Answered step by step

Verified Expert Solution

Question

1 Approved Answer

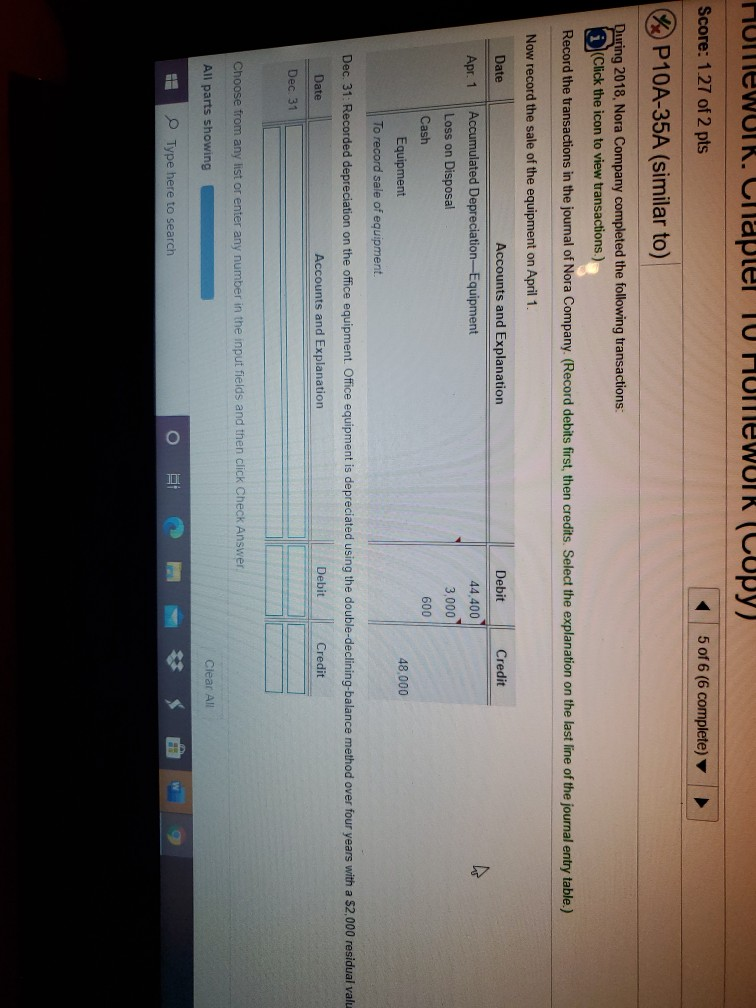

Score: 1.27 of 2 pts 5 of 6 (6 complete) P10A-35A (similar to) During 2018Nora Company completed the following transactions: (Click the icon to view

