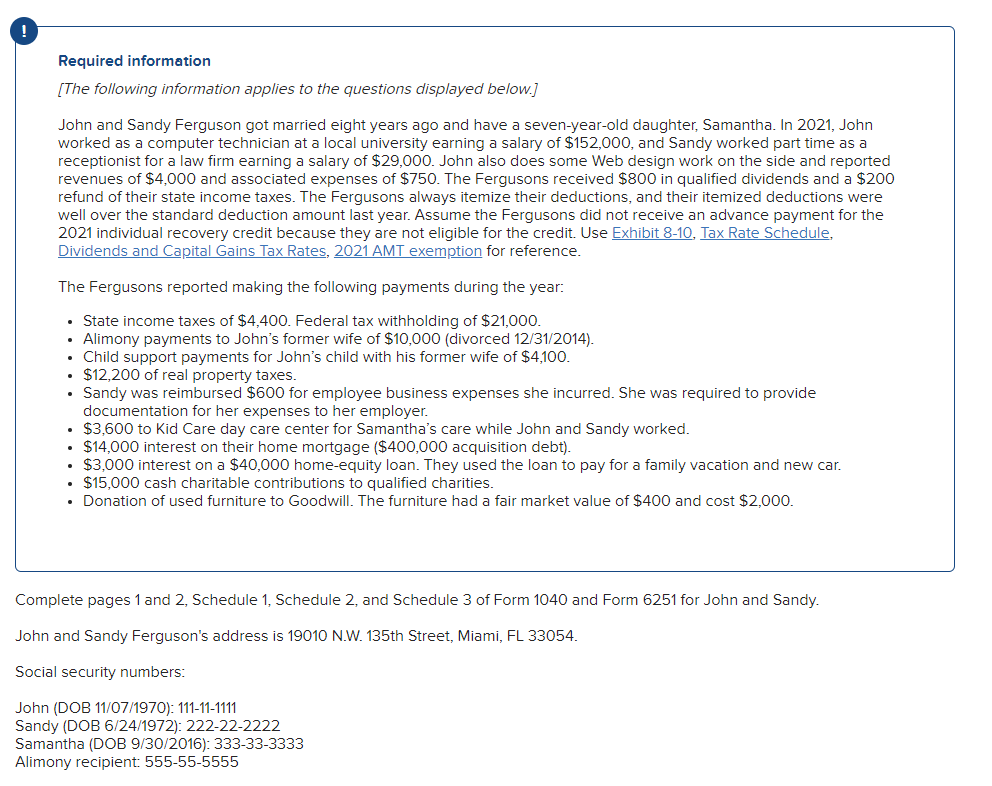

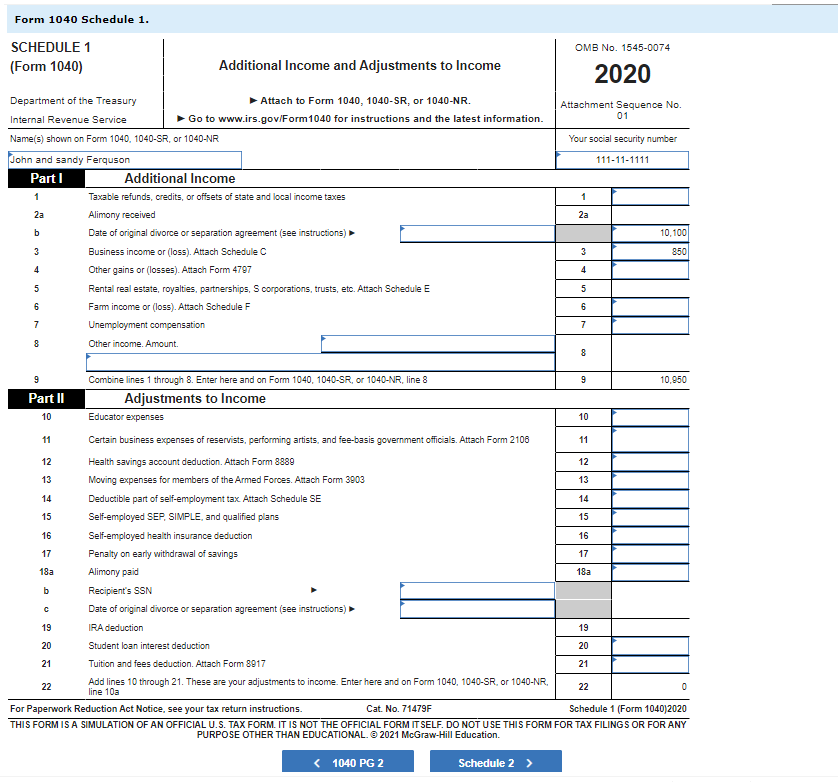

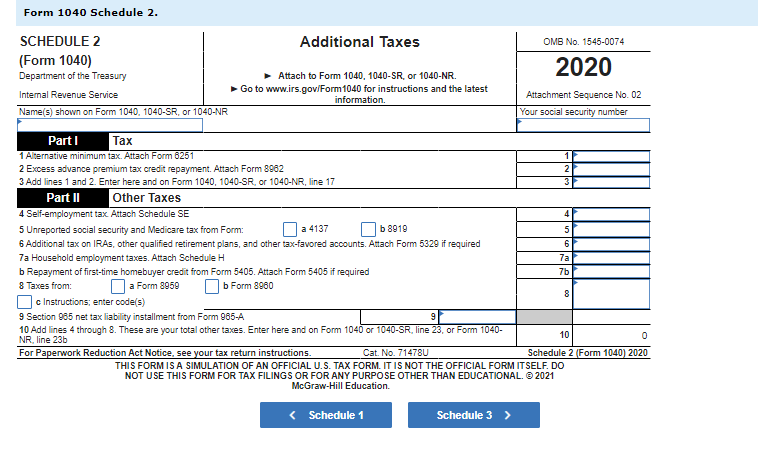

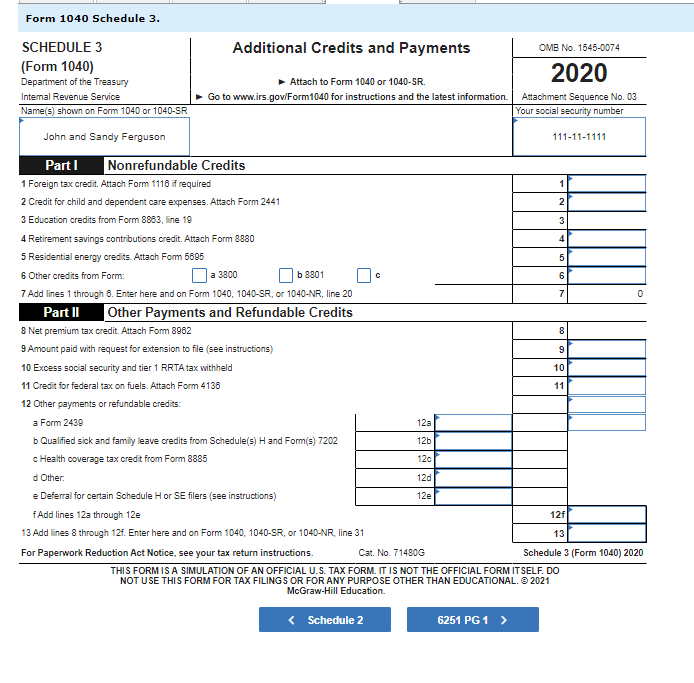

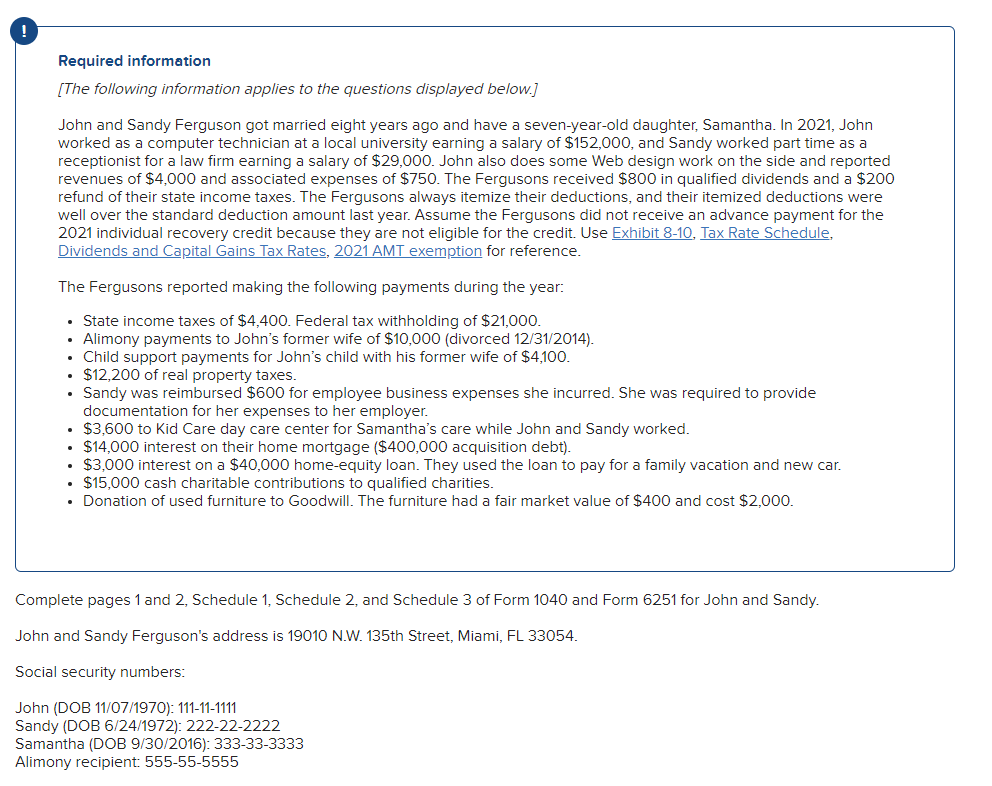

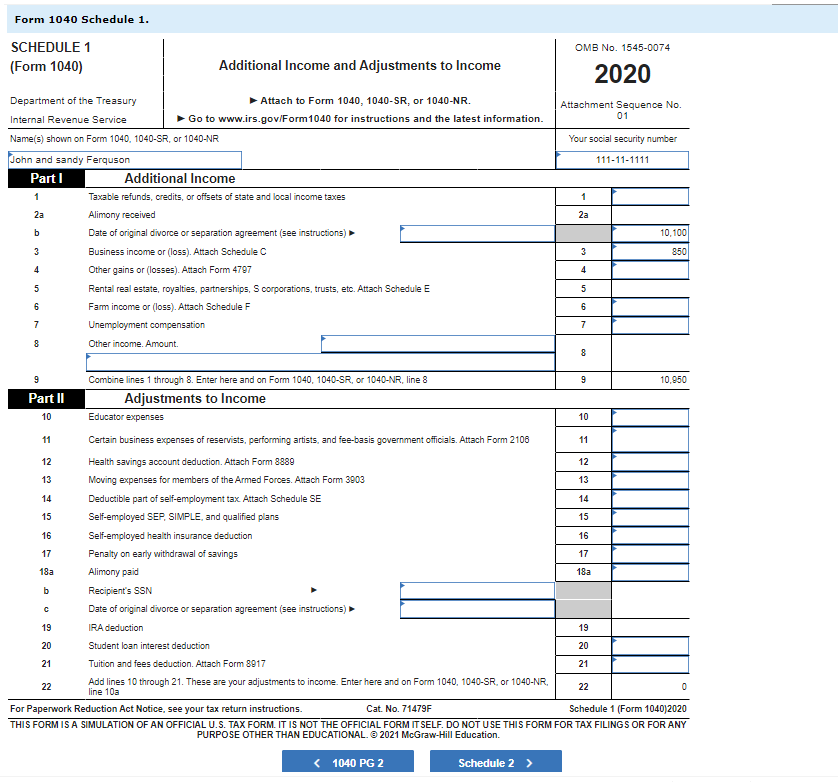

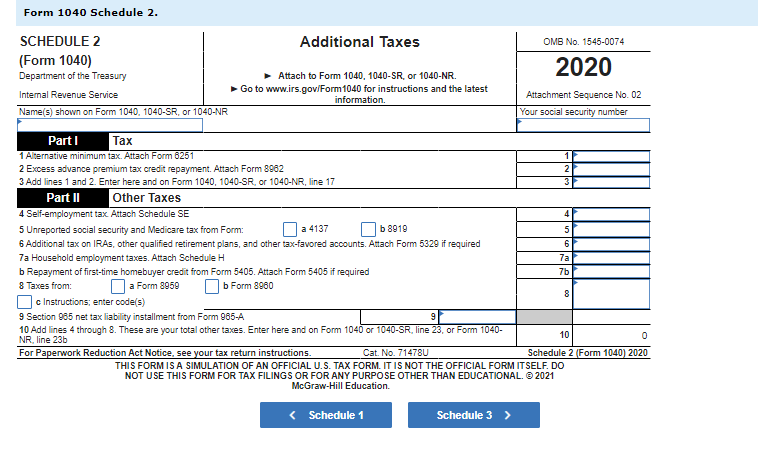

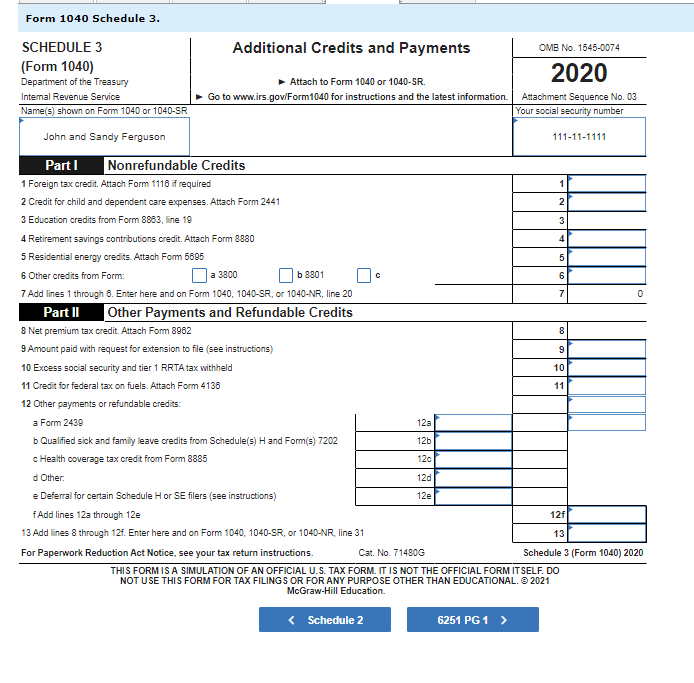

Required information [The following information applies to the questions displayed below. John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 Form 1040 Schedule 1. SCHEDULE 1 (Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2020 Attachment Sequence No. 01 Your social security number 111-11-1111 1 2a Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Name(s) shown on Form 1040 1040-SR, or 1040-NR John and sandy Ferguson Partl Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Fam income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income. Amount. 10.100) 3 850 4 5 6 7 8 9 9 10.950 Part II 10 Combine lines 1 through 8. Enter here and on Form 1040 1040-SR, or 1040-NR, line 3 Adjustments to Income Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Foroes. Attach Form 3903 13 14 Deductible part of self-employment tax Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction 16 17 Penalty on early withdrawal of savings 17 18a Alimony paid 18a b Recipient's SSN Date of original divorce or separation agreement (see instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 1040-SR or 1040-NR. line 10a 22 0 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040)2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL, 2021 McGraw-Hill Education. 2020 1. Form 1040 Schedule 2. SCHEDULE 2 Additional Taxes OMB No 1545-0074 (Form 1040) Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Intemal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information Attachment Sequence No. 02 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Part 1 Tax 1 Alternative minimum tax. Attach Form 6251 2 Excess advance premium tax credit repayment. Attach Form 8982 2 3 Add lines 1 and 2. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 17 3 Part II Other Taxes 4 Self-employment tax Attach Schedule SE 4 5 Unreported social security and Medicare tax from Form: a 4137 b 8910 5 6 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required 6 7a Household employment taxes. Attach Schedule H 7a b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required 7b 8 Taxes from: a Form 8050 b Form 8960 8 c Instructions, enter code(s) 9 Section 985 net tax liability installment from Form 965-A 9 10 Add lines 4 through 8. These are your total other taxes. Enter here and on Form 1040 or 1040-SR, line 23, or Form 1040- NR, line 231 10 0 For Paperwork Reduction Act Notice, see your tax return instructions Cat. No. 71478U Schedule 2 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. Form 1040 Schedule 3. 1 2 3 4 5 5 6 7 SCHEDULE 3 Additional Credits and Payments OMB No. 1545-0074 (Form 1040) 2020 Department of the Treasury Attach to Form 1040 or 1040-SR. Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information Attachment Sequence No. 03 Name(s) shown on Form 1040 or 1040-SR Your social security number John and Sandy Ferguson 111-11-1111 Part Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 if required 2 Credit for child and dependent care expenses. Attach Form 2441 3 Education credits from Form 8983, line 19 4 Retirement savings contributions credit. Attach Form 8880 5 Residential energy credits. Attach Form 5805 6 Other credits from Form: a 3800 b 8801 7 Add lines 1 through B. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 20 0 Part II Other Payments and Refundable Credits 8 Net premium tax credit. Attach Form 8962 9 Amount paid with request for extension to file (see instructions) 10 Excess social security and tier 1 RRTA tax withheld 11 Credit for federal tax on fuels. Attach Form 4138 12 Other payments or refundable credits: a Form 2439 12a b Qualified sick and family leave credits from Schedule(s) H and Form(s) 7202 12b c Health coverage tax credit from Form 8885 d Other: e Deferral for certain Schedule H or SE filers (see instructions) 12e fAdd lines 12a through 12e 12f 13 Add lines 8 through 121. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 31 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71480G Schedule 3 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. 8 9 10 11 12c 12d 13 Required information [The following information applies to the questions displayed below. John and Sandy Ferguson got married eight years ago and have a seven-year-old daughter, Samantha. In 2021, John worked as a computer technician at a local university earning a salary of $152,000, and Sandy worked part time as a receptionist for a law firm earning a salary of $29,000. John also does some Web design work on the side and reported revenues of $4,000 and associated expenses of $750. The Fergusons received $800 in qualified dividends and a $200 refund of their state income taxes. The Fergusons always itemize their deductions, and their itemized deductions were well over the standard deduction amount last year. Assume the Fergusons did not receive an advance payment for the 2021 individual recovery credit because they are not eligible for the credit. Use Exhibit 8-10, Tax Rate Schedule, Dividends and Capital Gains Tax Rates, 2021 AMT exemption for reference. The Fergusons reported making the following payments during the year: State income taxes of $4,400. Federal tax withholding of $21,000. Alimony payments to John's former wife of $10,000 (divorced 12/31/2014). Child support payments for John's child with his former wife of $4,100. $12,200 of real property taxes. Sandy was reimbursed $600 for employee business expenses she incurred. She was required to provide documentation for her expenses to her employer. $3,600 to Kid Care day care center for Samantha's care while John and Sandy worked. $14,000 interest on their home mortgage ($400,000 acquisition debt). $3,000 interest on a $40,000 home-equity loan. They used the loan to pay for a family vacation and new car. $15,000 cash charitable contributions to qualified charities. Donation of used furniture to Goodwill. The furniture had a fair market value of $400 and cost $2,000. Complete pages 1 and 2, Schedule 1, Schedule 2, and Schedule 3 of Form 1040 and Form 6251 for John and Sandy. John and Sandy Ferguson's address is 19010 N.W. 135th Street, Miami, FL 33054. Social security numbers: John (DOB 11/07/1970): 111-11-1111 Sandy (DOB 6/24/1972): 222-22-2222 Samantha (DOB 9/30/2016): 333-33-3333 Alimony recipient: 555-55-5555 Form 1040 Schedule 1. SCHEDULE 1 (Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2020 Attachment Sequence No. 01 Your social security number 111-11-1111 1 2a Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Name(s) shown on Form 1040 1040-SR, or 1040-NR John and sandy Ferguson Partl Additional Income 1 Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Fam income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income. Amount. 10.100) 3 850 4 5 6 7 8 9 9 10.950 Part II 10 Combine lines 1 through 8. Enter here and on Form 1040 1040-SR, or 1040-NR, line 3 Adjustments to Income Educator expenses 10 11 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 11 12 Health savings account deduction. Attach Form 8889 12 13 