Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3: Stefanie is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $350,000, of which $300,000

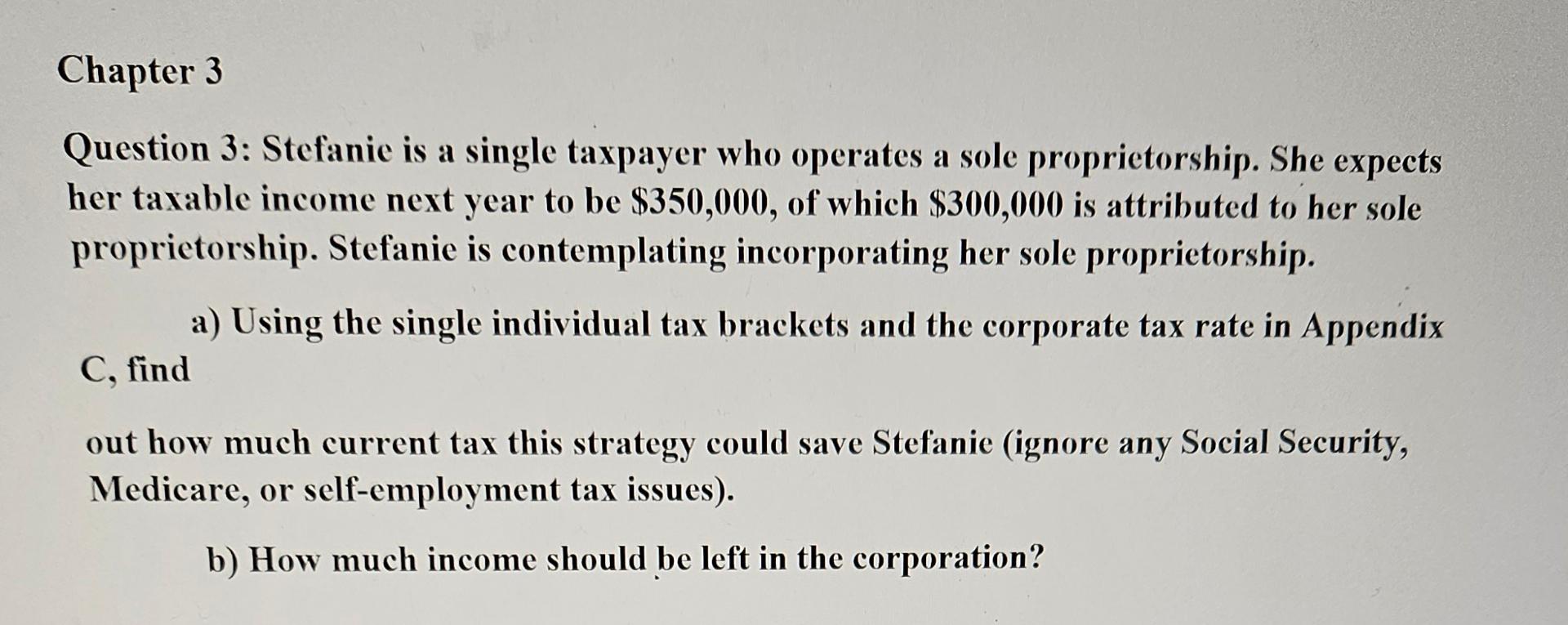

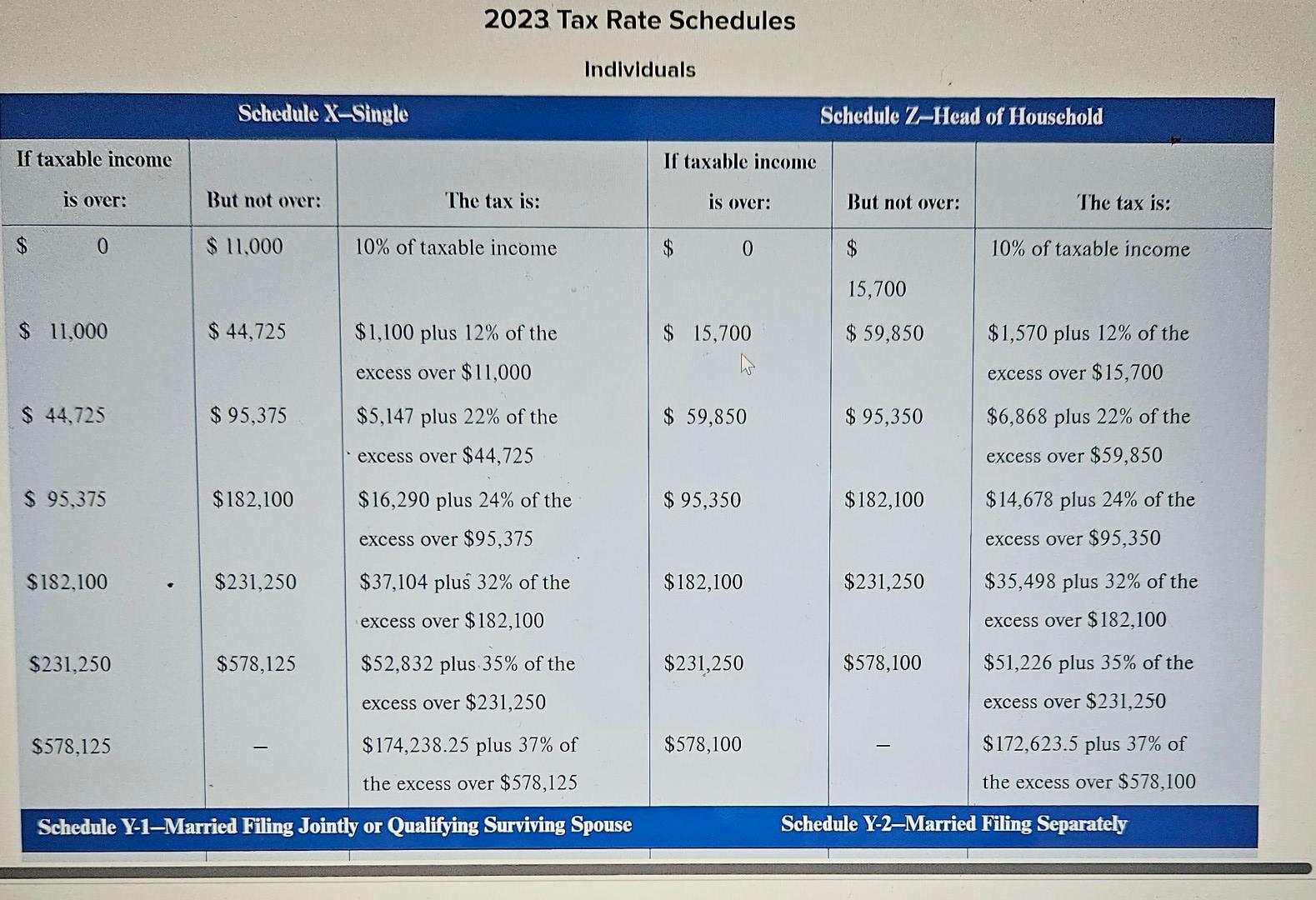

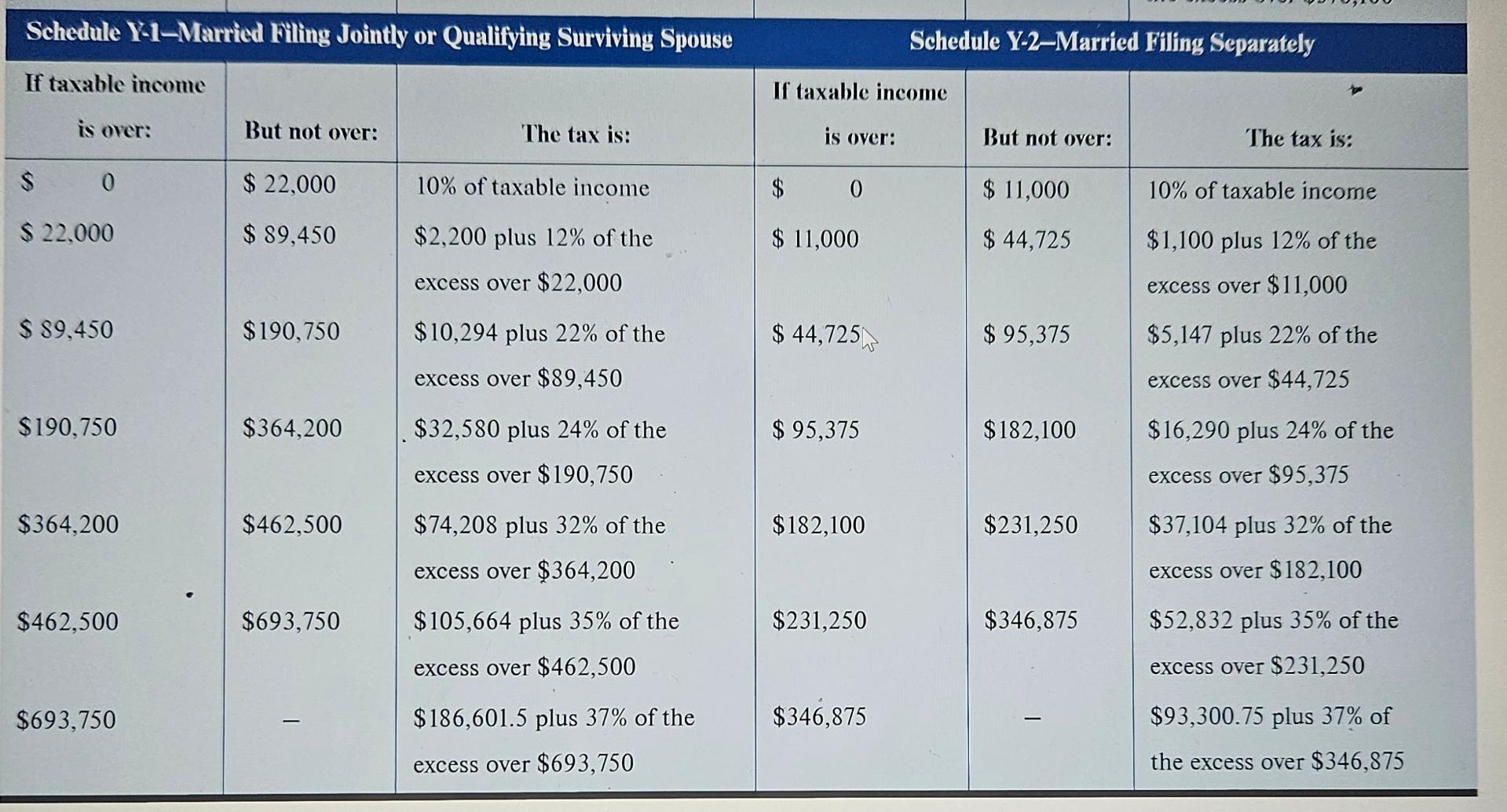

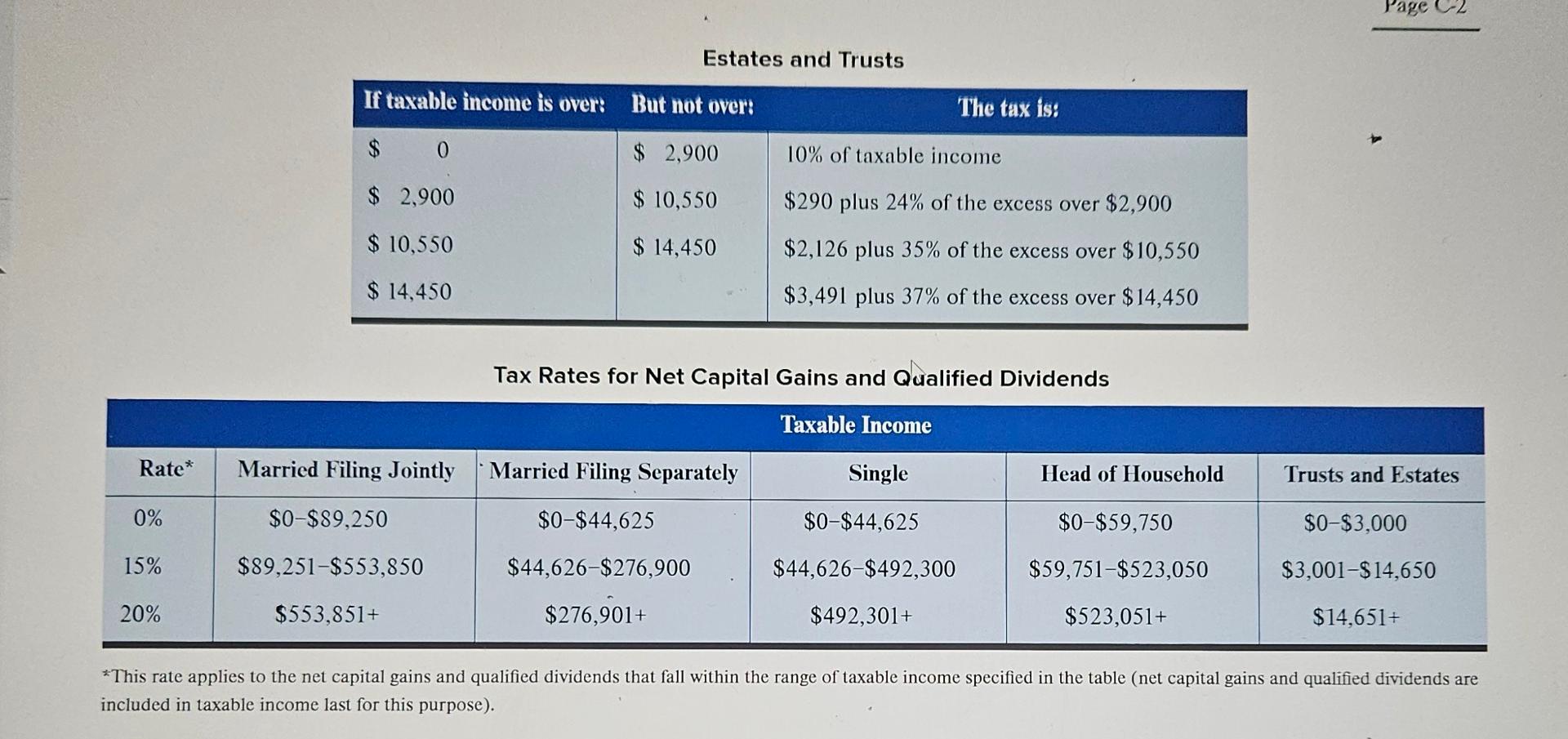

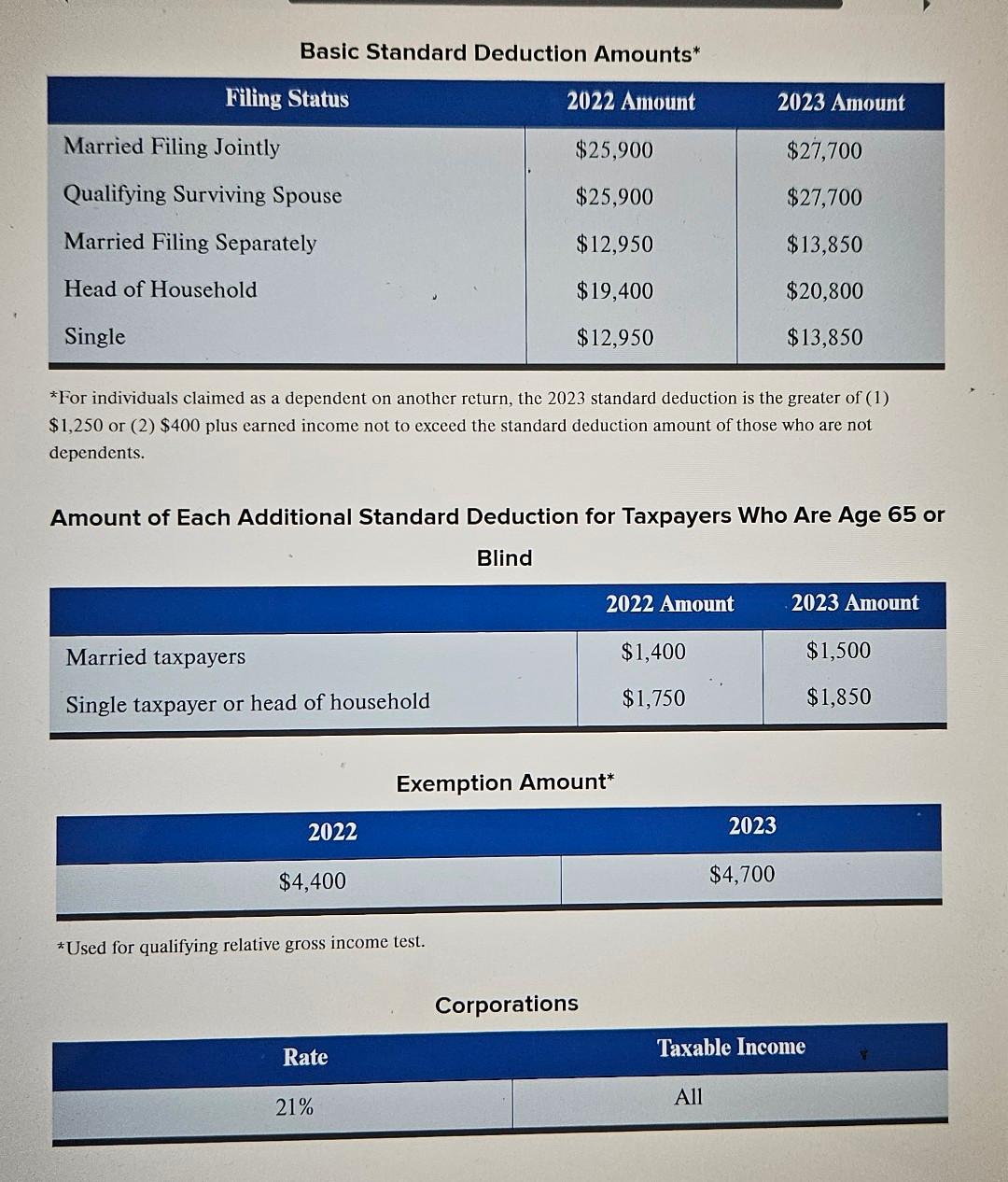

Question 3: Stefanie is a single taxpayer who operates a sole proprietorship. She expects her taxable income next year to be $350,000, of which $300,000 is attributed to her sole proprictorship. Stefanie is contemplating incorporating her sole proprietorship. a) Using the single individual tax brackets and the corporate tax rate in Appendix C, find out how much current tax this strategy could save Stefanie (ignore any Social Security, Medicare, or self-employment tax issues). b) How much income should be left in the corporation? 