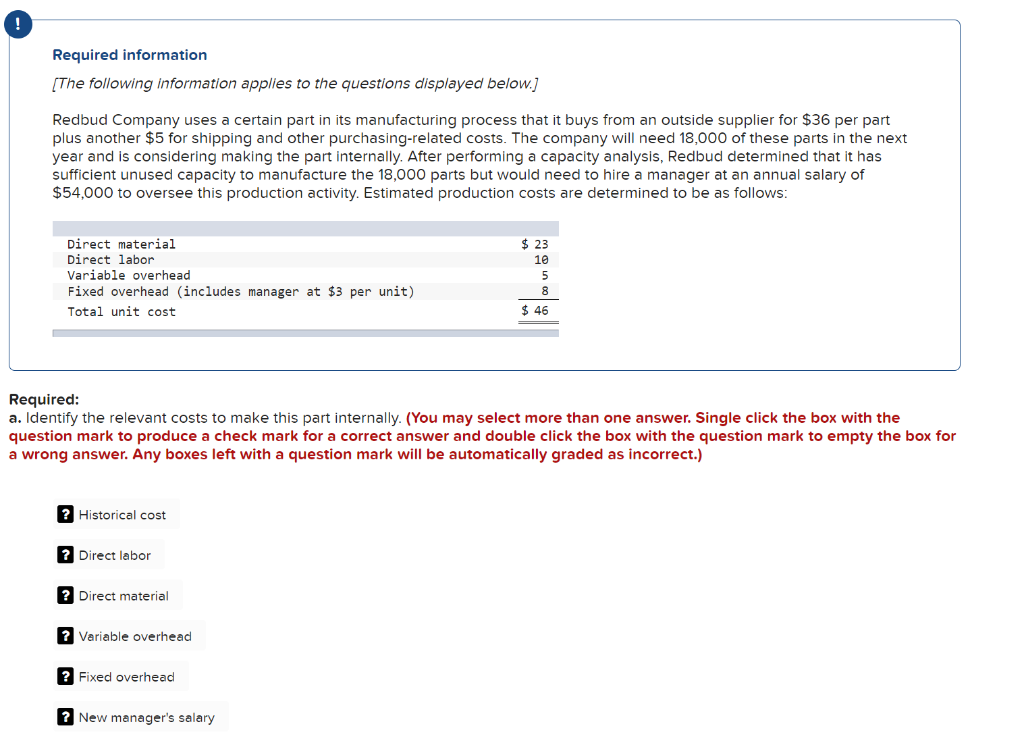

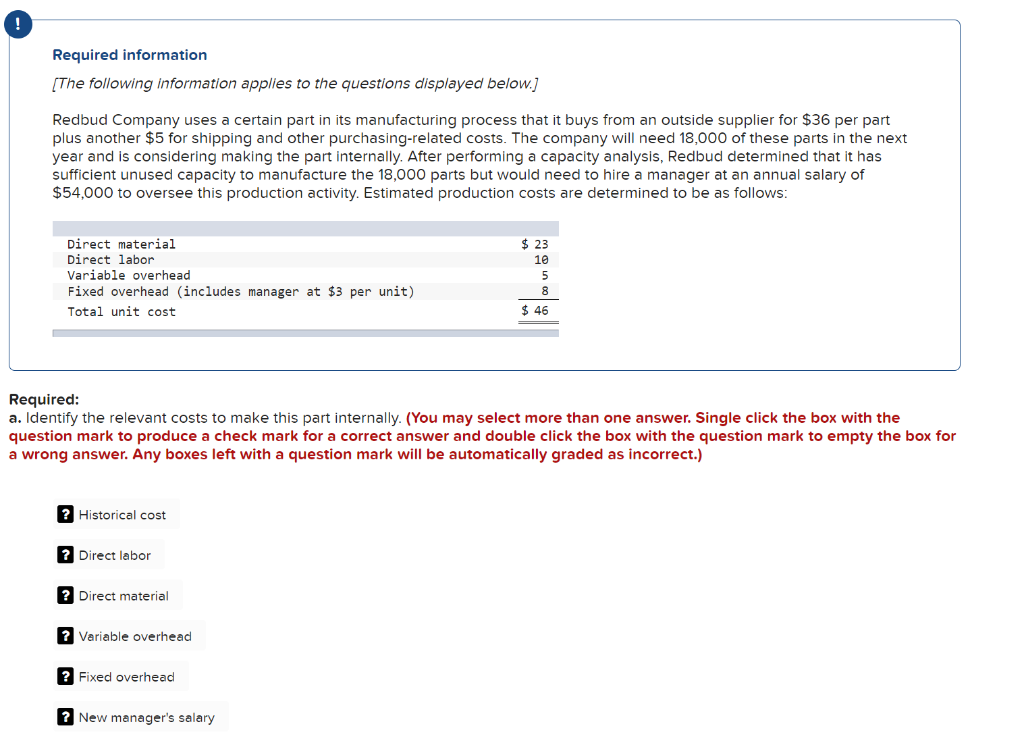

Required information (The following information applies to the questions displayed below.] Petro Motors Inc. (PMI) produces small gasoline-powered motors for use in lawn mowers. The company has been growing steadily over the past five years and is operating at full capacity. PMI recently completed the addition of new plant and equipment at a cost of $7,800,000, thereby increasing its manufacturing capacity to 100,000 motors annually. The addition to plant and equipment will be depreciated on a straight-line basis over 10 years. Sales of motors were 60,000 units prior to the completion of the additional capacity. Cost records indicated that manufacturing costs had totaled $60 per motor, of which $48 per motor was considered to be variable manufacturing costs. PMI has used the volume of activity at full capacity as the basis for applying fixed manufacturing overhead. The normal selling price is $80 per motor, and PMI pays a 5% commission on the sale of its motors. LawnPro.com offered to purchase 35,000 motors at a price of $60 per unit to test the viability of distributing lawn mower replacement motors through its website. PMI would be expected to produce the motors, store them in its warehouse, and ship individual motors to LawnPro.com customers. As orders are placed directly through the LawnPro.com website, they would be forwarded instantly to PMI. No commissions will be paid on this special sales order, and freight charges will be paid by the customer purchasing a motor. f. Assume that with the additional plant capacity, sales of motors in PMI's regular market are expected to increase by 33 1/3% in the coming 12 months. Identify all the relevant costs that PMI should consider in evaluating the special sales order from LawnPro.com. