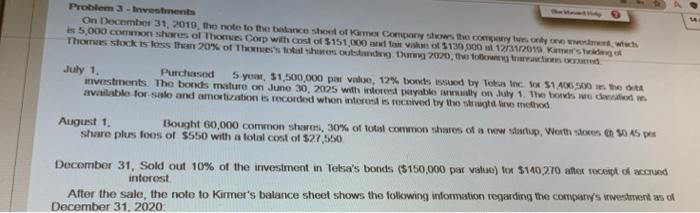

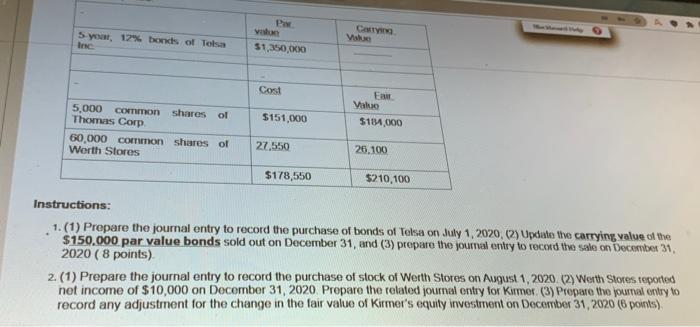

Problem 3 - Investments On December 31, 2019, the note to the balance sheet of Company shows the present is 5,000 common shares of Thomas Corp with cost of $151,000 and love of $139,000 w 121317010 Kg Thores stocks rss than 20% of Thrones's total showers outside thg 2020, the boots Purchased July 1. 5 yow, $1,500,000 par value, 12% bonus issued by Toba Inc fox 51 AS 500 the investments. The bonds mature on June 30, 2025 with interes payable way on July 1. The bod wedi available for sale and amortization is recorded when interent is received by the stryd toe method August 1. Bought 60,000 common shares, 30% of total common shares of a www startsp, Werth scores 50 45 pe share plus foes of $550 with a total cost of $27,550 December 31, Sold out 10% of the investment in Telsa's bonds ($150,000 par value) to $140.270 after took and interest After the sale, the note to Kirmer's balance sheet shows the following information regardiry the company's rowerowent as of December 31, 2020 val 5 year, 12% tons of Totsa Inc Cat Value $1,350,000 Cost E Value 5,000 CONTOn shares Thomas Corp ol $151.000 $184.000 60,000 common shares of Werth Stores 27.550 26.100 $178,550 $210,100 Instructions: 1. (1) Prepare the journal entry to record the purchase of bonds of Telsa on July 1, 2020,(2) Update the carrying value of the $150,000 par value bonds sold out on December 31, and (3) prepare the journal entry to record the sale on December 31 2020 ( 8 points) 2. (1) Prepare the journal entry to record the purchase of stock of Werth Stores on August 1,2020 (2) Werth Stores reported net income of $10,000 on December 31, 2020 Prepare the related journal entry for Kmet (3) Propare the youmal entry to record any adjustment for the change in the fair value of Kirmer's equity investment on December 31, 2020 (6 points) Problem 3 - Investments On December 31, 2019, the note to the balance sheet of Company shows the present is 5,000 common shares of Thomas Corp with cost of $151,000 and love of $139,000 w 121317010 Kg Thores stocks rss than 20% of Thrones's total showers outside thg 2020, the boots Purchased July 1. 5 yow, $1,500,000 par value, 12% bonus issued by Toba Inc fox 51 AS 500 the investments. The bonds mature on June 30, 2025 with interes payable way on July 1. The bod wedi available for sale and amortization is recorded when interent is received by the stryd toe method August 1. Bought 60,000 common shares, 30% of total common shares of a www startsp, Werth scores 50 45 pe share plus foes of $550 with a total cost of $27,550 December 31, Sold out 10% of the investment in Telsa's bonds ($150,000 par value) to $140.270 after took and interest After the sale, the note to Kirmer's balance sheet shows the following information regardiry the company's rowerowent as of December 31, 2020 val 5 year, 12% tons of Totsa Inc Cat Value $1,350,000 Cost E Value 5,000 CONTOn shares Thomas Corp ol $151.000 $184.000 60,000 common shares of Werth Stores 27.550 26.100 $178,550 $210,100 Instructions: 1. (1) Prepare the journal entry to record the purchase of bonds of Telsa on July 1, 2020,(2) Update the carrying value of the $150,000 par value bonds sold out on December 31, and (3) prepare the journal entry to record the sale on December 31 2020 ( 8 points) 2. (1) Prepare the journal entry to record the purchase of stock of Werth Stores on August 1,2020 (2) Werth Stores reported net income of $10,000 on December 31, 2020 Prepare the related journal entry for Kmet (3) Propare the youmal entry to record any adjustment for the change in the fair value of Kirmer's equity investment on December 31, 2020 (6 points)