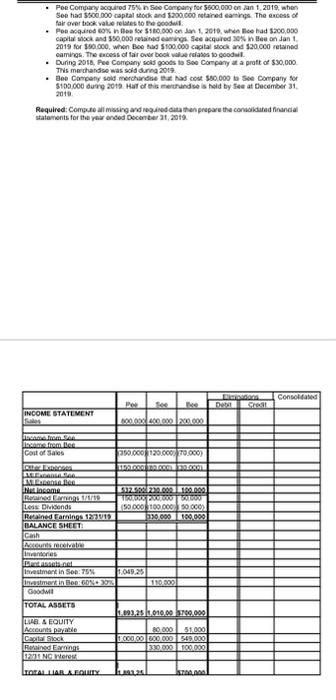

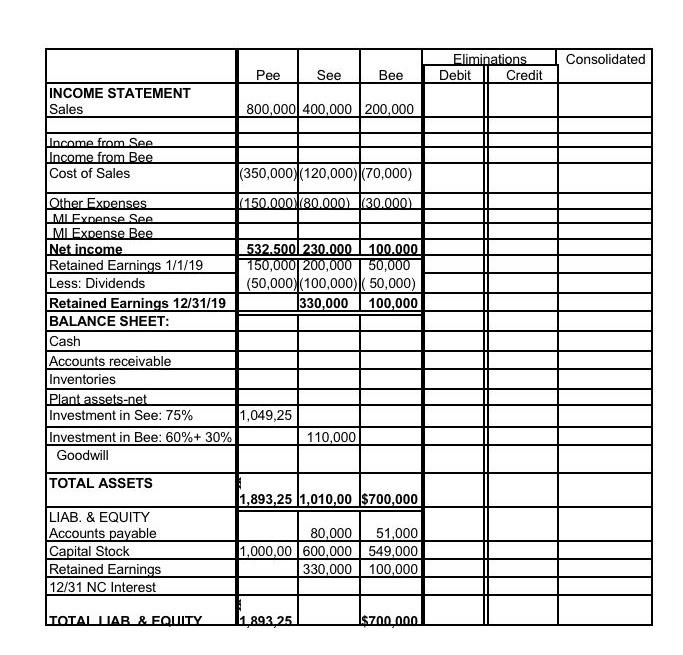

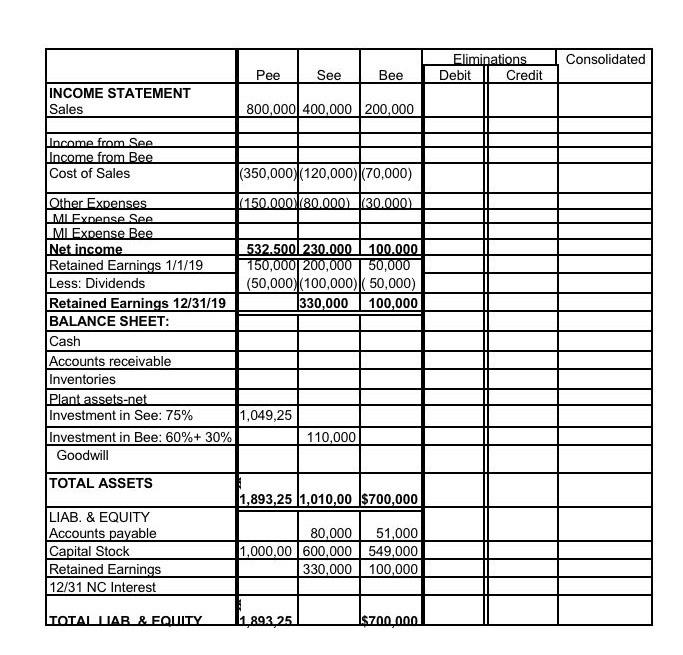

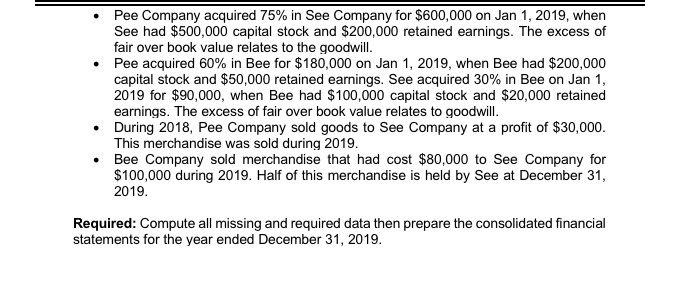

. Poe Company acquired 75% Soo Company for $600,000 na 1 2019, when See had 800.000 capital stock and $200.000 metare coming The excess of Pair overbook value relates to the goodul Po acquired to be for $100.000 1. 2010, when he had 5200,000 capitarock and 590.000 retained cantins See acqured 20 oson Jan 1 2019 for $90.000, when Bead 5100.000 capital stock and 520.000 retained Conaprot of $30.000 caminos The excess of far for y sold merchant Required: Computeal missing and data the prepare the candidated Panda Stations for the year ended December 2009 2010 Consolated INCOME STATEMENT 100 000 000 boom.nl Liarem les Cost of Saks 250.000 120.000.000) COLORS HAIRSTREARATE TENDALS TORNA Netcome 22. 230.000 100.000 FOR Less Donds 50.000 100000 50000) Remained Earnings 12719 020.000 100.000 BALANCE SHEET Cash A cette intores Del investment in Son 75% 11.049.25 Un esmentin BOD ON 110.000 Godt TOTAL ASSETS 1.093.25.1.010.00 100.000 LUAR & EQUITY Apayable 80 000 51.000 Capital Sock 100000 000 000 569.000 Roined Earnings 330.000 100.000 32 NG Wrest TOTALLAR A ELLY LL26 ko Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital stock and $200,000 retained earnings. The excess of fair over book value relates to the goodwill. Pee acquired 60% in Bee for $180,000 on Jan 1, 2019, when Bee had $200,000 capital stock and $50,000 retained earnings. See acquired 30% in Bee on Jan 1, 2019 for $90,000, when Bee had $100,000 capital stock and $20,000 retained earnings. The excess of fair over book value relates to goodwill. During 2018, Pee Company sold goods to See Company at a profit of $30,000. This merchandise was sold during 2019. Bee Company sold merchandise that had cost $80,000 to See Company for $100,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financial statements for the year ended December 31, 2019. Eliminations Debit Credit Consolidated Pee See Bee INCOME STATEMENT Sales 800,000 400,000 200,000 Income from See Income from Bee Cost of Sales (350,000 (120,000) (70,000) Other Expenses (150.000 80.000) 130.000) ML Expense See ML Expense Bee Net income 532.500 230.000 100.000 Retained Earnings 1/1/19 150,000 200,000 50,000 Less: Dividends (50,000) (100,000) 50,000) Retained Earnings 12/31/19 330,000 100,000 BALANCE SHEET: Cash Accounts receivable Inventories Plant assets-net Investment in See: 75% 1,049,25 Investment in Bee: 60%+ 30% 110,000 Goodwill TOTAL ASSETS 11,893,25 1,010,00 $700,000 LIAB. & EQUITY Accounts payable Capital Stock Retained Earnings 12/31 NC Interest 80,000 51,000 1,000,00 600,000 549,000 330,000 100,000 TOTAL TIAR & EQUITY 1,893,25 $700.000 Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital stock and $200,000 