Answered step by step

Verified Expert Solution

Question

1 Approved Answer

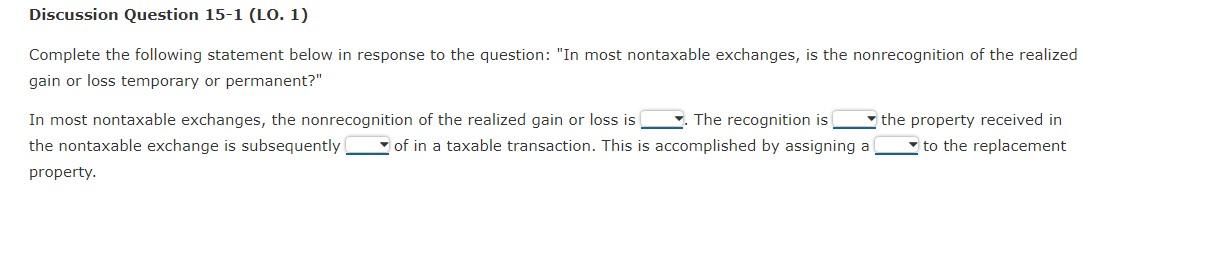

POptions: 1. the nonrecognition of the realized gain or loss is ______ permanent/temporary. 2.The recognition is _____ deferred until/ recognized before 3. ...is subsequently _____

POptions: 1. the nonrecognition of the realized gain or loss is ______ permanent/temporary.

POptions: 1. the nonrecognition of the realized gain or loss is ______ permanent/temporary.

2.The recognition is _____ deferred until/ recognized before

3. ...is subsequently _____ reacquired/ disposed/ improved

4. carryover basis/ fair market value basis/ stepped-up basis

Discussion Question 15-1 (LO. 1) Complete the following statement below in response to the question: "In most nontaxable exchanges, is the nonrecognition of the realized gain or loss temporary or permanent?" In most nontaxable exchanges, the nonrecognition of the realized gain or loss is The recognition is the property received in the nontaxable exchange is subsequently of in a taxable transaction. This is accomplished by assigning a to the replacement propertyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started