2023 Tax Rate Schedules Individuals \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Schedule X Single } & \multicolumn{3}{|c|}{ Schedule Z-Head of Houschold } \\ \hline \begin{tabular}{l} If taxable income \\ is over: \end{tabular} & But not over: & The tax is: & \begin{tabular}{l} If taxable income \\ is over: \end{tabular} & But not over: & The tax is: \\ \hline 0 & $11,000 & 10% of taxable income & $0 & \begin{tabular}{l} $ \\ 15,700 \end{tabular} & 10% of taxable income \\ \hline$11,000 & $44,725 & \begin{tabular}{l} $1,100 plus 12% of the \\ excess over $11,000 \end{tabular} & $15,700 & $59,850 & \begin{tabular}{l} $1,570 plus 12% of the \\ excess over $15,700 \end{tabular} \\ \hline$44,725 & $95,375 & \begin{tabular}{l} $5,147 plus 22% of the \\ excess over $44,725 \end{tabular} & $59,850 & $95,350 & \begin{tabular}{l} $6,868 plus 22% of the \\ excess over $59,850 \end{tabular} \\ \hline$95,375 & $182,100 & \begin{tabular}{l} $16,290 plus 24% of the \\ excess over $95,375 \end{tabular} & $95,350 & $182,100 & \begin{tabular}{l} $14,678 plus 24% of the \\ excess over $95,350 \end{tabular} \\ \hline$182,100 & $231,250 & \begin{tabular}{l} $37,104 plus 32% of the \\ excess over $182,100 \end{tabular} & $182,100 & $231,250 & \begin{tabular}{l} $35,498 plus 32% of the \\ excess over $182,100 \end{tabular} \\ \hline$231,250 & $578,125 & \begin{tabular}{l} $52,832 plus 35% of the \\ excess over $231,250 \end{tabular} & $231,250 & $578,100 & \begin{tabular}{l} $51,226 plus 35% of the \\ excess over $231,250 \end{tabular} \\ \hline$578,125 & - & \begin{tabular}{l} $174,238.25 plus 