retained earnings. The excess of fair over book value relates to the goodwill. Pee acquired 60% in Bee for $180,000 on Jan 1, 2019, when Bee had $200,000 capital stock and $50,000 retained earnings. See acquired 30% in Bee on Jan 1, 2019 for $90,000, when Bee had $100,000 capital stock and $20,000 retained earnings. The excess of fair over book value relates to goodwill. . During 2018, Pee Company sold goods to See Company at a profit of $30,000. This merchandise was sold during 2019. Bee Company sold merchandise that had cost $80,000 to See Company for $100,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financial statements for the year ended December 31, 2019. Consolidated Eliminations Debit Credit Pee See Bee INCOME STATEMENT Sales 800,000 400,000 200,000 Income from See Income from Bee Cost of Sales (350,000) (120,000) (70,000) Other Expenses 150.000 80.000) 130.000) ML Expense See ML Expense Bee Net income 532.500 230.000 100.000 Retained Earnings 1/1/19 150,000 200,000 50,000 Less: Dividends (50,000) 100,000) 50,000) Retained Earnings 12/31/19 330,000 100,000 BALANCE SHEET: Cash Accounts receivable inventories Plant assets-net Investment in See: 75% 1,049,25 Investment in Bee: 60%+ 30% 110,000 Goodwill TOTAL ASSETS 11,893,25 1,010,00 $700,000 LIAB. & EQUITY Accounts payable Capital Stock Retained Earnings 12/31 NC Interest 80,000 51,000 1,000,00 600,000 549,000 330,000 100,000 TOTAL LIAR & EQUITY 893 25 . Poe Company acquired 75% Soo Company for $600,000 na 1 2019, when See had 800.000 capital stock and $200.000 metare coming The excess of Pair overbook value relates to the goodul Po acquired to be for $100.000 1. 2010, when he had 5200,000 capitarock and 590.000 retained cantins See acqured 20 oson Jan 1 2019 for $90.000, when Bead 5100.000 capital stock and 520.000 retained Conaprot of $30.000 caminos The excess of far for y sold merchant Required: Computeal missing and data the prepare the candidated Panda Stations for the year ended December 2009 2010 Consolated INCOME STATEMENT 100 000 000 boom.nl Liarem les Cost of Saks 250.000 120.000.000) COLORS HAIRSTREARATE TENDALS TORNA Netcome 22. 230.000 100.000 FOR Less Donds 50.000 100000 50000) Remained Earnings 12719 020.000 100.000 BALANCE SHEET Cash A cette intores Del investment in Son 75% 11.049.25 Un esmentin BOD ON 110.000 Godt TOTAL ASSETS 1.093.25.1.010.00 100.000 LUAR & EQUITY Apayable 80 000 51.000 Capital Sock 100000 000 000 569.000 Roined Earnings 330.000 100.000 32 NG Wrest TOTALLAR A ELLY LL26 ko Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital stock and $200,000 retained earnings. The excess of fair over book value relates to the goodwill. Pee acquired 60% in Bee for $180,000 on Jan 1, 2019, when Bee had $200,000 capital stock and $50,000 retained earnings. See acquired 30% in Bee on Jan 1, 2019 for $90,000, when Bee