Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prepare the required journal entries for each of the following transactions during December, 2020 for Tatum, Inc. Tatum is a calendar year-end company that

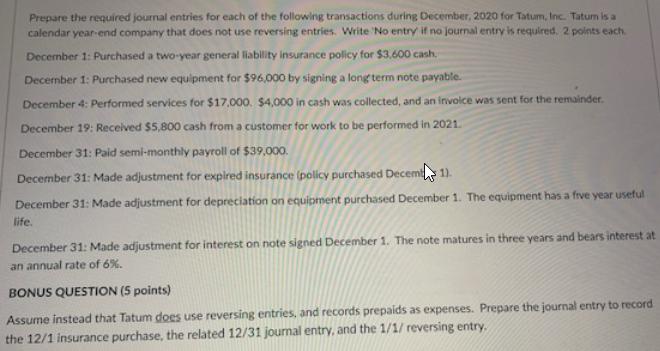

Prepare the required journal entries for each of the following transactions during December, 2020 for Tatum, Inc. Tatum is a calendar year-end company that does not use reversing entries. Write No entry if no journal entry is required. 2 points each December 1: Purchased a two-year general liabllity insurance policy for $3.600 cash. December 1: Purchased new equipment for $96,000 by signing a long term note payable. December 4: Performed services for $17,000. $4,000 in cash was collected, and an invoice was sent for the remainder. December 19: Received $5,800 cash from a customer for work to be performed in 2021. December 31: Paid semi-monthly payroll of $39,00. December 31: Made adjustment for expired insurance (policy purchased Decemt 1). December 31: Made adjustment for depreciation on equipment purchased December 1. The equipment has a frve year useful life. December 31: Made adjustment for interest on note signed December 1. The note matures in three years and bears interest at an annual rate of 6%. BONUS QUESTION (5 points) Assume instead that Tatum does use reversing entries, and records prepaids as expenses. Prepare the journal entry to record the 12/1 insurance purchase, the related 12/31 journal entry, and the 1/1/ reversing entry.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Date Particulars Debit Credit 01Dec Prepaid Insurance 360000 To Cash 360000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started