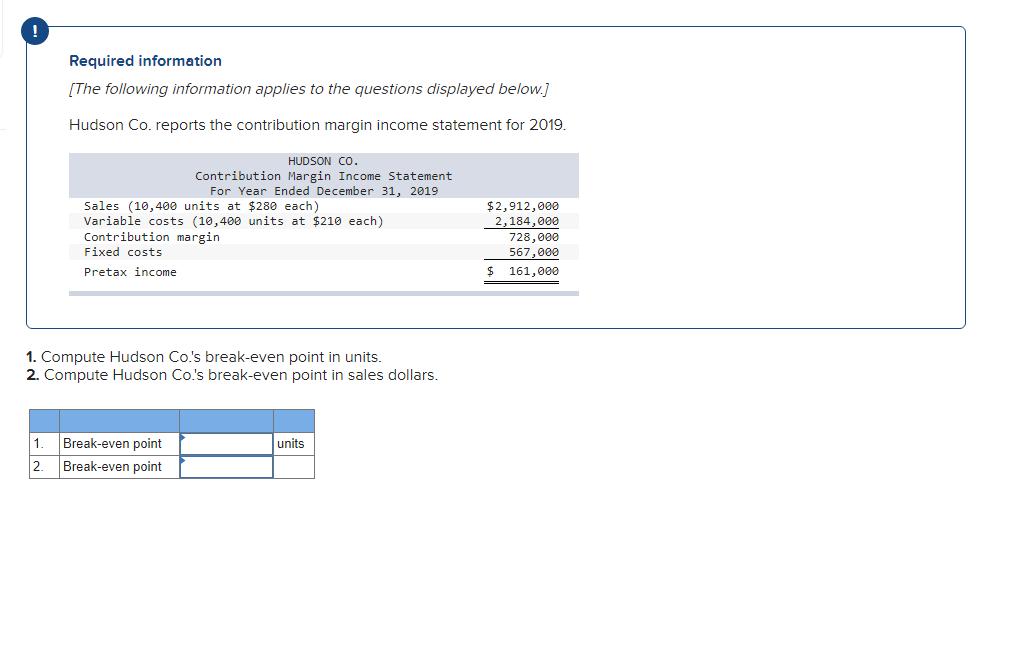

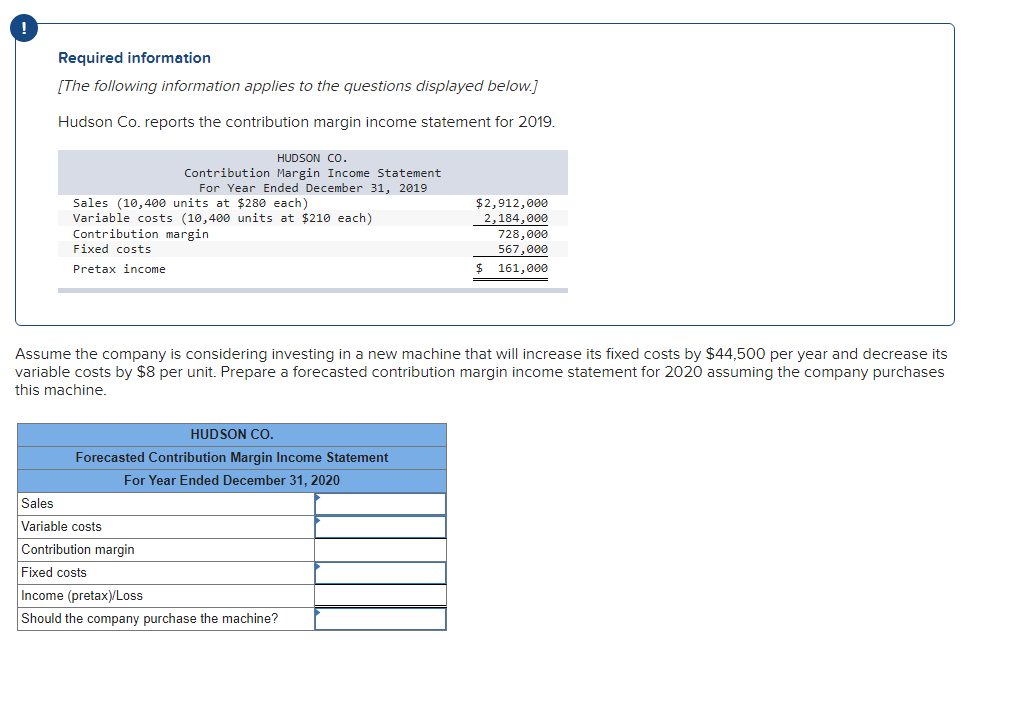

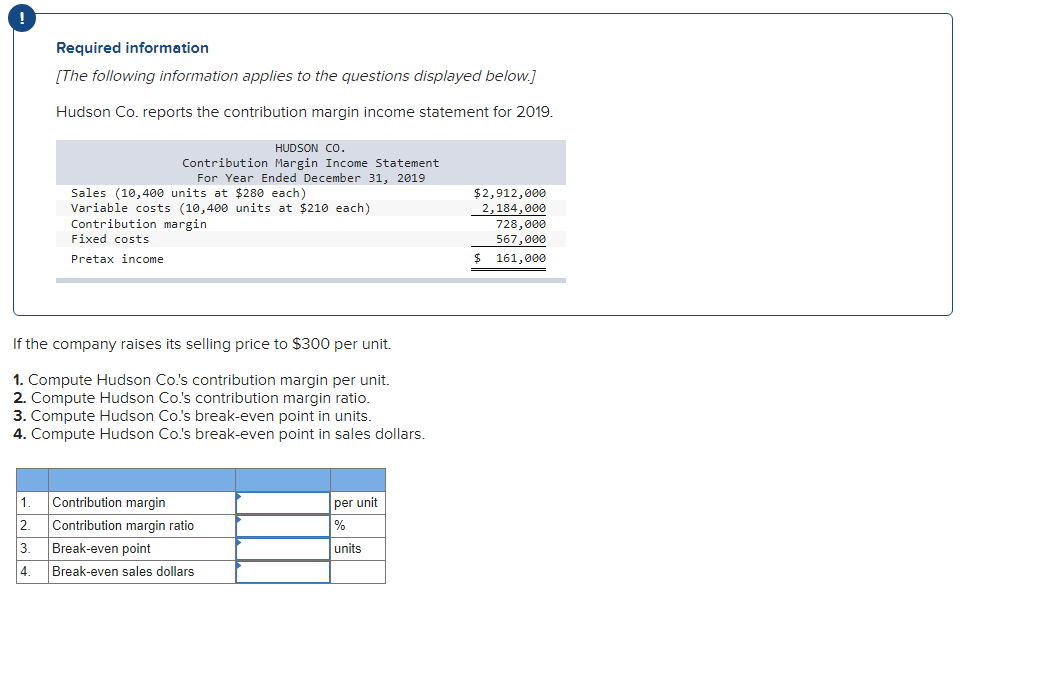

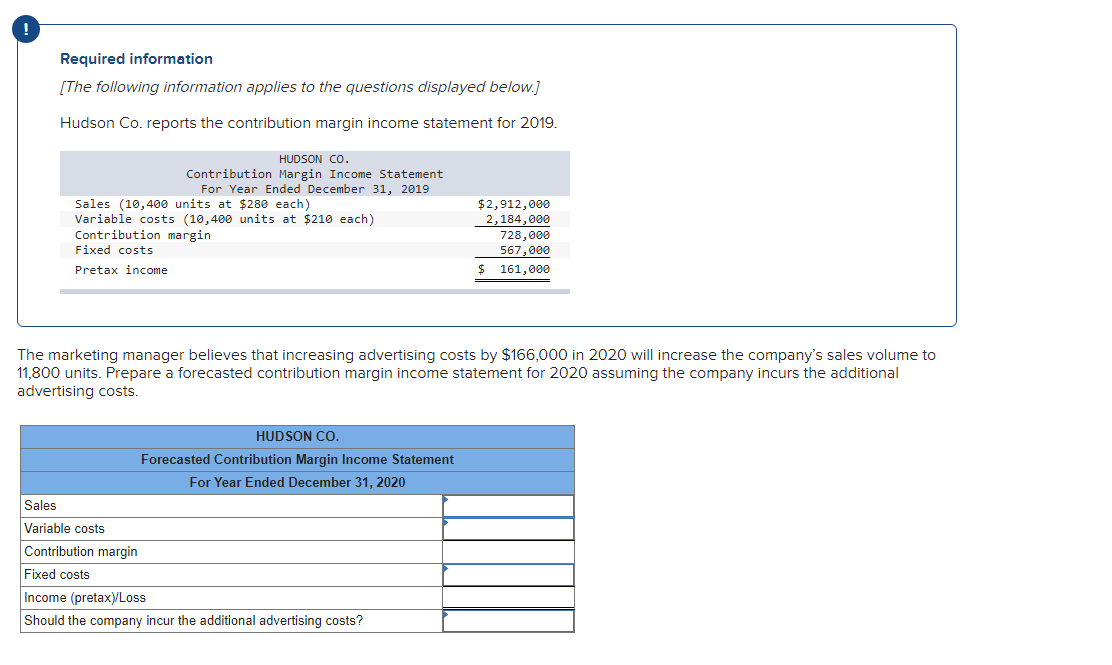

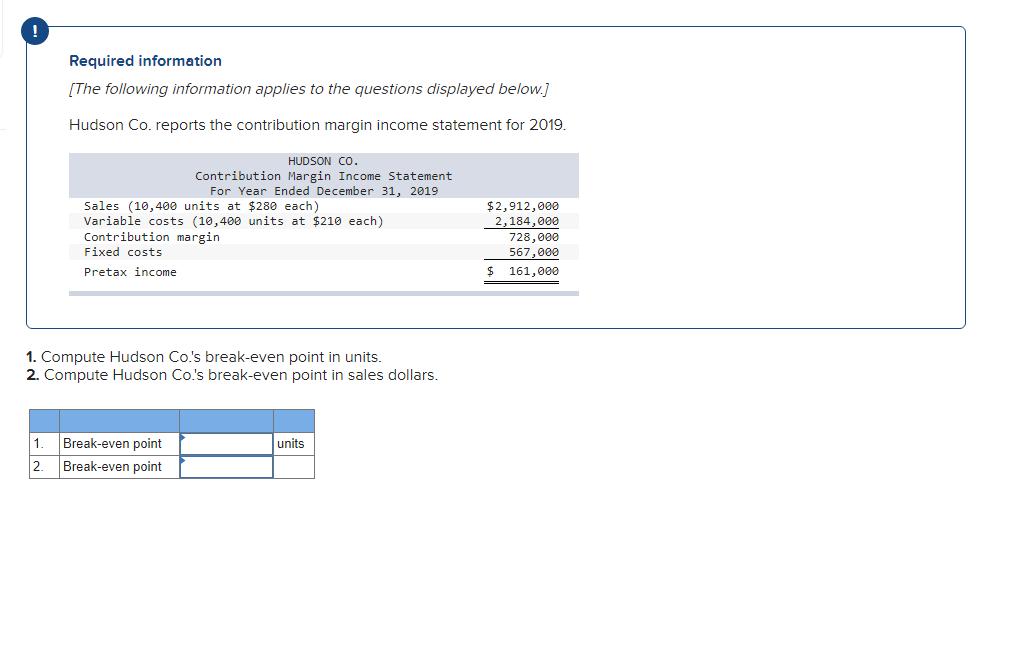

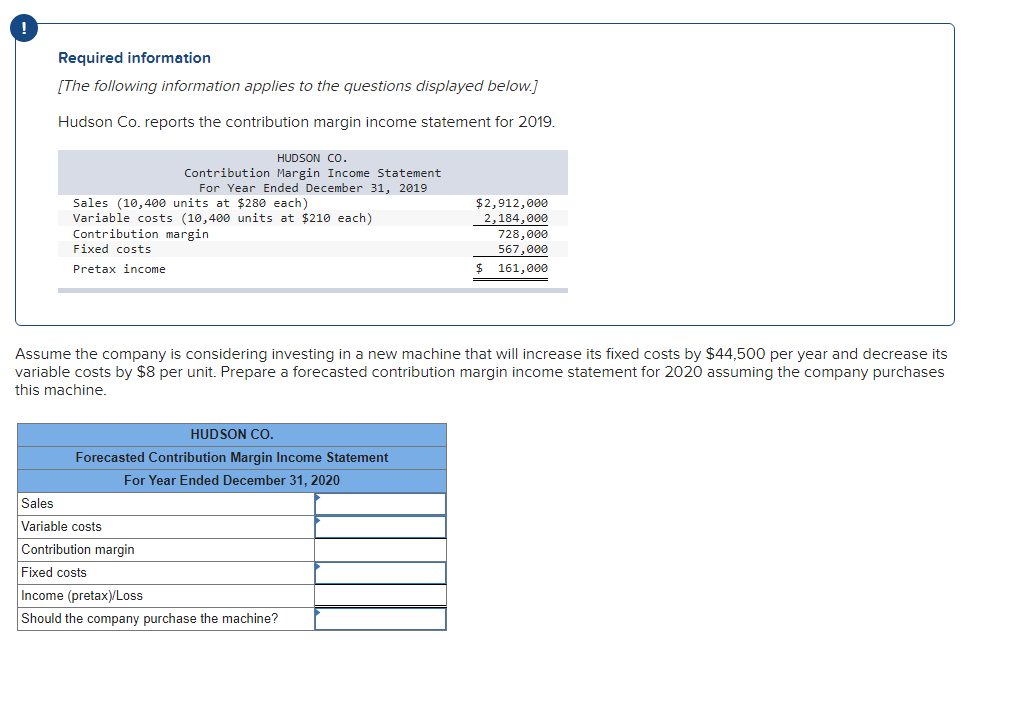

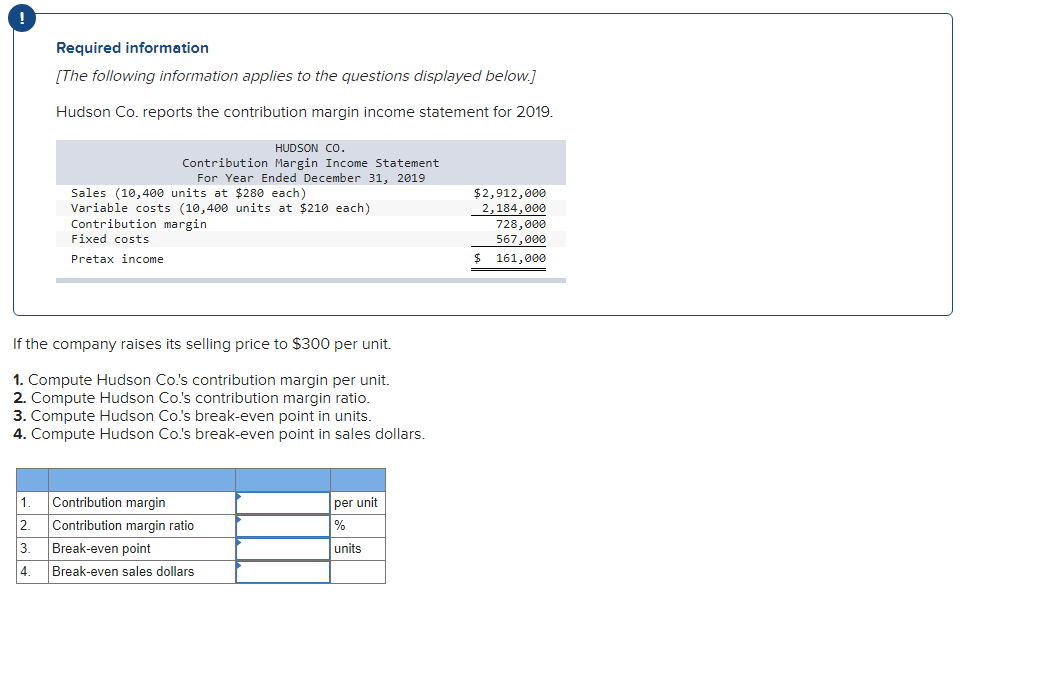

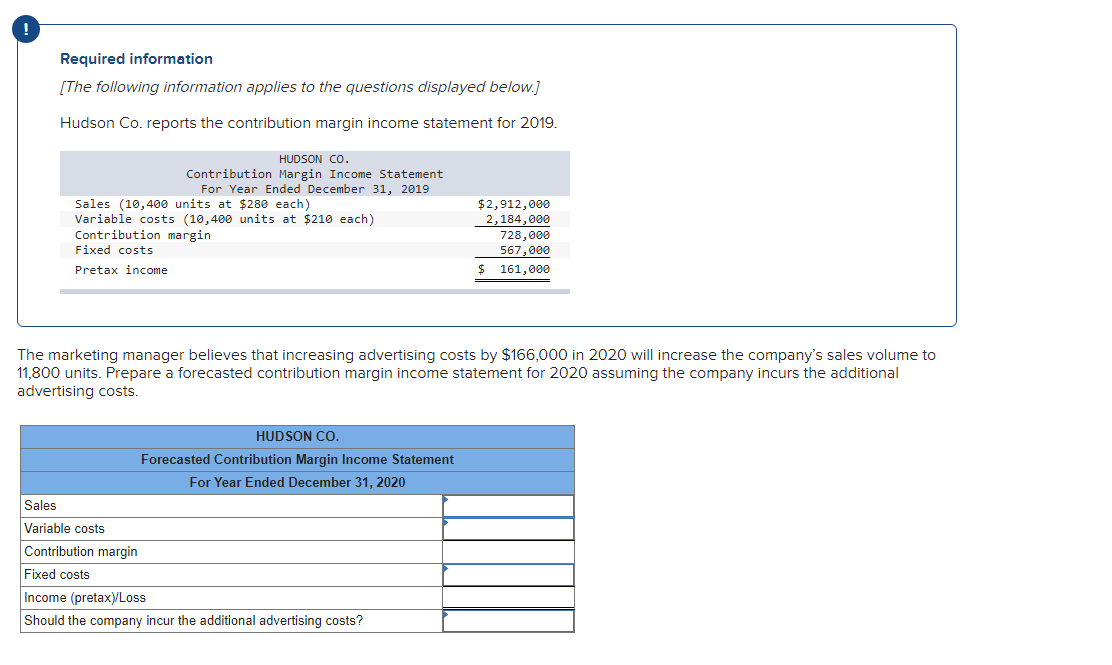

Required information [The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2019. HUDSON CO. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin Fixed costs Pretax income $2,912,000 2,184,000 728,000 567,000 $ 161,000 1. Compute Hudson Co.'s break-even point in units. 