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) ? Variable manufacturing costs per motor. ? Costs associated with storing the motors in the PMI Warehouse to await shipment. ? Fixed costs. ? Commisions and freight. ? An opportunity cost equal to the amount of contribution foregone if PMI were to accept the special order. Required information [The following information applies to the questions displayed below.] Redbud Company uses a certain part in its manufacturing process that it buys from an outside supplier for $36 per part plus another $5 for shipping and other purchasing-related costs. The company will need 18,000 of these parts in the next year and is considering making the part internally. After performing a capacity analysis, Redbud determined that it has sufficient unused capacity to manufacture the 18,000 parts but would need to hire a manager at an annual salary of $54,000 to oversee this production activity. Estimated production costs are determined to be as follows: $ 23 10 Direct material Direct labor Variable overhead Fixed overhead (includes manager at $3 per unit) Total unit cost 5 8 $ 46 Required: a. Identify the relevant costs to make this part internally. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Historical cost ? Direct labor ? Direct material ? Variable overhead Fixed overhead New manager's salary ! Required information [The following information applies to the questions displayed below.] EagleEye Company, a manufacturer of digital cameras, is considering entry into the digital binocular market. EagleEye Company currently does not produce binoculars of any style, so this venture would require a careful analysis of relevant manufacturing costs to correctly assess its ability to compete. The market price for this binocular style is well established at $147 per unit. EagleEye has enough square footage in its plant to accommodate the new production line, although several pieces of new equipment would be required; their estimated cost is $4,950,000. EagleEye requires a minimum ROI of 14% on any product line investment and estimates that if it enters this market with its digital binocular product at the prevailing market price, it is confident of its ability to sell 30,000 units each year. b. Calculate the target cost per unit for entry into the digital binocular market. (Round your answer to 2 decimal places.) Target cost per unit