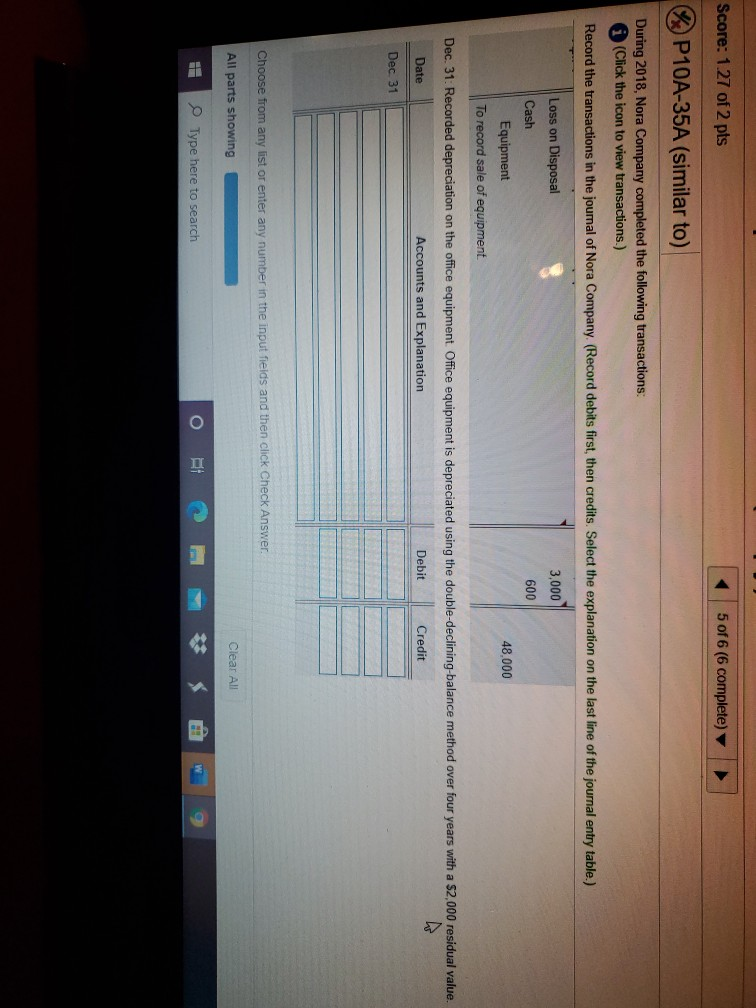

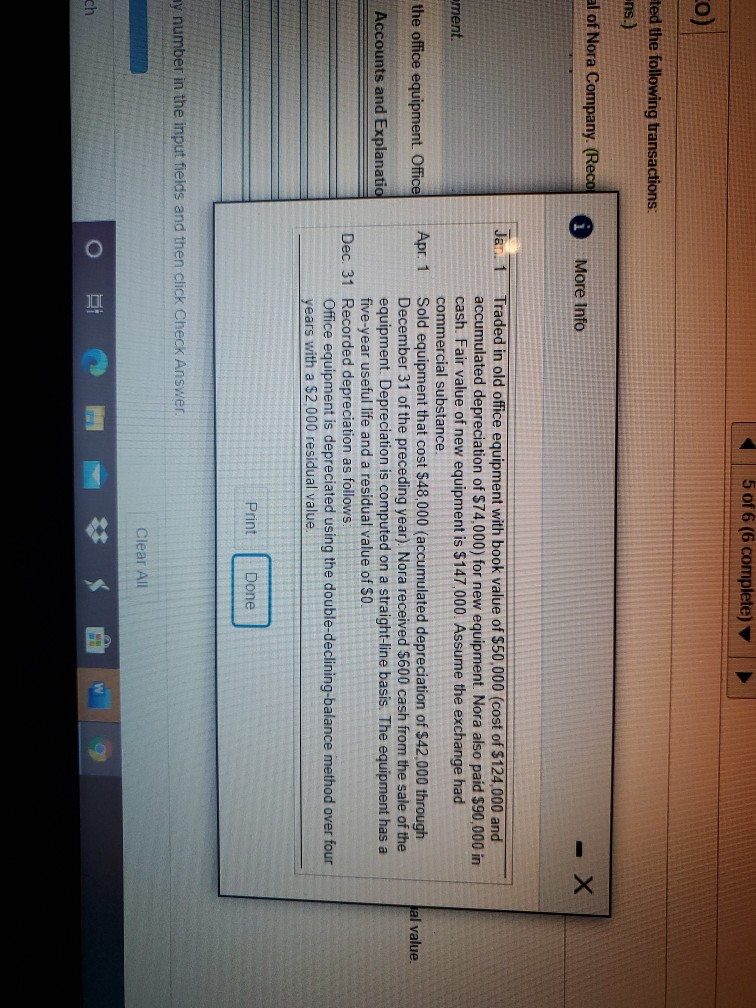

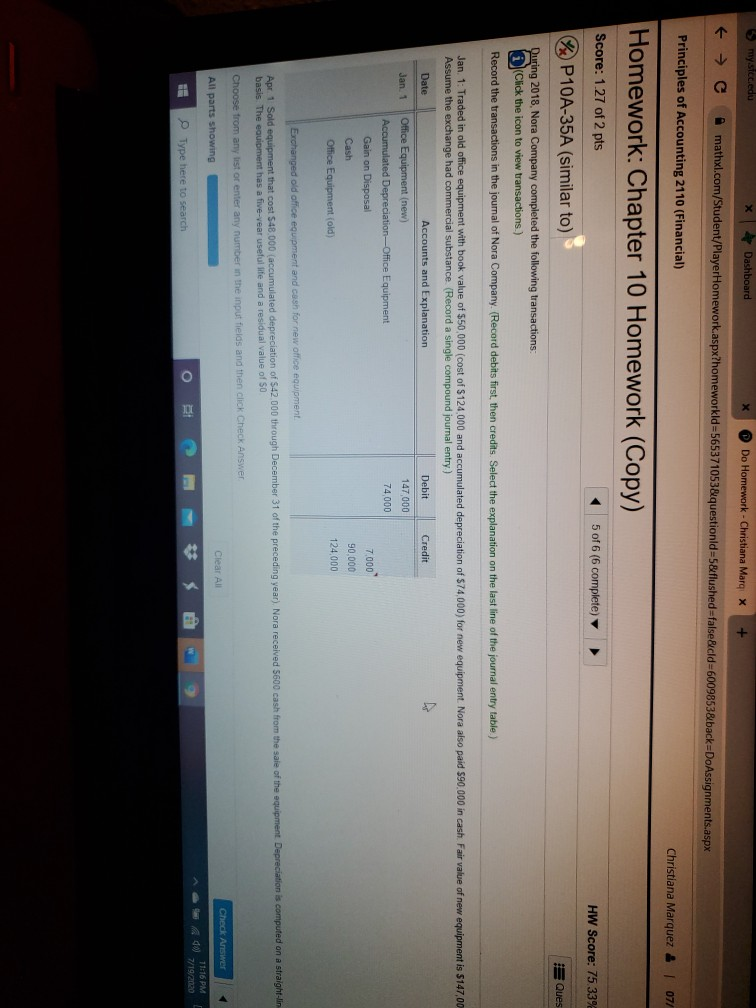

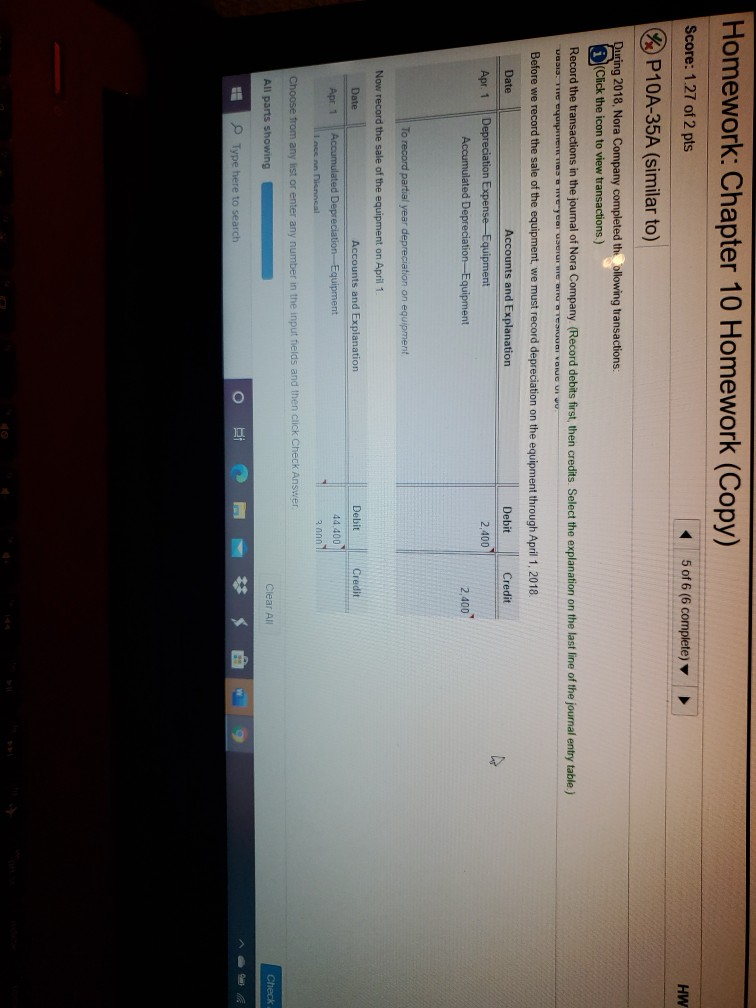

Score: 1.27 of 2 pts 5 of 6 (6 complete) P10A-35A (similar to) During 2018Nora Company completed the following transactions: (Click the icon to view transactions.) Record the transactions in the journal of Nora Company. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Loss on Disposal 3,000 600 Cash 48.000 Equipment To record sale of equipment Dec. 31: Recorded depreciation on the office equipment Office equipment is depreciated using the double-declining balance method over four years with a $2,000 residual value. Date Accounts and Explanation Debit Credit Dec 31 Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Type here to search W 5 of 6 (6 complete) CO) Eted the following transactions: ens.) al of Nora Company. (Reco More Info - X ament the office equipment Office al value. Jan. 1 Traded in old office equipment with book value of $50,000 (cost of $124,000 and accumulated depreciation of $74.000) for new equipment. Nora also paid $90,000 in cash. Fair value of new equipment is $147,000. Assume the exchange had commercial substance. Apr. 1 Sold equipment that cost $48,000 (accumulated depreciation of $42,000 through December 31 of the preceding year) Nora received $600 cash from the sale of the equipment. Depreciation is computed on a straight-line basis. The equipment has a five-year useful life and a residual value of $0. Dec. 31 Recorded depreciation as follows Office equipment is depreciated using the double-declining-balance method over four years with a $2,000 residual value Accounts and Explanatio Print Done ny number in the input fields and then click