Answered step by step

Verified Expert Solution

Question

1 Approved Answer

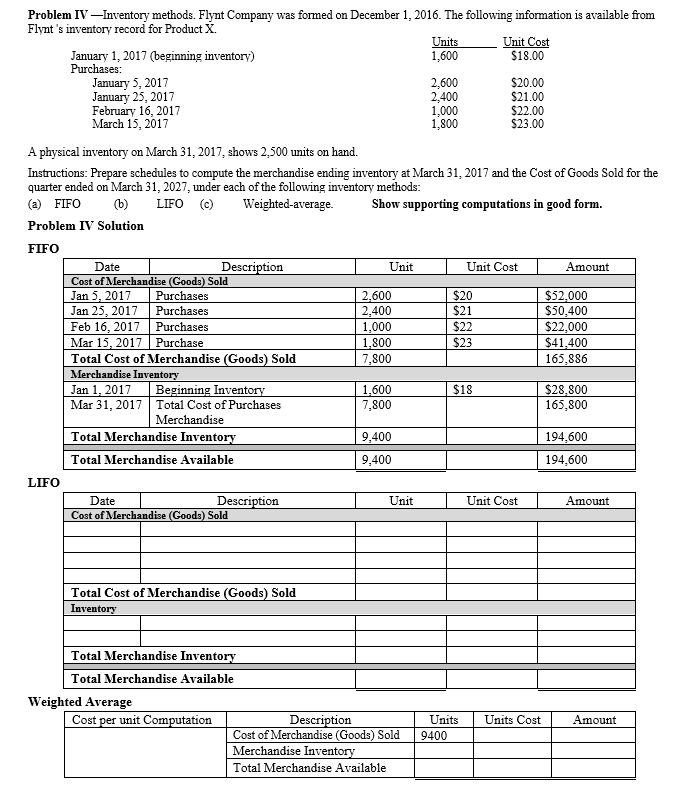

Problem IV-Inventory methods. Flynt Company was formed on December 1, 2016. The following information is available from Flynt's inventory record for Product X. January

Problem IV-Inventory methods. Flynt Company was formed on December 1, 2016. The following information is available from Flynt's inventory record for Product X. January 1, 2017 (beginning inventory) Purchases: January 5, 2017 January 25, 2017 February 16, 2017 March 15, 2017 A physical inventory on March 31, 2017, shows 2,500 units on hand. Units Unit Cost 1,600 $18.00 2,600 $20.00 2,400 $21.00 1,000 $22.00 1,800 $23.00 Instructions: Prepare schedules to compute the merchandise ending inventory at March 31, 2017 and the Cost of Goods Sold for the quarter ended on March 31, 2027, under each of the following inventory methods: (a) FIFO (b) LIFO (c) Weighted-average. Show supporting computations in good form. Problem IV Solution FIFO Date Description Unit Unit Cost Amount Cost of Merchandise (Goods) Sold Jan 5, 2017 Purchases 2,600 $20 $52,000 Jan 25, 2017 Purchases 2,400 $21 $50,400 Feb 16, 2017 Purchases 1,000 $22 $22,000 Mar 15, 2017 Purchase 1,800 $23 $41,400 Total Cost of Merchandise (Goods) Sold 7,800 165,886 Merchandise Inventory Jan 1, 2017 Beginning Inventory 1,600 $18 $28,800 Mar 31, 2017 Total Cost of Purchases 7,800 165,800 Merchandise Total Merchandise Inventory 9,400 194,600 Total Merchandise Available 9,400 194,600 LIFO Date Description Unit Unit Cost Amount Cost of Merchandise (Goods) Sold Total Cost of Merchandise (Goods) Sold Inventory Total Merchandise Inventory Total Merchandise Available Weighted Average Cost per unit Computation Description Cost of Merchandise (Goods) Sold Merchandise Inventory Total Merchandise Available Units 9400 Units Cost Amount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started