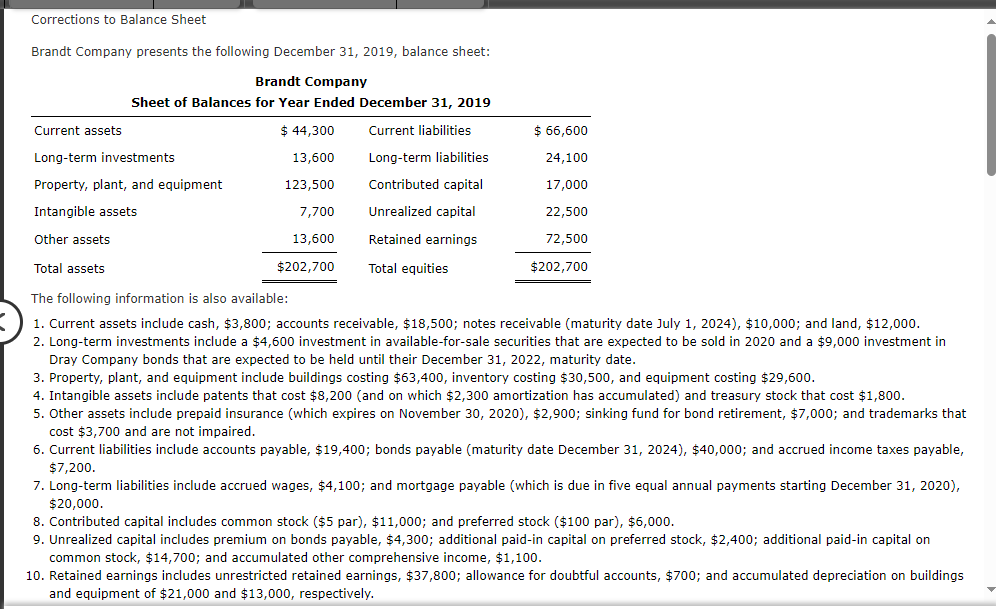

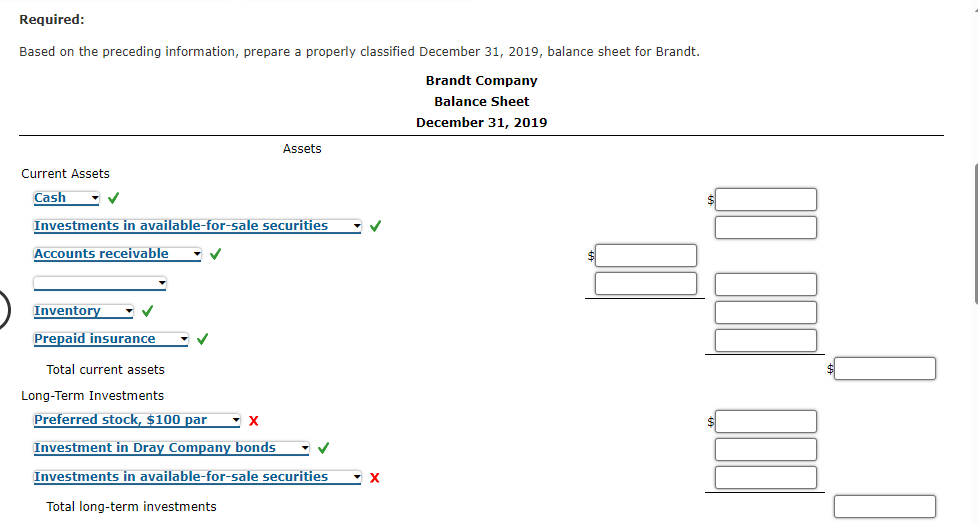

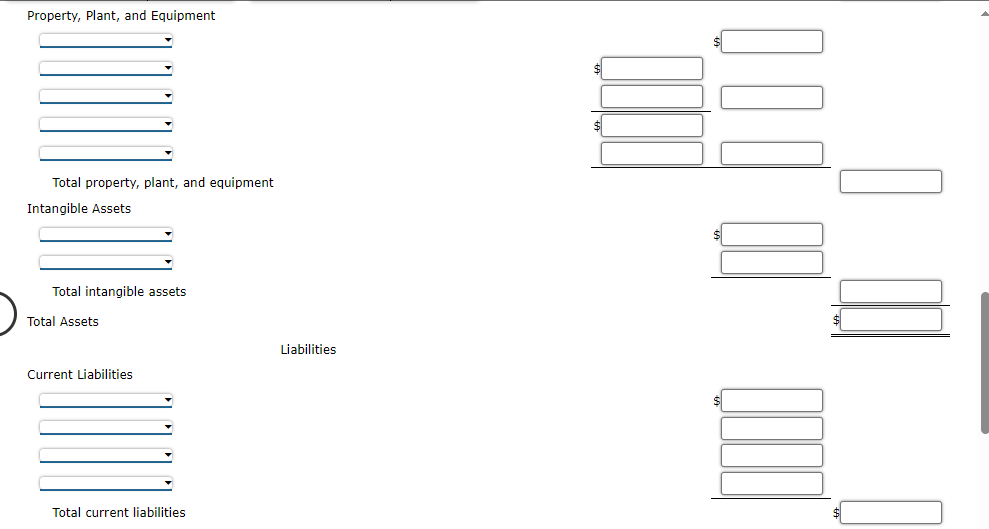

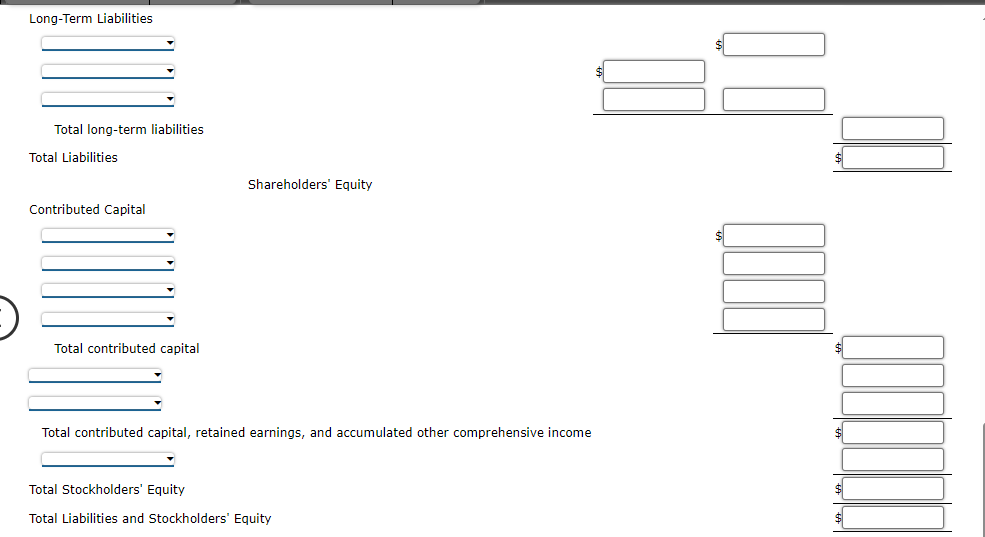

Required: Based on the preceding information, prepare a properly classified December 31, 2019, balance sheet for Brandt. Corrections to Balance Sheet Brandt Company presents the following December 31, 2019, balance sheet: The following information is also available: 1. Current assets include cash, $3,800; accounts receivable, $18,500; notes receivable (maturity date July 1,2024 ), $10,000; and land, $12,000. 2. Long-term investments include a $4,600 investment in available-for-sale securities that are expected to be sold in 2020 and a $9,000 investment in Dray Company bonds that are expected to be held until their December 31,2022, maturity date. 3. Property, plant, and equipment include buildings costing $63,400, inventory costing $30,500, and equipment costing $29,600. 4. Intangible assets include patents that cost $8,200 (and on which $2,300 amortization has accumulated) and treasury stock that cost $1,800. 5. Other assets include prepaid insurance (which expires on November 30, 2020), $2,900; sinking fund for bond retirement, $7,000; and trademarks that cost $3,700 and are not impaired. 6. Current liabilities include accounts payable, $19,400; bonds payable (maturity date December 31,2024 ), $40,000; and accrued income taxes payable, $7,200. 7. Long-term liabilities include accrued wages, $4,100; and mortgage payable (which is due in five equal annual payments starting December 31,2020 ), $20,000. 8. Contributed capital includes common stock ( $5 par), $11,000; and preferred stock ( $100 par), $6,000. 9. Unrealized capital includes premium on bonds payable, $4,300; additional paid-in capital on preferred stock, $2,400; additional paid-in capital on common stock, $14,700; and accumulated other comprehensive income, $1,100. 10. Retained earnings includes unrestricted retained earnings, $37,800; allowance for doubtful accounts, $700; and accumulated depreciation on buildings and equipment of $21,000 and $13,000, respectively. Long-Term Liabilities Total long-term liabilities Total Liabilities Shareholders' Equity Total contributed capital Total contributed capital, retained earnings, and accumulated other comprehensive income Total Stockholders' Equity Total Liabilities and Stockholders' Equity Property, Plant, and Equipment Total property, plant, and equipment Intangible Assets Total intangible assets Total Assets Liabilities Current Liabilities Total current liabilities