Check Answer Clear All W ch 3 mystcc.edu Dashboard Do Homework - Christiana Marq x 1 C mathxl.com/Student/PlayerHomework.aspx?homeworkld=565371053&questionid=5&flushed=false&cd=6009853&back-DoAssignments.aspx Principles of Accounting 2110 (Financial) Christiana Marquez & 07/ Homework: Chapter 10 Homework (Copy) Score: 1.27 of 2 pts 5 of 6 (6 complete) > HW Score: 75 339 P10A-35A (similar to) Ques During 2018 Nora Company completed the following transactions: Click the icon to view transactions.) Record the transactions in the journal of Nora Company. (Record debits first, then credits. Select the explanation on the last line of the journal entry table) also paid $90,000 in cash. Fair value of new equipment is $147,00 Jan 1: Traded in old office equipment with book value of $50,000 (cost of $124,000 and accumulated depreciation of $74,000) for new equipment Assume the exchange had commercial substance. (Record a single compound journal entry) Date Accounts and Explanation Debit Credit Jan 1 Office Equipment (new) 147,000 Accumulated Depreciation - Office Equipment 74.000 Gain on Disposal 7.000 Cash 90,000 Office Equipment (old) 124.000 Exchanged old office equipment and cash for new office equipment Apr 1 Sold equipment that cost $48.000 (accumulated depreciation of 542.000 through December 31 of the preceding year). Nora received 5600 cash from the sale of the equipment Depreciation is computed on a straight-lin basis. The equipment has a five-vear useful life and a residual value of $0 Choose from any test or enter any number in the input fields and then click Check Answer Clear All Check Answer All parts showing 11:16 PM 4 40 7/19/2020 F Type here to search Homework: Chapter 10 Homework (Copy) Score: 127 of 2 pts 5 of 6 (6 complete) HW