2. Compute Hudson Co.'s break-even point in sales dollars. 1 units Break-even point Break-even point 2 Required information (The following information applies to the questions displayed below. Hudson Co. reports the contribution margin income statement for 2019. HUDSON Co. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin Fixed costs Pretax income $2,912,000 2,184,000 728,000 567,000 $ 161,000 Assume the company is considering investing in a new machine that will increase its fixed costs by $44,500 per year and decrease its variable costs by $8 per unit. Prepare a forecasted contribution margin income statement for 2020 assuming the company purchases this machine. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales Variable costs Contribution margin Fixed costs Income (pretax)Loss Should the company purchase the machine? Required information [The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2019. HUDSON Co. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin Fixed costs Pretax income $2,912,000 2,184,000 728,000 567,000 $ 161,000 If the company raises its selling price to $300 per unit. 1. Compute Hudson Co.'s contribution margin per unit. 2. Compute Hudson Co.'s contribution margin ratio. 3. Compute Hudson Co.'s break-even point in units. 4. Compute Hudson Co.'s break-even point in sales dollars. 1 per unit % 2. Contribution margin Contribution margin ratio Break-even point Break-even sales dollars 3 units 4 Required information [The following information applies to the questions displayed below.] Hudson Co. reports the contribution margin income statement for 2019. HUDSON Co. Contribution Margin Income Statement For Year Ended December 31, 2019 Sales (10,400 units at $280 each) Variable costs (10,400 units at $210 each) Contribution margin Fixed costs Pretax income $2,912,000 2,184,000 728,000 567,000 $ 161,000 The marketing manager believes that increasing advertising costs by $166,000 in 2020 will increase the company's sales volume to 11,800 units. Prepare a forecasted contribution margin income statement for 2020 assuming the company incurs the additional advertising costs. HUDSON CO. Forecasted Contribution Margin Income Statement For Year Ended December 31, 2020 Sales Variable costs Contribution margin Fixed costs Income (pretax) Loss Should the company incur the additional advertising costs