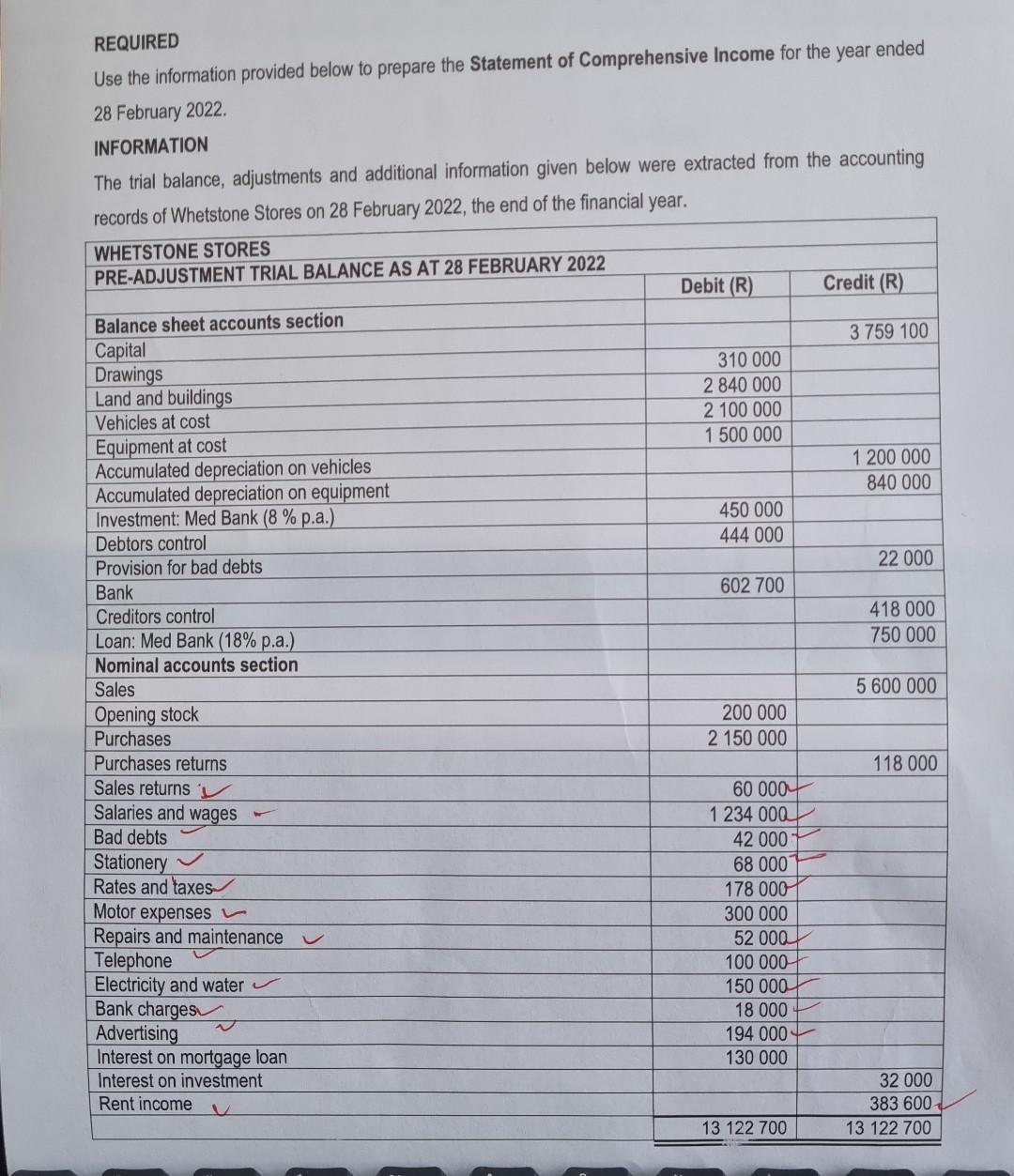

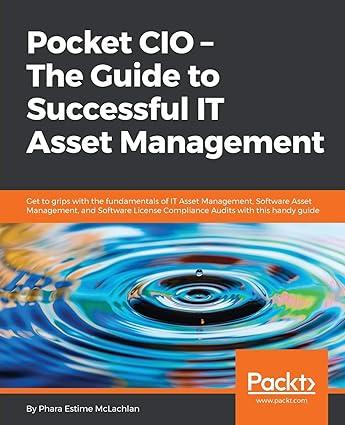

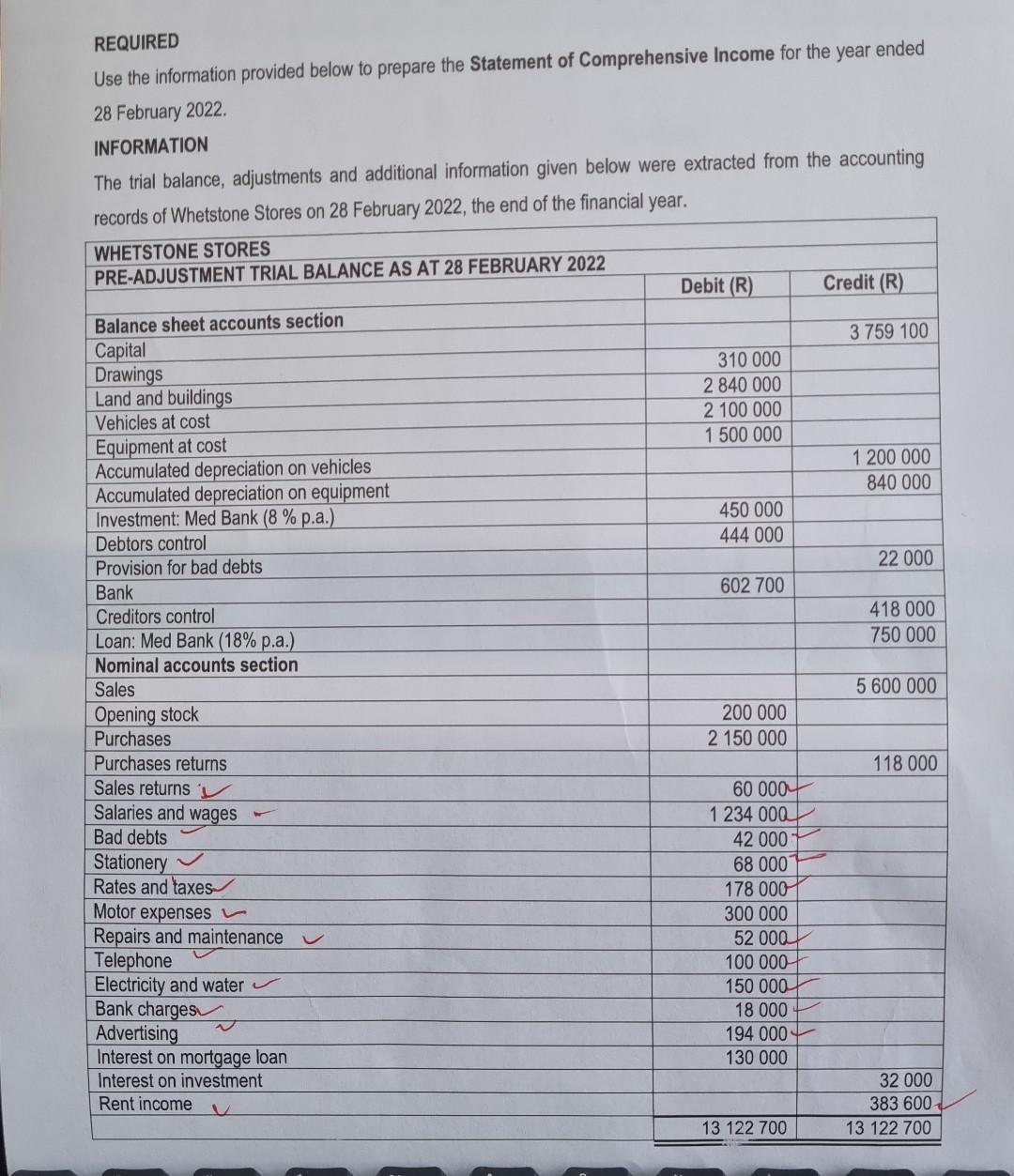

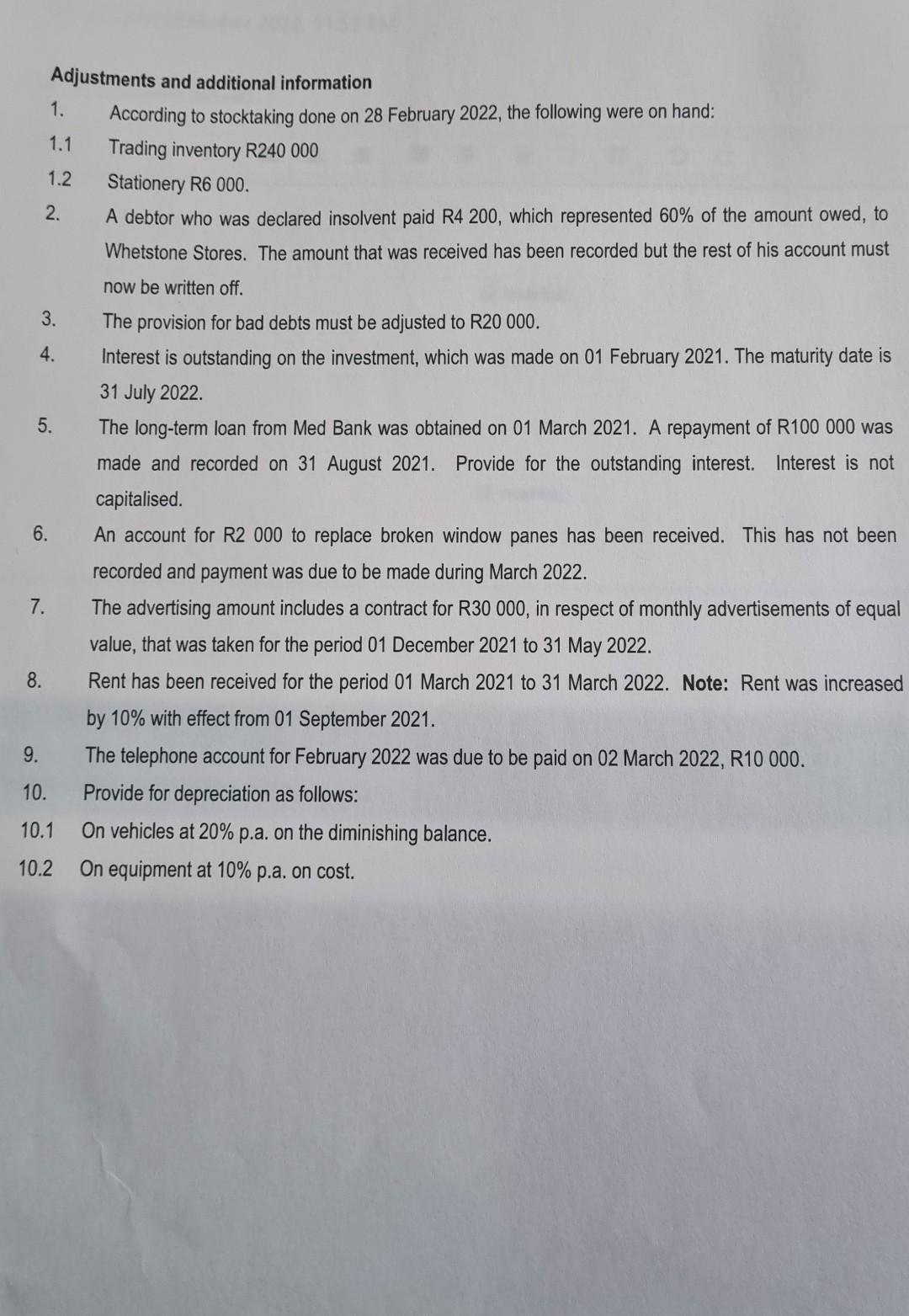

REQUIRED Use the information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2022. INFORMATION The trial balance, adjustments and additional information given below were extracted from the accounting Ctnrae n28 Fahruarv 2022. the end of the financial year. Adjustments and additional information 1. According to stocktaking done on 28 February 2022 , the following were on hand: 1.1 Trading inventory R240 000 1.2 Stationery R6 000. 2. A debtor who was declared insolvent paid R4 200, which represented 60% of the amount owed, to Whetstone Stores. The amount that was received has been recorded but the rest of his account must now be written off. 3. The provision for bad debts must be adjusted to R20 000 . 4. Interest is outstanding on the investment, which was made on 01 February 2021. The maturity date is 31 July 2022. 5. The long-term loan from Med Bank was obtained on 01 March 2021. A repayment of R100 000 was made and recorded on 31 August 2021 . Provide for the outstanding interest. Interest is not capitalised. 