P10A-35A (similar to) During 2018 Nora Company completed thollowing transactions: (Click the icon to view transactions.) Record the transactions in the journal of Nora Company (Record debits first, then credits. Select the explanation on the last line of the journal entry table) 313. Before we record the sale of the equipment, we must record depreciation on the equipment through April 1, 2018 Date Accounts and Explanation Debit Credit Apr 1 Depreciation Expense-Equipment 2.400 Accumulated Depreciation Equipment 2.400 To record partial year depreciation on equipment Now record the sale of the equipment on April 1 Date Credit Accounts and Explanation Accumulated Depreciation Equipment Debit 44 400 Apr 1 I nee Dinneal Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Check Type here to search HUMEWUIK. Chapel 10 HUMEWUIK (Copy) Score: 1.27 of 2 pts 5 of 6 (6 complete) P10A-35A (similar to) During 2018, Nora Company completed the following transactions: (Click the icon to view transactions.) Record the transactions in the journal of Nora Company. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Debit Credit Now record the sale of the equipment on April 1. Date Accounts and Explanation Apr. 1 Accumulated Depreciation-Equipment Loss on Disposal Cash Equipment To record sale of equipment. 44.400 3,000 600 48.000 Dec. 31: Recorded depreciation on the office equipment. Office equipment is depreciated using the double-declining-balance method over four years with a $2,000 residual valu Date Accounts and Explanation Debit Credit Dec 31 Choose from any list or enter any number in the input fields and then click Check Answer All parts showing Clear All Type here to search O W

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started