37% of \\ the excess over $578,125 \end{tabular} & $578,100 & - & \begin{tabular}{l} $172,623.5 plus 37% of \\ the excess over $578,100 \end{tabular} \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Schedule Y-1-Married Filing Jointly or Qualifying Surviving Spouse } & \multicolumn{3}{|c|}{ Schedule Y-2-Married Filing Separately } \\ \hline \begin{tabular}{l} If taxable income \\ is over: \end{tabular} & But not over: & The tax is: & \begin{tabular}{l} If taxable income \\ is over: \end{tabular} & But not over: & The tax is: \\ \hline$0 & $22,000 & 10% of taxable income & $0 & $11,000 & 10% of taxable income \\ \hline$22,000 & $89,450 & \begin{tabular}{l} $2,200 plus 12% of the \\ excess over $22,000 \end{tabular} & $11,000 & $44,725 & \begin{tabular}{l} $1,100 plus 12% of the \\ excess over $11,000 \end{tabular} \\ \hline$9,450 & $190,750 & \begin{tabular}{l} $10,294 plus 22% of the \\ excess over $89,450 \end{tabular} & $44,725 & $95,375 & \begin{tabular}{l} $5,147 plus 22% of the \\ excess over $44,725 \end{tabular} \\ \hline$190,750 & $364,200 & \begin{tabular}{l} $32,580 plus 24% of the \\ excess over $190,750 \end{tabular} & $95,375 & $182,100 & \begin{tabular}{l} $16,290 plus 24% of the \\ excess over $95,375 \end{tabular} \\ \hline$364,200 & $462,500 & \begin{tabular}{l} $74,208 plus 32% of the \\ excess over $364,200 \end{tabular} & $182,100 & $231,250 & \begin{tabular}{l} $37,104 plus 32% of the \\ excess over $182,100 \end{tabular} \\ \hline$462,500 & $693,750 & \begin{tabular}{l} $105,664 plus 35% of the \\ excess over $462,500 \end{tabular} & $231,250 & $346,875 & \begin{tabular}{l} $52,832 plus 35% of the \\ excess over $231,250 \end{tabular} \\ \hline$693,750 & - & \begin{tabular}{l} $186,601.5 plus 37% of the \\ excess over $693,750 \end{tabular} & $346,875 & - & \begin{tabular}{l} $93,300.75 plus 37% of \\ the excess over $346,875 \end{tabular} \\ \hline \end{tabular} Estates and Trusts Tax Rates for Net Capital Gains and Qualified Dividends *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose). Basic Standard Deduction Amounts* * For individuals claimed as a dependent on another return, the 2023 standard deduction is the greater of (1) $1,250 or (2) $400 plus earned income not to exceed the standard deduction amount of those who are not dependents. Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind Exemption Amount* Used for qualifying relative gross income test. Corporations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started