Answered step by step

Verified Expert Solution

Question

1 Approved Answer

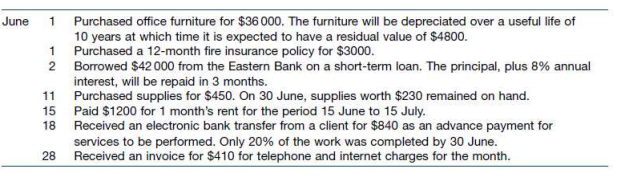

Q2.Adjusting entries (GST version) Hui Yu, lawyer, had the following transactions related to the business during June. Required (a) Prepare the journal entries to record

Q2.Adjusting entries (GST version)

Hui Yu, lawyer, had the following transactions related to the business during June.

Required

(a) Prepare the journal entries to record each transaction and prepare any adjusting entries as at 30 June, the end of the accounting year (GST is 10%). Assume the telephone tax invoice for $451 was issued on 28 June. (15 Marks)

(b) Describe what the complete set of financial statement is and how statements are prepared (10 Marks)

June 1 1 2 Purchased office furniture for $36 000. The furniture will be depreciated over a useful life of 10 years at which time it is expected to have a residual value of $4800. Purchased a 12-month fire insurance policy for $3000. Borrowed $42 000 from the Eastern Bank on a short-term loan. The principal, plus 8% annual interest, will be repaid in 3 months. Purchased supplies for $450. On 30 June, supplies worth $230 remained on hand. Paid $1200 for 1 month's rent for the period 15 June to 15 July. Received an electronic bank transfer from a client for $840 as an advance payment for services to be performed. Only 20% of the work was completed by 30 June. Received an invoice for $410 for telephone and internet charges for the month. 11 15 18 28Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started