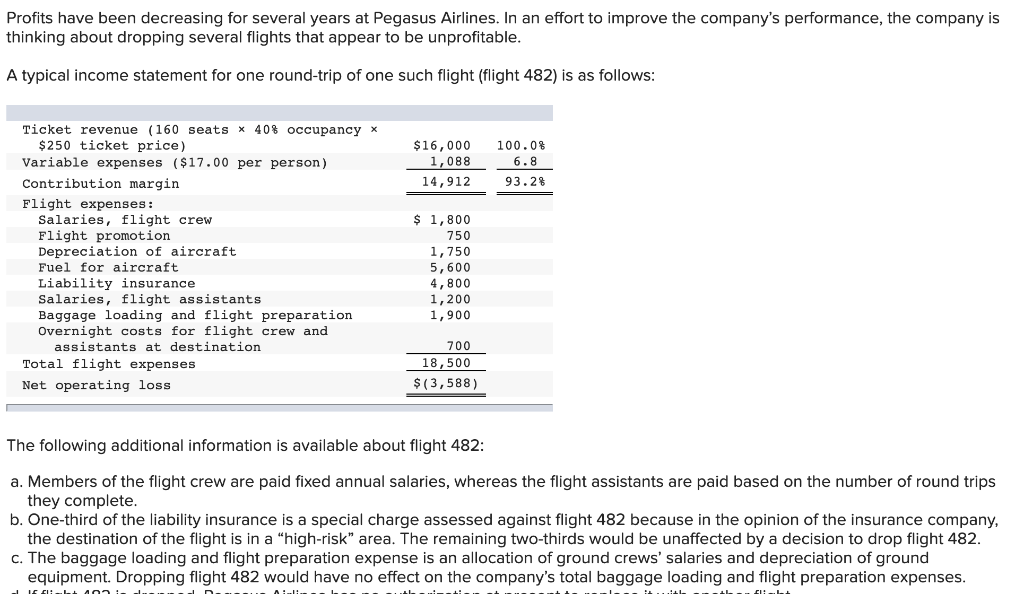

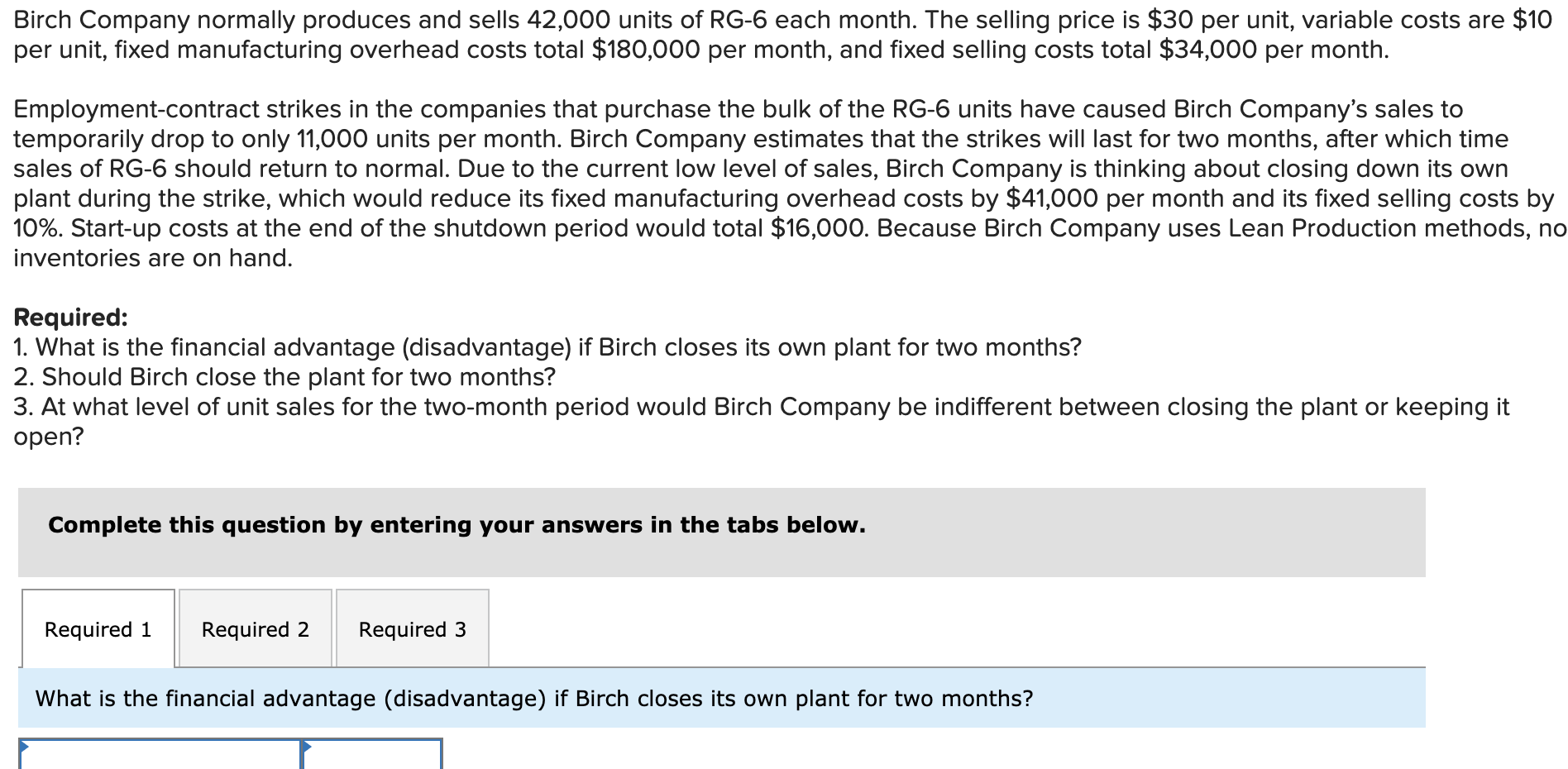

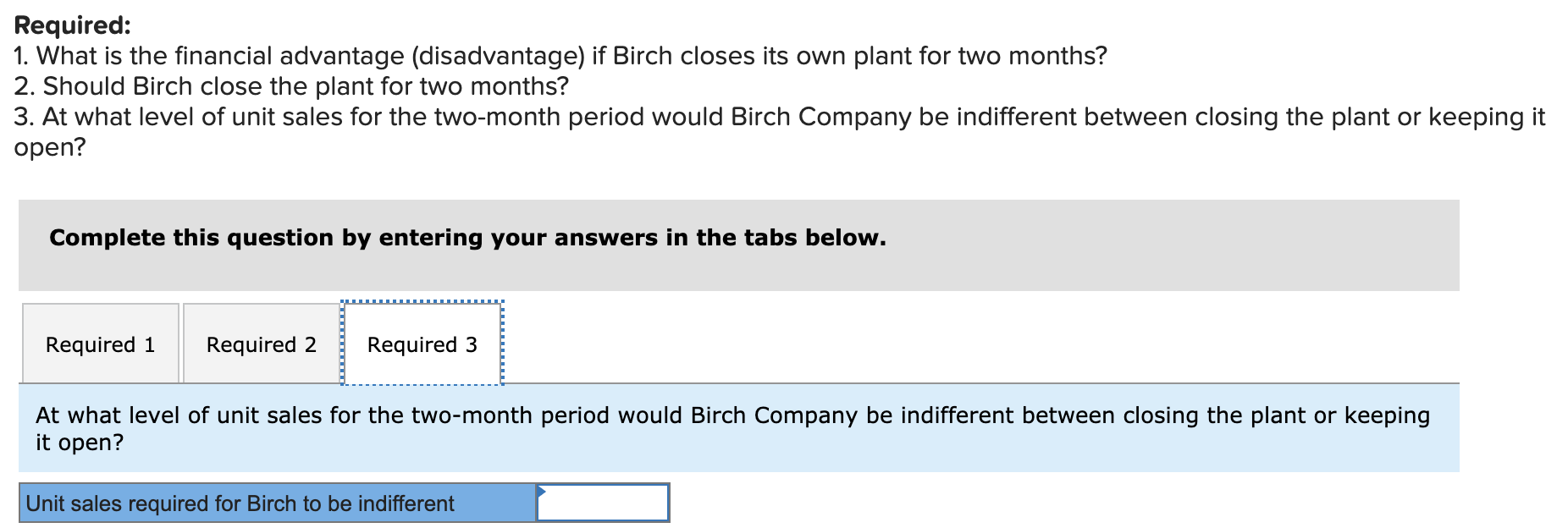

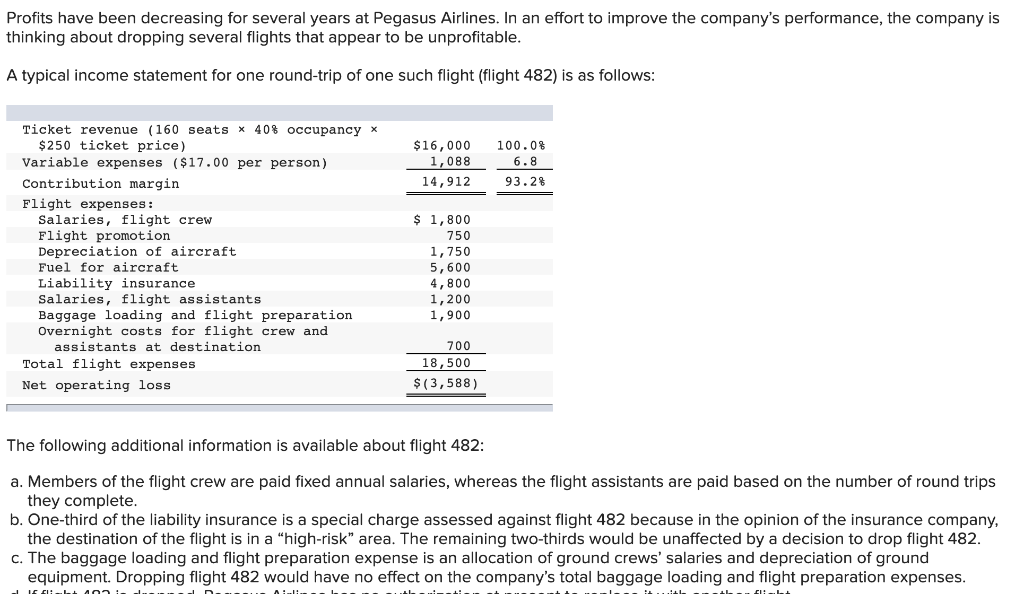

Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company's performance, the company is thinking about dropping several flights that appear to be unprofitable. A typical income statement for one round-trip of one such flight (flight 482) is as follows: $ 16,000 1,088 14,912 100.0% 6.8 93.28 Ticket revenue (160 seats x 40% occupancy X $250 ticket price) Variable expenses ($17.00 per person) Contribution margin Flight expenses: Salaries, flight crew Flight promotion Depreciation of aircraft Fuel for aircraft Liability insurance Salaries, flight assistants Baggage loading and flight preparation Overnight costs for flight crew and assistants at destination Total flight expenses Net operating loss $ 1,800 750 1,750 5,600 4,800 1,200 1,900 700 18,500 $(3,588) The following additional information is available about flight 482: a. Members of the flight crew are paid fixed annual