Answered step by step

Verified Expert Solution

Question

1 Approved Answer

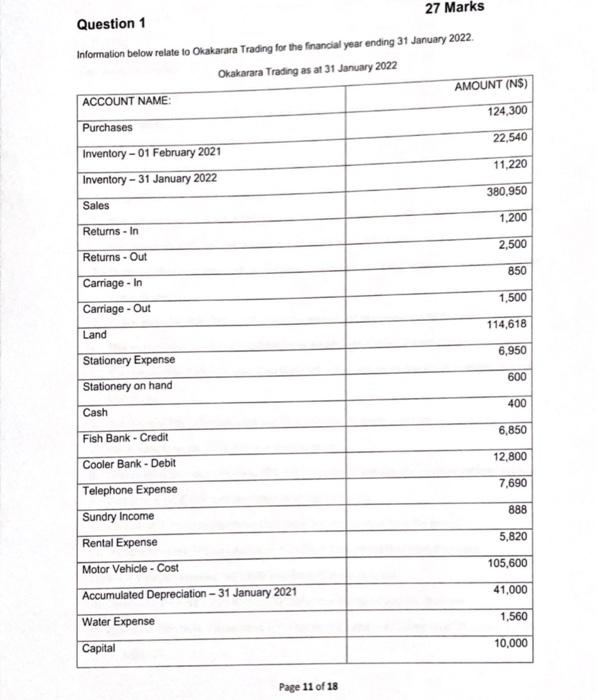

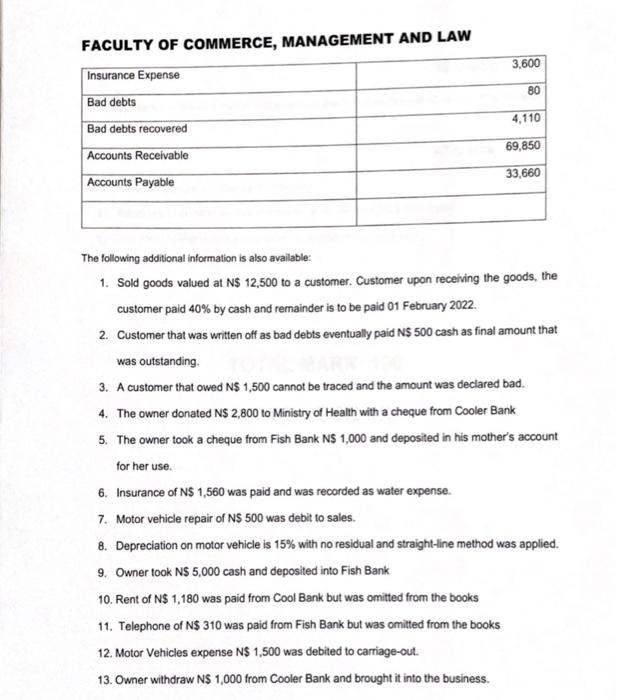

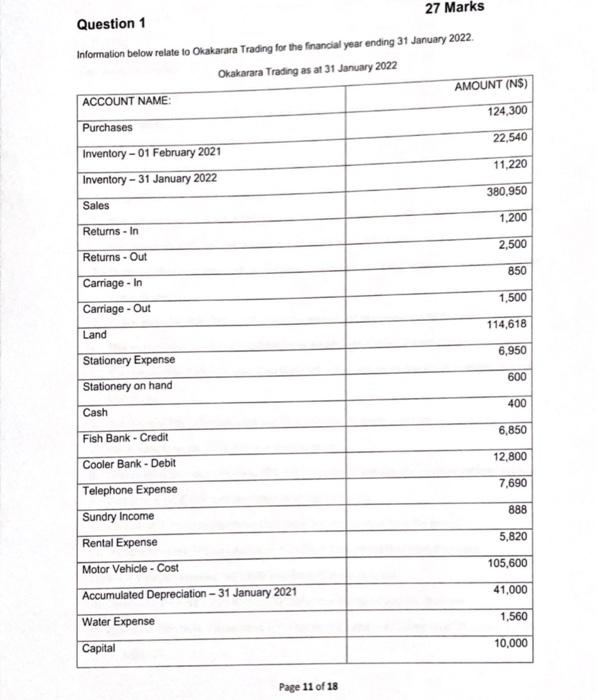

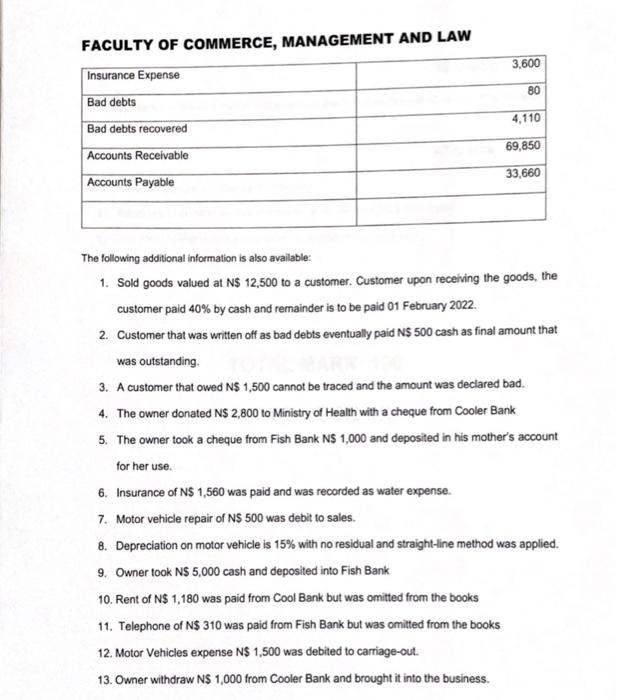

prepare a statement of comprehensive income as at 31 January 2022 Question 1 27 Marks Information below relate to Okakarara Trading for the financial year

prepare a statement of comprehensive income as at 31 January 2022

Question 1 27 Marks Information below relate to Okakarara Trading for the financial year ending 31 January 2022. Okakarara Trading as at 31 January 2022 ACCOUNT NAME: AMOUNT (NS) Purchases 124.300 Inventory - 01 February 2021 22,540 Inventory - 31 January 2022 11.220 380.950 Sales 1.200 Returns - In 2.500 Returns-Out 850 Carriage - In Carriage - Out 1,500 114,618 Land 6,950 Stationery Expense Stationery on hand 600 400 Cash 6,850 Fish Bank - Credit 12.800 Cooler Bank - Debit 7,690 888 5,820 Telephone Expense Sundry Income Rental Expense Motor Vehicle - Cost Accumulated Depreciation - 31 January 2021 Water Expense 105,600 41,000 1,560 Capital 10,000 Page 11 of 18 3.600 80 FACULTY OF COMMERCE, MANAGEMENT AND LAW Insurance Expense Bad debts Bad debts recovered Accounts Receivable Accounts Payable 4,110 69,850 33.660 The following additional information is also available: 1. Sold goods valued at N$ 12,500 to a customer. Customer upon receiving the goods, the customer paid 40% by cash and remainder is to be paid 01 February 2022. 2. Customer that was written off as bad debts eventually paid NS 500 cash as final amount that was outstanding 3. A customer that owed N$ 1,500 cannot be traced and the amount was declared bad. 4. The owner donated N$ 2,800 to Ministry of Health with a cheque from Cooler Bank 5. The owner took a cheque from Fish Bank NS 1,000 and deposited in his mother's account for her use. 6. Insurance of N$ 1,560 was paid and was recorded as water expense. 7. Motor vehicle repair of N$ 500 was debit to sales. 8. Depreciation on motor vehicle is 15% with no residual and straight-line method was applied. 9. Owner took N$ 5,000 cash and deposited into Fish Bank 10. Rent of N$ 1,180 was paid from Cool Bank but was omitted from the books 11. Telephone of N$ 310 was paid from Fish Bank but was omitted from the books 12. Motor Vehicles expense N$ 1,500 was debited to carriage-out 13. Owner withdraw N$ 1,000 from Cooler Bank and brought it into the business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started