Answered step by step

Verified Expert Solution

Question

1 Approved Answer

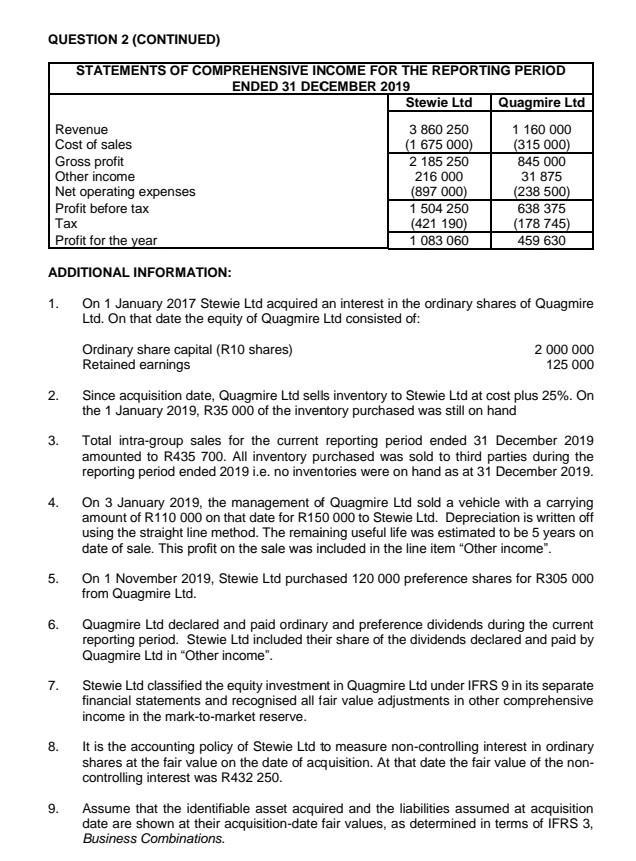

QUESTION 2 (CONTINUED) STATEMENTS OF COMPREHENSIVE INCOME FOR THE REPORTING PERIOD ENDED 31 DECEMBER 2019 Revenue Cost of sales Gross profit Other income Net

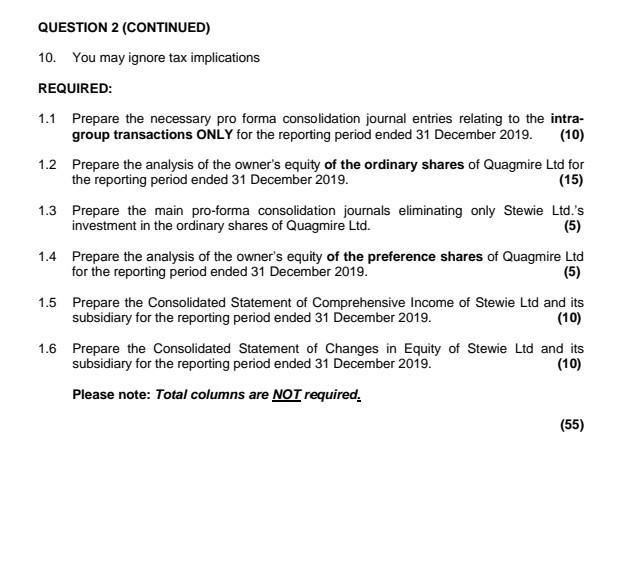

QUESTION 2 (CONTINUED) STATEMENTS OF COMPREHENSIVE INCOME FOR THE REPORTING PERIOD ENDED 31 DECEMBER 2019 Revenue Cost of sales Gross profit Other income Net operating expenses Profit before tax Tax Profit for the year 1. 2. 3. ADDITIONAL INFORMATION: On 1 January 2017 Stewie Ltd acquired an interest in the ordinary shares of Quagmire Ltd. On that date the equity of Quagmire Ltd consisted of: 4. 5. 6. 7. 8. 9. Stewie Ltd 3 860 250 (1 675 000) Ordinary share capital (R10 shares) Retained earnings 2 185 250 216 000 (897 000) 1 504 250 (421 190) 1 083 060 Quagmire Ltd 1 160 000 (315 000) 845 000 31 875 (238 500) 638 375 (178 745) 459 630 2 000 000 125 000 Since acquisition date, Quagmire Ltd sells inventory to Stewie Ltd at cost plus 25%. On the 1 January 2019, R35 000 of the inventory purchased was still on hand Total intra-group sales for the current reporting period ended 31 December 2019 amounted to R435 700. All inventory purchased was sold to third parties during the reporting period ended 2019 i.e. no inventories were on hand as at 31 December 2019. On 3 January 2019, the management of Quagmire Ltd sold a vehicle with a carrying amount of R110 000 on that date for R150 000 to Stewie Ltd. Depreciation is written off using the straight line method. The remaining useful life was estimated to be 5 years on date of sale. This profit on the sale was included in the line item "Other income". On 1 November 2019, Stewie Ltd purchased 120 000 preference shares for R305 000 from Quagmire Ltd. Quagmire Ltd declared and paid ordinary and preference dividends during the current reporting period. Stewie Ltd included their share of the dividends declared and paid by Quagmire Ltd in "Other income". Stewie Ltd classified the equity investment in Quagmire Ltd under IFRS 9 in its separate financial statements and recognised all fair value adjustments in other comprehensive income in the mark-to-market reserve. It is the accounting policy of Stewie Ltd to measure non-controlling interest in ordinary shares at the fair value on the date of acquisition. At that date the fair value of the non- controlling interest was R432 250. Assume that the identifiable asset acquired and the liabilities assumed at acquisition date are shown at their acquisition-date fair values, as determined in terms of IFRS 3, Business Combinations. QUESTION 2 (CONTINUED) 10. You may ignore tax implications REQUIRED: 1.1 Prepare the necessary pro forma consolidation journal entries relating to the intra- group transactions ONLY for the reporting period ended 31 December 2019. (10) 1.2 Prepare the analysis of the owner's equity of the ordinary shares of Quagmire Ltd for the reporting period ended 31 December 2019. (15) 1.3 Prepare the main pro-forma consolidation journals eliminating only Stewie Ltd.'s investment in the ordinary shares of Quagmire Ltd. (5) 1.4 Prepare the analysis of the owner's equity of the preference shares of Quagmire Ltd for the reporting period ended 31 December 2019. (5) 1.5 Prepare the Consolidated Statement of Comprehensive Income of Stewie Ltd and its subsidiary for the reporting period ended 31 December 2019. (10) 1.6 Prepare the Consolidated Statement of Changes in Equity of Stewie Ltd and its subsidiary for the reporting period ended 31 December 2019. (10) Please note: Total columns are NOT required. (55)

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

11 Pro forma consolidation journal entries for the reporting period ended 31 December 2019 1 Inventory purchased by Stewie Ltd from Quagmire Ltd Date ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started