QS 3-3

QS 3-3

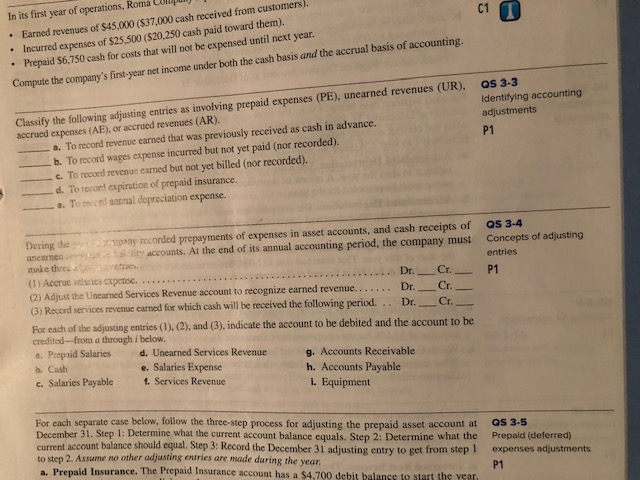

In its first year of operations, Roma CUmpui . Earned revenues of $45,000 ($37,000 cash received from customers) . Incurred expenses of $25,500 (S20,250 cash paid toward them). Prepaid $6,750 cash for costs that will not be expensed until next year Compute the company's first-year net income under both the cash basis and the accrual basis of accounting. Classify the following adjusting entries as involving prepaid expenses (PE), unearned revenues (UR), accrued expenses (AE), or accrued revenues (AR). Qs 3-3 Identifying accounting adjustments P1 a. To record revenue earned that was previously received as cash in advance. b. To rocord wages expense incurred but not yet paid (nor recorded). c. To record revenue eamed but not yet billed (nor recorded). d. To record expiration of prepaid insurance. e. To ond anal depreciation expense. ippay corded prepayments of expenses in asset accounts, and cash receipts of QS 3-4 During the unearneo make thre. Concepts of adjusting entries lty accounts. At the end of its annual accounting period, the company must (1) Accrue rics expeise. P1 (2) Adjust the Unearned Services Revenue account to recognize earned revenue...... Dr. Cr. Dr 3) Record services revenue earned for which cash will be received the following period.. . --Cr-- For each of the adjusting entries (). (2), and (3), indicate the account to be debited and the account to be creditod-from a through i below e. Prepaid Salariesd. Unearned Services Revenue h. Cash g. Accounts Receivable h. Accounts Payable i. Equipment e. Salaries Expense c. Salaries Payable . Services Revenue current account balance should equal. Step 3: Record the December 31 adjusting entry to get from step 1 to step 2. Assume no other adjusting entries are made during the year a. Prepaid Insurance. The Prepaid Insurance account has a $4,700 debit balance to start the vear For each separate case below, follow the three-step process for adjusting the prepaid asset account at December 31. Step 1: Determine what the current account balance equals. Step 2: Determine what the QS 3-5 Prepaid (deferred) expenses adjustments P1

QS 3-3

QS 3-3