Answered step by step

Verified Expert Solution

Question

1 Approved Answer

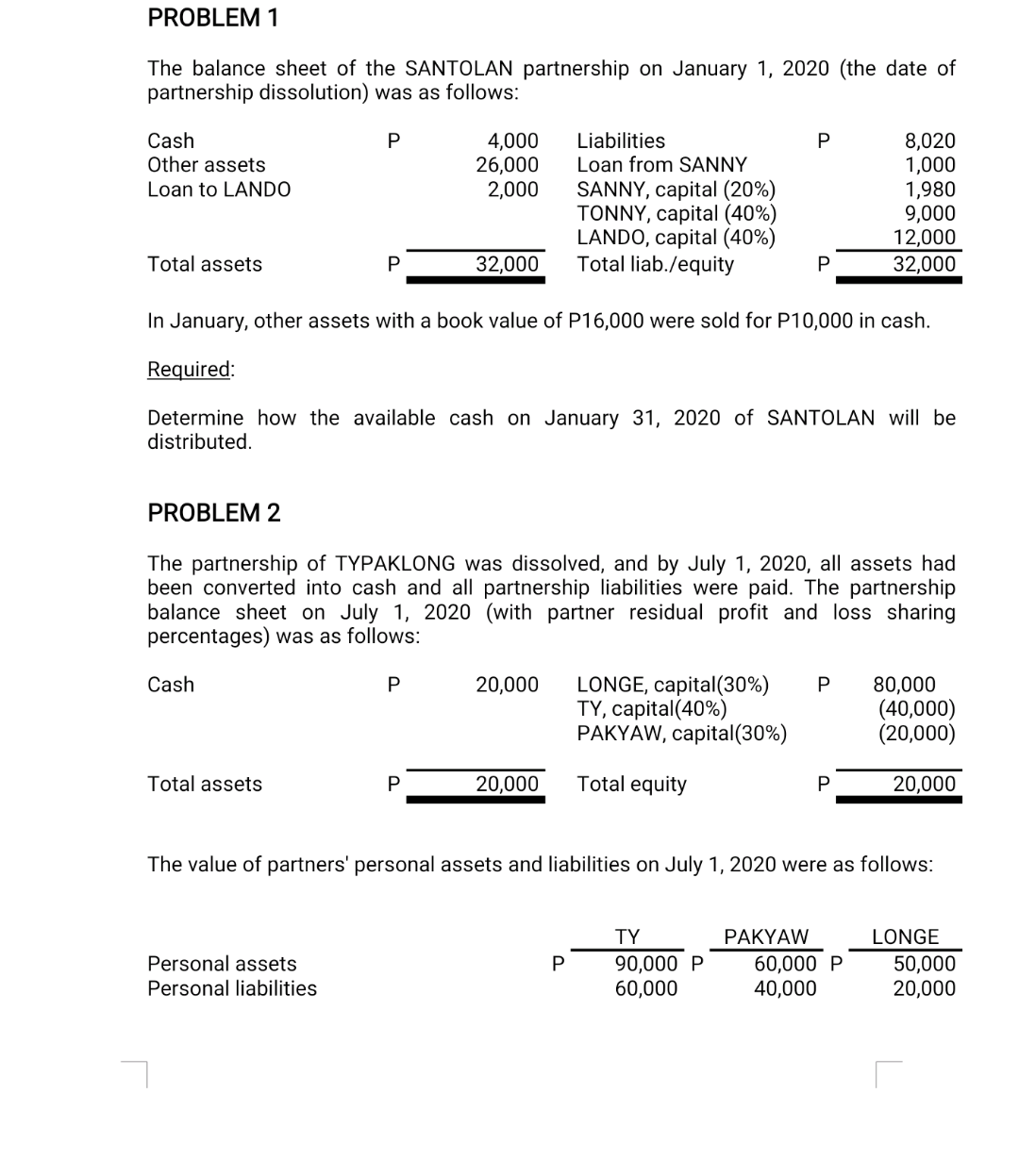

PROBLEM 1 The balance sheet of the SANTOLAN partnership on January 1, 2020 (the date of partnership dissolution) was as follows: P. Cash Other assets

