Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Review View Help Open in Desktop App Tell me what you want to do Editing 12 A B I U Av A A Ev

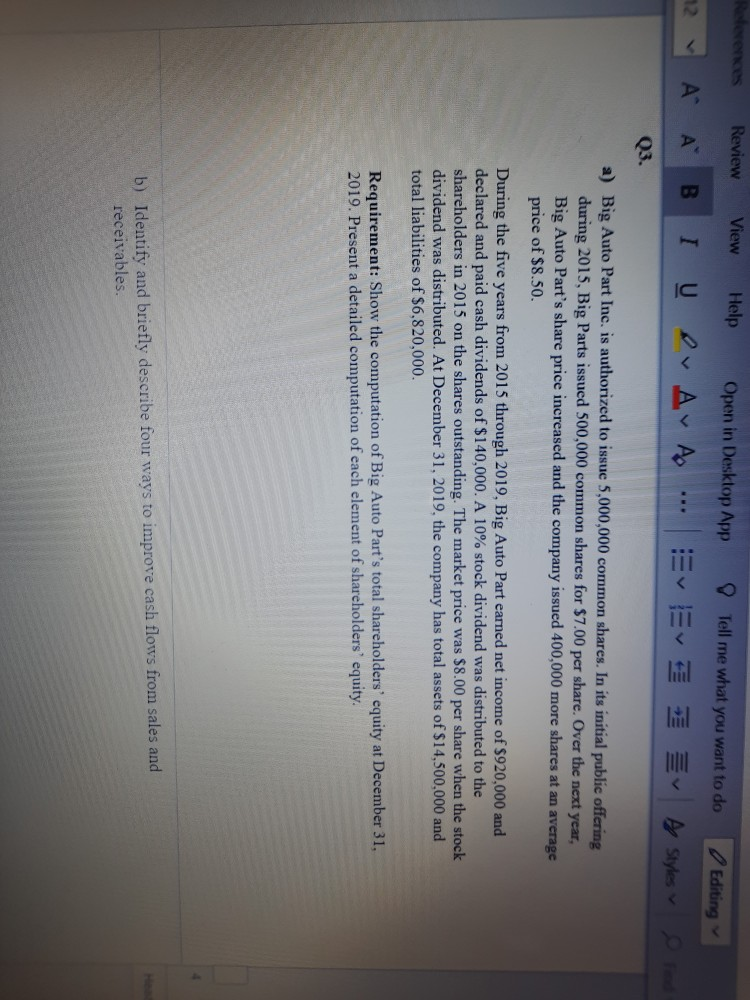

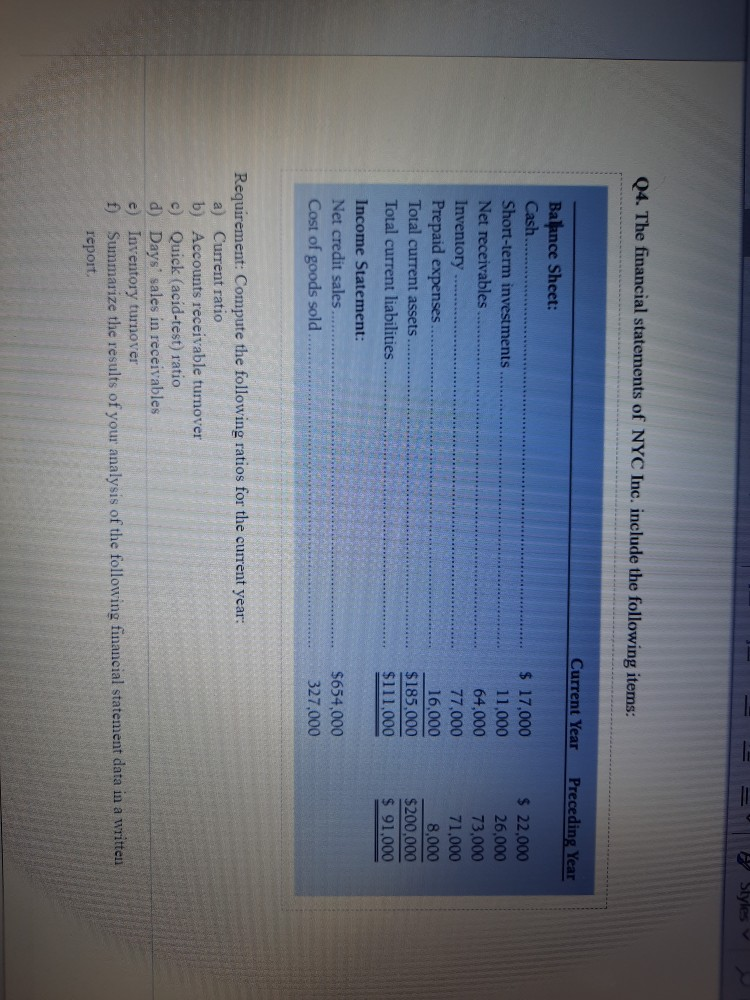

Review View Help Open in Desktop App Tell me what you want to do Editing 12 " A B I U Av A A Ev Ev Styles Q3. a) Big Auto Part Inc. is authorized to issue 5,000,000 common shares. In its initial public offering during 2015, Big Parts issued 500,000 common shares for $7.00 per share. Over the next year, Big Auto Part's share price increased and the company issued 400,000 more shares at an average price of $8.50 During the five years from 2015 through 2019, Big Auto Part earned net income of $920,000 and declared and paid cash dividends of $140,000. A 10% stock dividend was distributed to the shareholders in 2015 on the shares outstanding. The market price was $8.00 per share when the stock dividend was distributed. At December 31, 2019, the company has total assets of $14,500,000 and total liabilities of $6,820,000. Requirement: Show the computation of Big Auto Part's total shareholders' equity at December 31, 2019. Present a detailed computation of each element of shareholders' equity. b) Identify and briefly describe four ways to improve cash flows from sales and receivables. Styles Q4. The financial statements of NYC Inc. include the following items: Current Year Preceding Year Balance Sheet: Cash Short-term investments Net receivables Inventory Prepaid expenses Total current assets Total current liabilities Income Statement: Net credit sales Cost of goods sold $ 17,000 11,000 64,000 77,000 16.000 $185.000 $111.000 $ 22,000 26,000 73,000 71.000 8,000 $200,000 $ 91,000 $654,000 327,000 Requirement: Compute the following ratios for the current year: a) Current ratio b) Accounts receivable turnover c) Quick (acid-test) ratio d) Days' sales in receivables e) Inventory turnover f) Summarize the results of your analysis of the following financial statement data in a written report

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started