Question: Return to the initial inflation assumptions (5 percent on price and 2 percent on cash costs). a. Assume that the sales quantity estimate remains at

Return to the initial inflation assumptions (5 percent on price and 2 percent on cash costs).

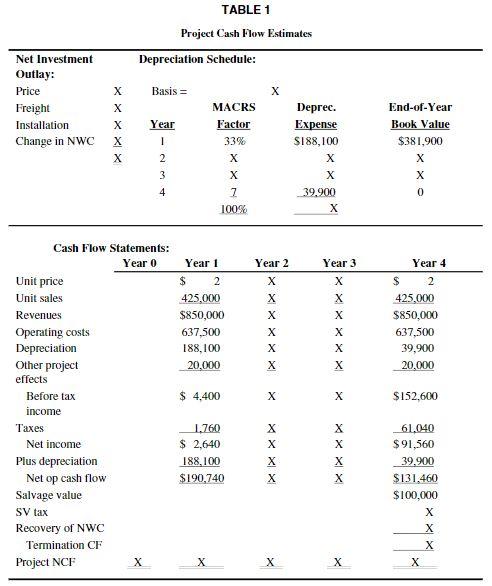

a. Assume that the sales quantity estimate remains at 425,000 units per year. What Year 0 unit price would the company have to set to cause the project to just break even?

b. Now assume that the sales price remains at $2. What annual unit sales volume would be needed for the project to break even?

TABLE 1 Project Cash Flow Estimates Net Investment Depreciation Schedule: Outlay: Price X Basis = Freight X CRS Deprec. End-of-Year Year Factor Expense Book Value Installation X Change in NWC X 33% SI88, 100 $381,900 X 2 X 3 X X X 4 39.900 100% X Cash Flow Statements: Year 0 Year 1 Year 2 Year 3 Year 4 Unit price $ 2 X X 2 Unit sales 425,000 X 425,000 Revenues $850,000 X X $850,000 Operating costs Depreciation 637,500 637,500 188,100 39,900 Other project effects 20,000 20,000 Before tax $ 4,400 $152,600 income es 1,760 X 61,040 $ 2,640 $91,560 Net income X Plus depreciation Net op cash flow 188,100 39,900 $190,740 $131,460 Salvage value $100,000 SV tax X Recovery of NWC Termination CF Project NCF X X X. 11

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Solution 1 2958 Working Price 2200000 Freight 80000 ... View full answer

Get step-by-step solutions from verified subject matter experts