had $100,000 capital stock and $20,000 retained earnings. The excess of fair over book value relates to goodwill. During 2018, Pee Company sold goods to See Company at a profit of $30,000. This merchandise was sold during 2019. Bee Company sold merchandise that had cost $80,000 to See Company for $100,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financial statements for the year ended December 31, 2019. Eliminations Debit Credit Consolidated Pee See Bee INCOME STATEMENT Sales 800,000 400,000 200,000 Income from See Income from Bee Cost of Sales (350,000 (120,000) (70,000) Other Expenses (150.000 80.000) 130.000) ML Expense See ML Expense Bee Net income 532.500 230.000 100.000 Retained Earnings 1/1/19 150,000 200,000 50,000 Less: Dividends (50,000) (100,000) 50,000) Retained Earnings 12/31/19 330,000 100,000 BALANCE SHEET: Cash Accounts receivable Inventories Plant assets-net Investment in See: 75% 1,049,25 Investment in Bee: 60%+ 30% 110,000 Goodwill TOTAL ASSETS 11,893,25 1,010,00 $700,000 LIAB. & EQUITY Accounts payable Capital Stock Retained Earnings 12/31 NC Interest 80,000 51,000 1,000,00 600,000 549,000 330,000 100,000 TOTAL TIAR & EQUITY 1,893,25 $700.000 Pee Company acquired 75% in See Company for $600,000 on Jan 1, 2019, when See had $500,000 capital stock and $200,000 retained earnings. The excess of fair over book value relates to the goodwill. Pee acquired 60% in Bee for $180,000 on Jan 1, 2019, when Bee had $200,000 capital stock and $50,000 retained earnings. See acquired 30% in Bee on Jan 1, 2019 for $90,000, when Bee had $100,000 capital stock and $20,000 retained earnings. The excess of fair over book value relates to goodwill. . During 2018, Pee Company sold goods to See Company at a profit of $30,000. This merchandise was sold during 2019. Bee Company sold merchandise that had cost $80,000 to See Company for $100,000 during 2019. Half of this merchandise is held by See at December 31, 2019. Required: Compute all missing and required data then prepare the consolidated financial statements for the year ended December 31, 2019. Consolidated Eliminations Debit Credit Pee See Bee INCOME STATEMENT Sales 800,000 400,000 200,000 Income from See Income from Bee Cost of Sales (350,000) (120,000) (70,000) Other Expenses 150.000 80.000) 130.000) ML Expense See ML Expense Bee Net income 532.500 230.000 100.000 Retained Earnings 1/1/19 150,000 200,000 50,000 Less: Dividends (50,000) 100,000) 50,000) Retained Earnings 12/31/19 330,000 100,000 BALANCE SHEET: Cash Accounts receivable inventories Plant assets-net Investment in See: 75% 1,049,25 Investment in Bee: 60%+ 30% 110,000 Goodwill TOTAL ASSETS 11,893,25 1,010,00 $700,000 LIAB. & EQUITY Accounts payable Capital Stock Retained Earnings 12/31 NC Interest 80,000 51,000 1,000,00 600,000 549,000 330,000 100,000 TOTAL LIAR & EQUITY 893 25