6. An account for R2 000 to replace broken window panes has been received. This has not been recorded and payment was due to be made during March 2022. 7. The advertising amount includes a contract for R30000, in respect of monthly advertisements of equal value, that was taken for the period 01 December 2021 to 31 May 2022. 8. Rent has been received for the period 01 March 2021 to 31 March 2022. Note: Rent was increased by 10% with effect from 01 September 2021. 9. The telephone account for February 2022 was due to be paid on 02 March 2022, R10000. 10. Provide for depreciation as follows: 10.1 On vehicles at 20% p.a. on the diminishing balance. 10.2 On equipment at 10% p.a. on cost. REQUIRED Use the information provided below to prepare the Statement of Comprehensive Income for the year ended 28 February 2022. INFORMATION The trial balance, adjustments and additional information given below were extracted from the accounting Ctnrae n28 Fahruarv 2022. the end of the financial year. Adjustments and additional information 1. According to stocktaking done on 28 February 2022 , the following were on hand: 1.1 Trading inventory R240 000 1.2 Stationery R6 000. 2. A debtor who was declared insolvent paid R4 200, which represented 60% of the amount owed, to Whetstone Stores. The amount that was received has been recorded but the rest of his account must now be written off. 3. The provision for bad debts must be adjusted to R20 000 . 4. Interest is outstanding on the investment, which was made on 01 February 2021. The maturity date is 31 July 2022. 5. The long-term loan from Med Bank was obtained on 01 March 2021. A repayment of R100 000 was made and recorded on 31 August 2021 . Provide for the outstanding interest. Interest is not capitalised. 6. An account for R2 000 to replace broken window panes has been received. This has not been recorded and payment was due to be made during March 2022. 7. The advertising amount includes a contract for R30000, in respect of monthly advertisements of equal value, that was taken for the period 01 December 2021 to 31 May 2022. 8. Rent has been received for the period 01 March 2021 to 31 March 2022. Note: Rent was increased by 10% with effect from 01 September 2021. 9. The telephone account for February 2022 was due to be paid on 02 March 2022, R10000. 10. Provide for depreciation as follows: 10.1 On vehicles at 20% p.a. on the diminishing balance. 10.2 On equipment at 10% p.a. on cost