Answered step by step

Verified Expert Solution

Question

1 Approved Answer

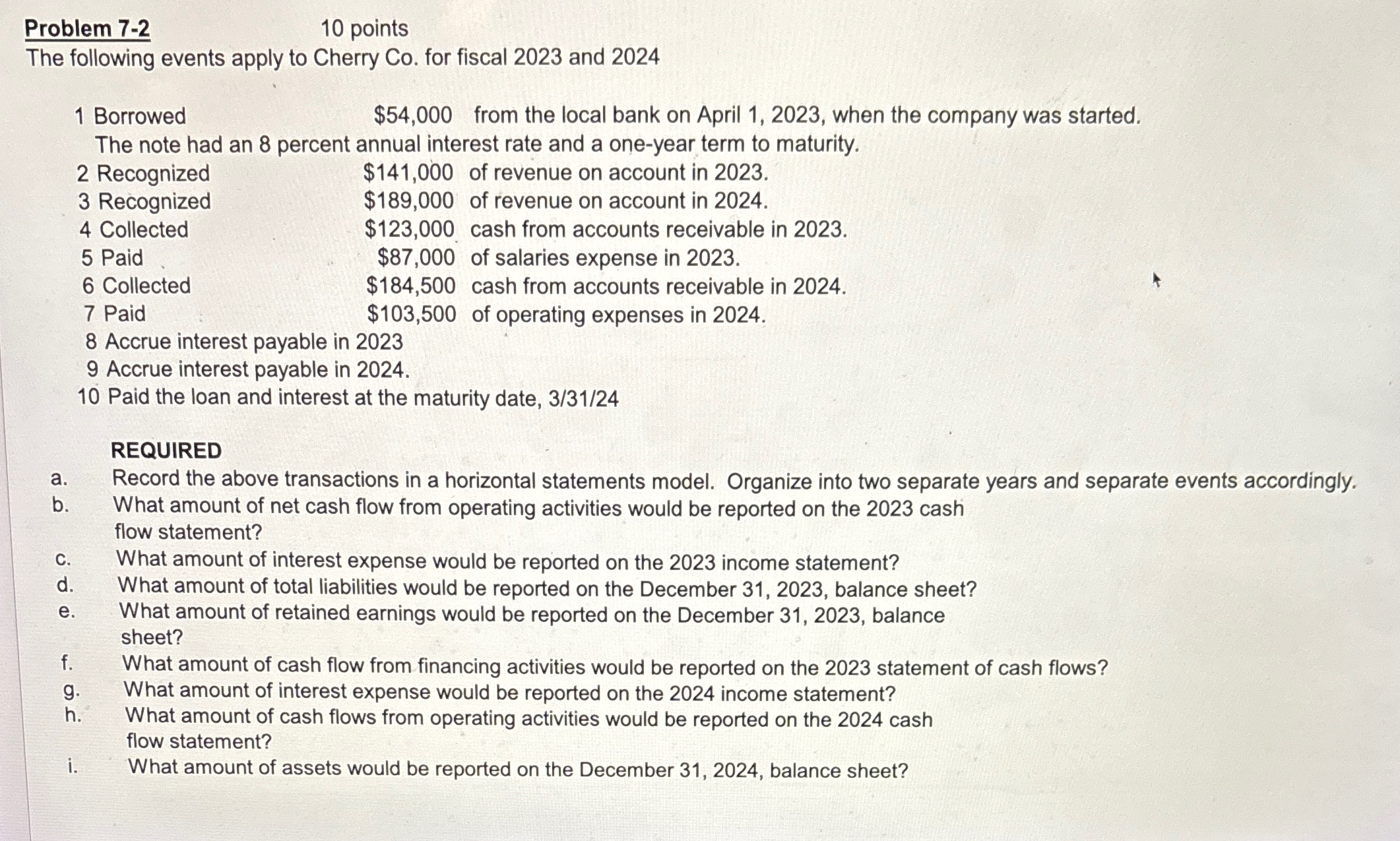

Problem 7 - 2 1 0 points The following events apply to Cherry Co . for fiscal 2 0 2 3 and 2 0 2

Problem

points

The following events apply to Cherry Co for fiscal and

Borrowed $ from the local bank on April when the company was started.

The note had an percent annual interest rate and a oneyear term to maturity.

Recognized

$ of revenue on account in

Recognized $ of revenue on account in

Collected $ cash from accounts receivable in

Paid $ of salaries expense in

Collected $ cash from accounts receivable in

Paid : $ of operating expenses in

Accrue interest payable in

Accrue interest payable in

Paid the loan and interest at the maturity date,

REQUIRED

a Record the above transactions in a horizontal statements model. Organize into two separate years and separate events accordingly.

b What amount of net cash flow from operating activities would be reported on the cash flow statement?

c What amount of interest expense would be reported on the income statement?

d What amount of total liabilities would be reported on the December balance sheet?

e What amount of retained earnings would be reported on the December balance sheet?

f What amount of cash flow from financing activities would be reported on the statement of cash flows?

g What amount of interest expense would be reported on the income statement?

h What amount of cash flows from operating activities would be reported on the cash flow statement?

i What amount of assets would be reported on the December balance sheet?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started