Answered step by step

Verified Expert Solution

Question

1 Approved Answer

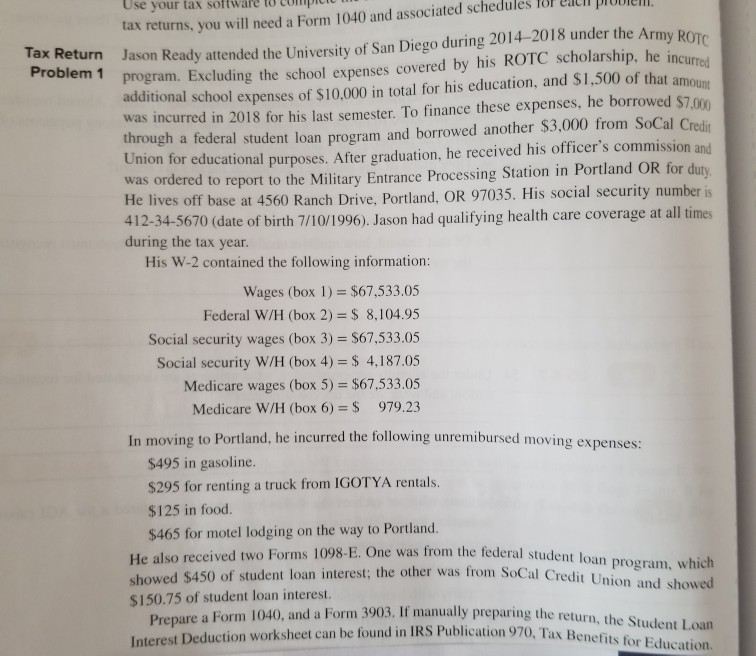

prepare 1040 form, 3903 form moving expenses, and schedule 1 appendix D 2018 tax table (single taxpayer) schedules 18 UAI pibiell associated ea Use your

prepare 1040 form, 3903 form moving expenses, and schedule 1

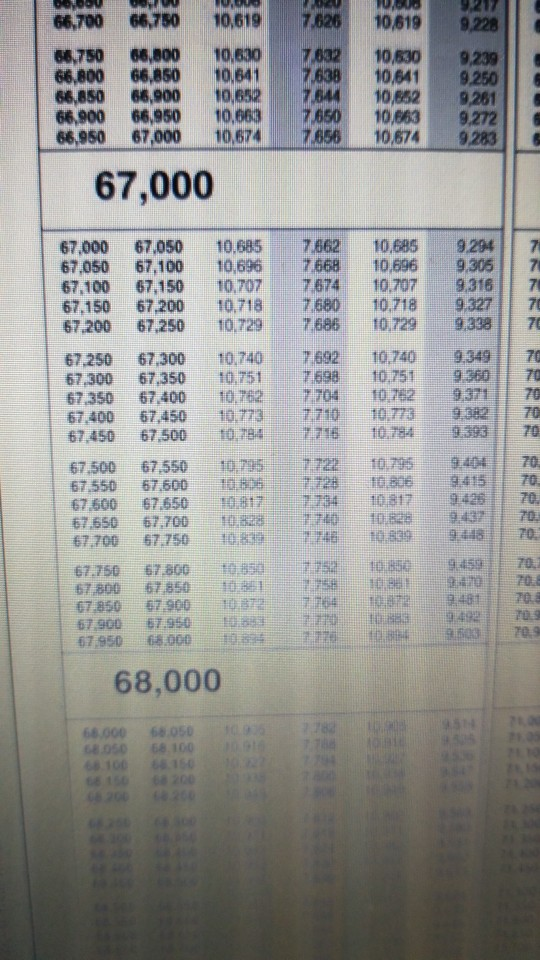

appendix D 2018 tax table (single taxpayer)