salaries, whereas the flight assistants are paid based on the number of round trips they complete. b. One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482. c. The baggage loading and flight preparation expense is an allocation of ground crews' salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's total baggage loading and flight preparation expenses. Birch Company normally produces and sells 42,000 units of RG-6 each month. The selling price is $30 per unit, variable costs are $10 per unit, fixed manufacturing overhead costs total $180,000 per month, and fixed selling costs total $34,000 per month. Employment-contract strikes in the companies that purchase the bulk of the RG-6 units have caused Birch Company's sales to temporarily drop to only 11,000 units per month. Birch Company estimates that the strikes will last for two months, after which time sales of RG-6 should return to normal. Due to the current low level of sales, Birch Company is thinking about closing down its own plant during the strike, which would reduce its fixed manufacturing overhead costs by $41,000 per month and its fixed selling costs by 10%. Start-up costs at the end of the shutdown period would total $16,000. Because Birch Company uses Lean Production methods, no inventories are on hand. Required: 1. What is the financial advantage (disadvantage) if Birch closes its own plant for two months? 2. Should Birch close the plant for two months? 3. At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping open? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the financial advantage (disadvantage) if Birch closes its own plant for two months? Required: 1. What is the financial advantage (disadvantage) if Birch closes its own plant for two months? 2. Should Birch close the plant for two months? 3. At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping it open? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 At what level of unit sales for the two-month period would Birch Company be indifferent between closing the plant or keeping it open? Unit sales required for Birch to be indifferent