Moving expenses for members of the Armed Foroes. Attach Form 3903 13 14 Deductible part of self-employment tax Attach Schedule SE 14 15 Self-employed SEP, SIMPLE, and qualified plans 15 16 Self-employed health insurance deduction 16 17 Penalty on early withdrawal of savings 17 18a Alimony paid 18a b Recipient's SSN Date of original divorce or separation agreement (see instructions) 19 IRA deduction 19 20 Student loan interest deduction 20 21 Tuition and fees deduction. Attach Form 8917 21 22 Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 1040-SR or 1040-NR. line 10a 22 0 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479F Schedule 1 (Form 1040)2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL, 2021 McGraw-Hill Education. 2020 1. Form 1040 Schedule 2. SCHEDULE 2 Additional Taxes OMB No 1545-0074 (Form 1040) Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Intemal Revenue Service Go to www.irs.gov/Form 1040 for instructions and the latest information Attachment Sequence No. 02 Name(s) shown on Form 1040, 1040-SR, or 1040-NR Your social security number Part 1 Tax 1 Alternative minimum tax. Attach Form 6251 2 Excess advance premium tax credit repayment. Attach Form 8982 2 3 Add lines 1 and 2. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 17 3 Part II Other Taxes 4 Self-employment tax Attach Schedule SE 4 5 Unreported social security and Medicare tax from Form: a 4137 b 8910 5 6 Additional tax on IRAs, other qualified retirement plans, and other tax-favored accounts. Attach Form 5329 if required 6 7a Household employment taxes. Attach Schedule H 7a b Repayment of first-time homebuyer credit from Form 5405. Attach Form 5405 if required 7b 8 Taxes from: a Form 8050 b Form 8960 8 c Instructions, enter code(s) 9 Section 985 net tax liability installment from Form 965-A 9 10 Add lines 4 