schedules 18 UAI pibiell associated ea Use your tax software to comp for tax returns, you will need a Form 1040 and Tax Return Problem 1 Jason Ready attended the University of San Diego during 2014-2018 under the Army ROT program. Excluding the school expenses covered by his ROTC scholarship, he incured program. Exc additional school expenses of $10,000 in total for his education, and S1,500 of that am was incurred in 2018 for his last semester. To finance these expenses, he borrowed $7,0 through a federal student loan program and borrowed another $3,000 from SoCal Credi for educational purposes. After graduation, he received his officer's commission rdered to report to the Military Entrance Processing Station in Portland OR for duty and was o He lives off base at 4560 Ranch Drive , Portland, OR 97035. His social security number 412-34-5670 (date of birth 7/10/1996). Jason had qualifying health care coverage at all time during the tax year His W-2 contained the following information: Wages (box I) = $67,533.05 Federal W/H (box 2) = $ 8,104.95 Social security wages (box 3) S67.533.05 Social security W/H (box 4) = $ 4,187.05 Medicare wages (box 5) = $67,533.05 Medicare W/H (box 6) = $ 979.23 In moving to Portland, he incurred the following unremibursed moving expenses $495 in gasoline. S295 for renting a truck from IGOTYA rentals. $125 in food $465 for motel lodging on the way to Portland. He also received two Forms 1098-E. One was from the federal student loan showed $450 of student loan interest; the other was from Soca $150.75 of student loan interest. l Credit Union and showed Prepare a Form 1040, and a Form 3903. If manually preparing the return , the Student Loan Interest Deduction worksheet can be found in IRS Publication 97 66,700 66,750 10,619 7826 10619 9228l 66,750 66,800 106307832 10630 923l 66850 10641 7638 10641 9.250 66,850 66,900 1062 784 10,852 9,261 66,900 66,950 10,6637650 10,863 9272 6 66,950 67,000 10,674 7 658 1074 9283 67,000 67,050 10.685 7.662 10.685 9294| 67,050 67,100 10,696 7668 10.696 9305 7 67,100 67,150 10.707 7874 10.707| 9316| 7 67.150 67.200 10.718 1.680 10,718 9.327 70 67.200 67,250 10729 7686 10729 9.3387 67,250 67,300 10,740 7692 10,740 9349 70 67.300 67350 10,751 769810751 9360 70 67,350 67400 107627704 10762 9371 70 | 67,400 67,450 10,773 : 7.710 10.773 902 1 170 70 67,450 67,500 .10784[i -7 71 /10784- 3 67.500 67,550095 1722 10.795 940470, 67,550 67.600 tan | tne 10306 9.415 I t70 67.600 67.650 8171 1 7734 man 9.42,170 67,650 67.700 10880 108970 67.700 67.750 10.8 108391 9,448117 67750 67800 108s0 108509459 70. 800 67850 1758 10 83704 67 850 67.900 10 mln 7264.hcari 9,48111708 67900 67950 101mo 949270s 67.950 68.000 3 68,000 66.000 68.050 schedules 18 UAI pibiell associated ea Use your tax software to comp for tax returns, you will need a Form 1040 and Tax Return Problem 1 Jason Ready attended the University of San Diego during 2014-2018 under the Army ROT program. Excluding the school expenses covered by his ROTC scholarship, he incured program. Exc additional school expenses of $10,000 in total for his education, and S1,500 of that am was incurred in 2018 for his last semester. To finance these expenses, he borrowed $7,0 through a federal student loan program and borrowed another $3,000 from SoCal Credi for educational purposes. After graduation, he received his officer's commission rdered to report to the Military Entrance Processing Station in Portland OR for duty and was o He lives off base at 4560 Ranch Drive , Portland, OR 97035. His social security number 412-34-5670 (date of birth 7/10/1996). Jason had qualifying health care coverage at all time during the tax year His W-2 contained the following information: Wages (box I) = $67,533.05 Federal W/H (box 2) = $ 8,104.95 Social security wages (box 3) S67.533.05 Social security W/H (box 4) = $ 4,187.05 Medicare wages (box 5) = $67,533.05 Medicare W/H (box 6) = $ 979.23 In moving to Portland, he incurred the following unremibursed moving expenses $495 in gasoline. S295 for renting a truck from IGOTYA rentals. $125 in food $465 for motel lodging on the way to Portland. He also received two Forms 1098-E. One was from the federal student loan showed $450 of student loan interest; the other was from Soca $150.75 of student loan interest. l Credit Union and showed Prepare a Form 1040, and a Form 3903. If manually preparing the return , the Student Loan Interest Deduction worksheet can be found in IRS Publication 97 66,700 66,750 10,619 7826 10619 9228l 66,750 66,800 106307832 10630 923l 66850 10641 7638 10641 9.250 66,850 66,900 1062 784 10,852 9,261 66,900 66,950 10,6637650 10,863 9272 6 66,950 67,000 10,674 7 658 1074 9283 67,000 67,050 10.685 7.662 10.685 9294| 67,050 67,100 10,696 7668 10.696 9305 7 67,100 67,150 10.707 7874 10.707| 9316| 7 67.150 67.200 10.718 1.680 10,718 9.327 70 67.200 67,250 10729 7686 10729 9.3387 67,250 67,300 10,740 7692 10,740 9349 70 67.300 67350 10,751 769810751 9360 70 67,350 67400 107627704 10762 9371 70 | 67,400 67,450 10,773 : 7.710 10.773 902 1 170 70 67,450 67,500 .10784[i -7 71 /10784- 3 67.500 67,550095 1722 10.795 940470, 67,550 67.600 tan | tne 10306 9.415 I t70 67.600 67.650 8171 1 7734 man 9.42,170 67,650 67.700 10880 108970 67.700 67.750 10.8 108391 9,448117 67750 67800 108s0 108509459 70. 800 67850 1758 10 83704 67 850 67.900 10 mln 7264.hcari 9,48111708 67900 67950 101mo 949270s 67.950 68.000 3 68,000 66.000 68.050Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started