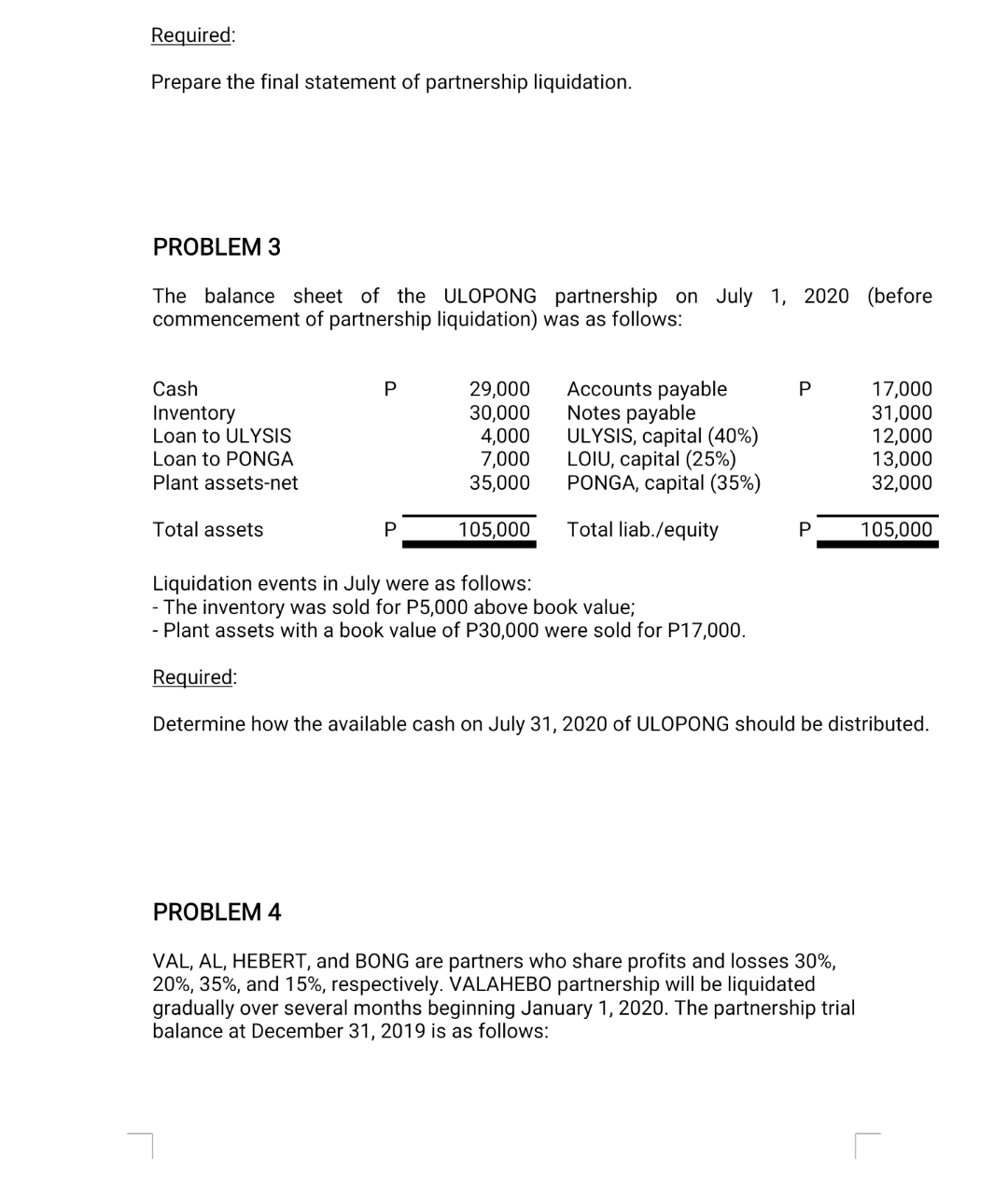

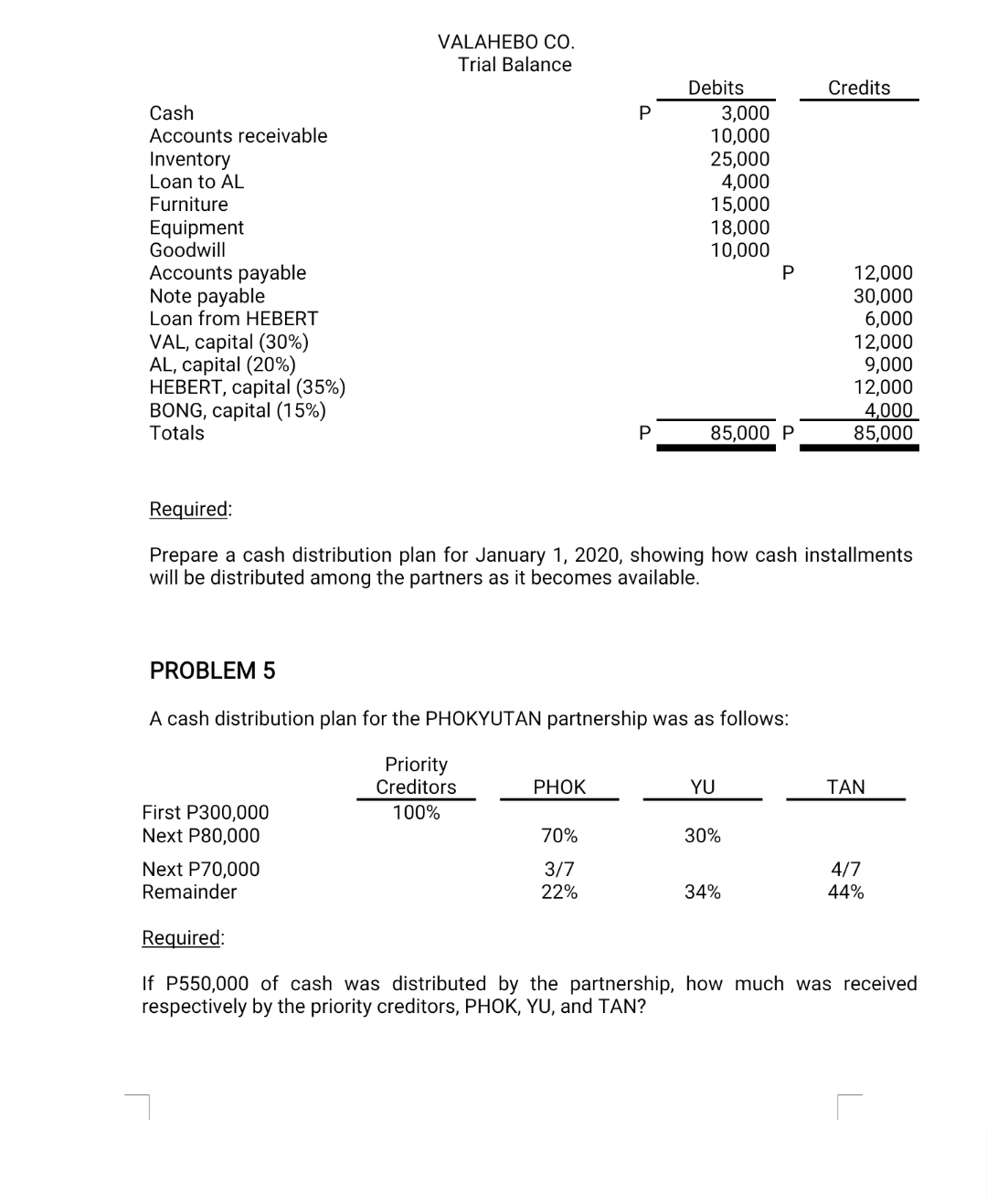

PROBLEM 1 The balance sheet of the SANTOLAN partnership on January 1, 2020 (the date of partnership dissolution) was as follows: P. Cash Other assets Loan to LANDO 4,000 26,000 2,000 Liabilities Loan from SANNY SANNY, capital (20%) TONNY, capital (40%) LANDO, capital (40%) Total liab./equity 8,020 1,000 1,980 9,000 12,000 32,000 Total assets 32,000 P In January, other assets with a book value of P16,000 were sold for P10,000 in cash. Required: Determine how the available cash on January 31, 2020 of SANTOLAN will be distributed PROBLEM 2 The partnership of TYPAKLONG was dissolved, and by July 1, 2020, all assets had been converted into cash and all partnership liabilities were paid. The partnership balance sheet on July 1, 2020 (with partner residual profit and loss sharing percentages) was as follows: Cash 20,000 LONGE, capital(30%) TY, capital(40%) PAKYAW, capital(30%) 80,000 (40,000) (20,000) Total assets 20,000 Total equity P 20,000 The value of partners' personal assets and liabilities on July 1, 2020 were as follows: Personal assets Personal liabilities TY 90,000 P 60,000 PAKYAW 60,000 P 40,000 LONGE 50,000 20,000 Required: Prepare the final statement of partnership liquidation. PROBLEM 3 The balance sheet of the ULOPONG partnership on July 1, 2020 (before commencement of partnership liquidation) was as follows: P. Cash Inventory Loan to ULYSIS Loan to PONGA Plant assets-net 29,000 30,000 4,000 7,000 35,000 Accounts payable Notes payable ULYSIS, capital (40%) LOIU, capital (25%) PONGA, capital (35%) 17,000 31,000 12,000 13,000 32,000 Total assets P 105,000 Total liab./equity P 105,000 Liquidation events in July were as follows: - The inventory was sold for P5,000 above book value; - Plant assets with a book value of P30,000 were sold for P17,000. Required: Determine how the available cash on July 31, 2020 of ULOPONG should be distributed. PROBLEM 4 VAL, AL, HEBERT, and BONG are partners who share profits and losses 30%, 20%, 35%, and 15%, respectively. VALAHEBO partnership will be liquidated gradually over several months beginning January 1, 2020. The partnership trial balance at December 31, 2019 is as follows: VALAHEBO CO. Trial Balance Credits Debits 3,000 10,000 25,000 4,000 15,000 18,000 10,000 Cash Accounts receivable Inventory Loan to AL Furniture Equipment Goodwill Accounts payable Note payable Loan from HEBERT VAL, capital (30%) AL, capital (20%) HEBERT, capital (35%) BONG, capital (15%) Totals P 12,000 30,000 6,000 12,000 9,000 12,000 4,000 85,000 P 85,000 P Required: Prepare a cash distribution plan for January 1, 2020, showing how cash installments will be distributed among the partners as it becomes available. PROBLEM 5 A cash distribution plan for the PHOKYUTAN partnership was as follows: Priority Creditors 100% PHOK YU TAN 70% 30% First P300,000 Next P80,000 Next P70,000 Remainder 3/7 22% 4/7 44% 34% Required: If P550,000 of cash was distributed by the partnership, how much was received respectively by the priority creditors, PHOK, YU, and TAN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started