through 8. These are your total other taxes. Enter here and on Form 1040 or 1040-SR, line 23, or Form 1040- NR, line 231 10 0 For Paperwork Reduction Act Notice, see your tax return instructions Cat. No. 71478U Schedule 2 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. Form 1040 Schedule 3. 1 2 3 4 5 5 6 7 SCHEDULE 3 Additional Credits and Payments OMB No. 1545-0074 (Form 1040) 2020 Department of the Treasury Attach to Form 1040 or 1040-SR. Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information Attachment Sequence No. 03 Name(s) shown on Form 1040 or 1040-SR Your social security number John and Sandy Ferguson 111-11-1111 Part Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 if required 2 Credit for child and dependent care expenses. Attach Form 2441 3 Education credits from Form 8983, line 19 4 Retirement savings contributions credit. Attach Form 8880 5 Residential energy credits. Attach Form 5805 6 Other credits from Form: a 3800 b 8801 7 Add lines 1 through B. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 20 0 Part II Other Payments and Refundable Credits 8 Net premium tax credit. Attach Form 8962 9 Amount paid with request for extension to file (see instructions) 10 Excess social security and tier 1 RRTA tax withheld 11 Credit for federal tax on fuels. Attach Form 4138 12 Other payments or refundable credits: a Form 2439 12a b Qualified sick and family leave credits from Schedule(s) H and Form(s) 7202 12b c Health coverage tax credit from Form 8885 d Other: e Deferral for certain Schedule H or SE filers (see instructions) 12e fAdd lines 12a through 12e 12f 13 Add lines 8 through 121. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 31 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71480G Schedule 3 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. 8 9 10 11 12c 12d 13