Answered step by step

Verified Expert Solution

Question

1 Approved Answer

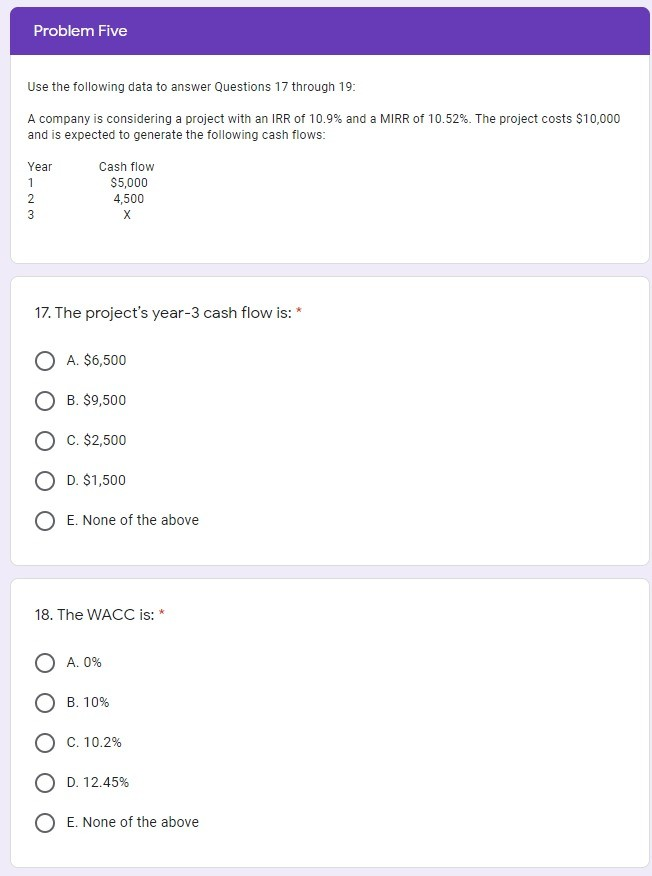

Problem Five Use the following data to answer Questions 17 through 19: A company is considering a project with an IRR of 10.9% and a

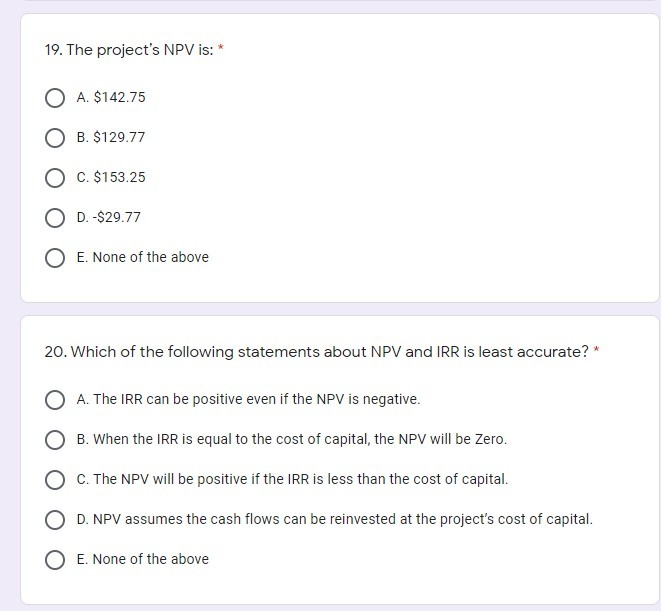

Problem Five Use the following data to answer Questions 17 through 19: A company is considering a project with an IRR of 10.9% and a MIRR of 10.52%. The project costs $10,000 and is expected to generate the following cash flows: Year 1 Cash flow $5,000 4,500 2 3 17. The project's year-3 cash flow is: * O A. $6,500 O B. $9,500 O C. $2,500 O D. $1,500 O E. None of the above 18. The WACC is: O A. 0% O B. 10% O C. 10.2% O D. 12.45% O E. None of the above 19. The project's NPV is: O A. $142.75 O B. $129.77 O C. $153.25 O D.-$29.77 E. None of the above 20. Which of the following statements about NPV and IRR is least accurate? * O A. The IRR can be positive even if the NPV is negative. B. When the IRR is equal to the cost of capital, the NPV will be Zero. C. The NPV will be positive if the IRR is less than the cost of capital. D. NPV assumes the cash flows can be reinvested at the project's cost of capital. E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started