Setup an amortization schedule for this problem. I need to know the effective interest rate and the answers below.

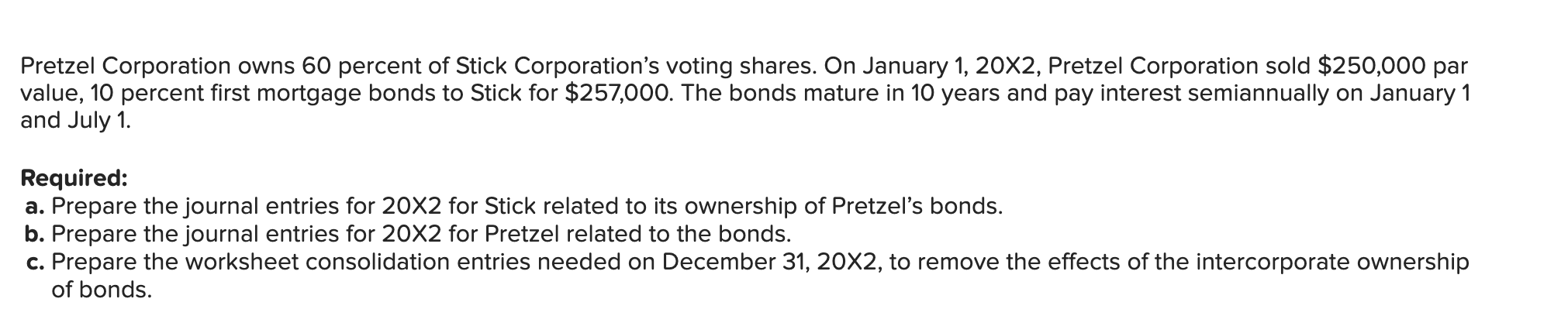

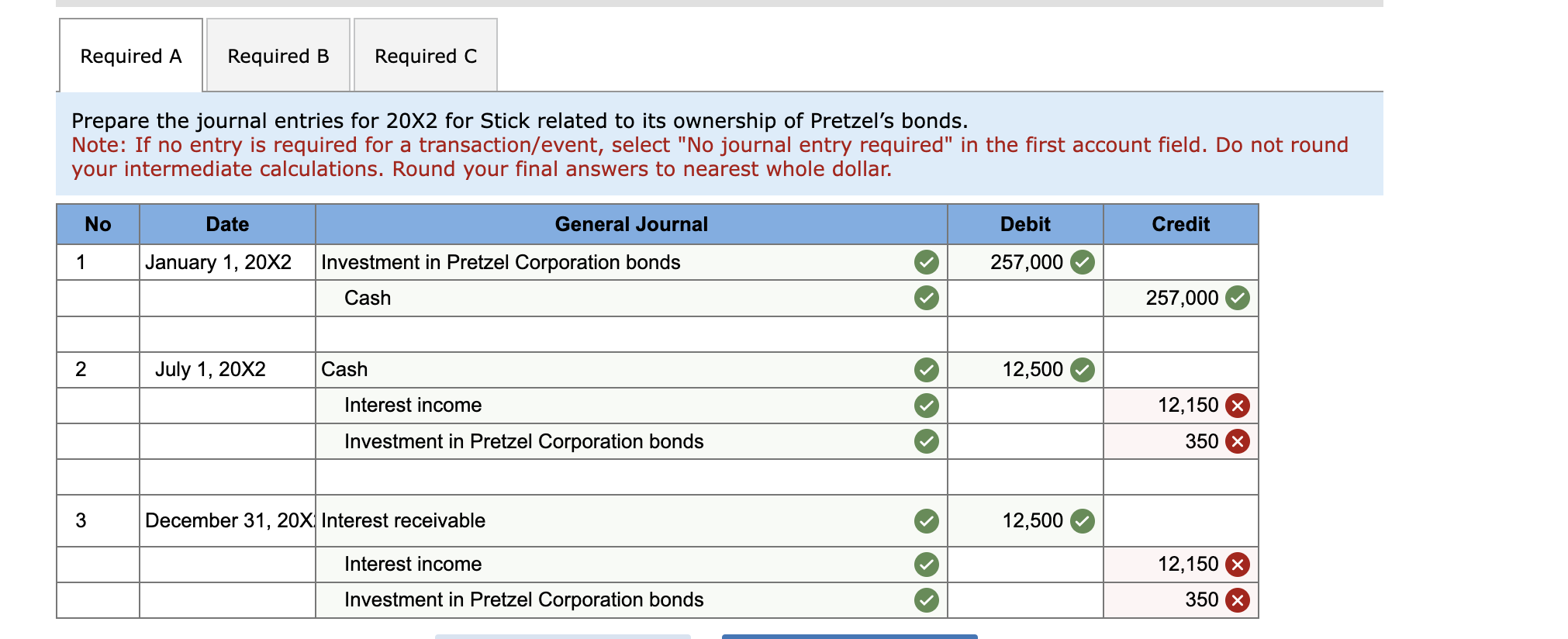

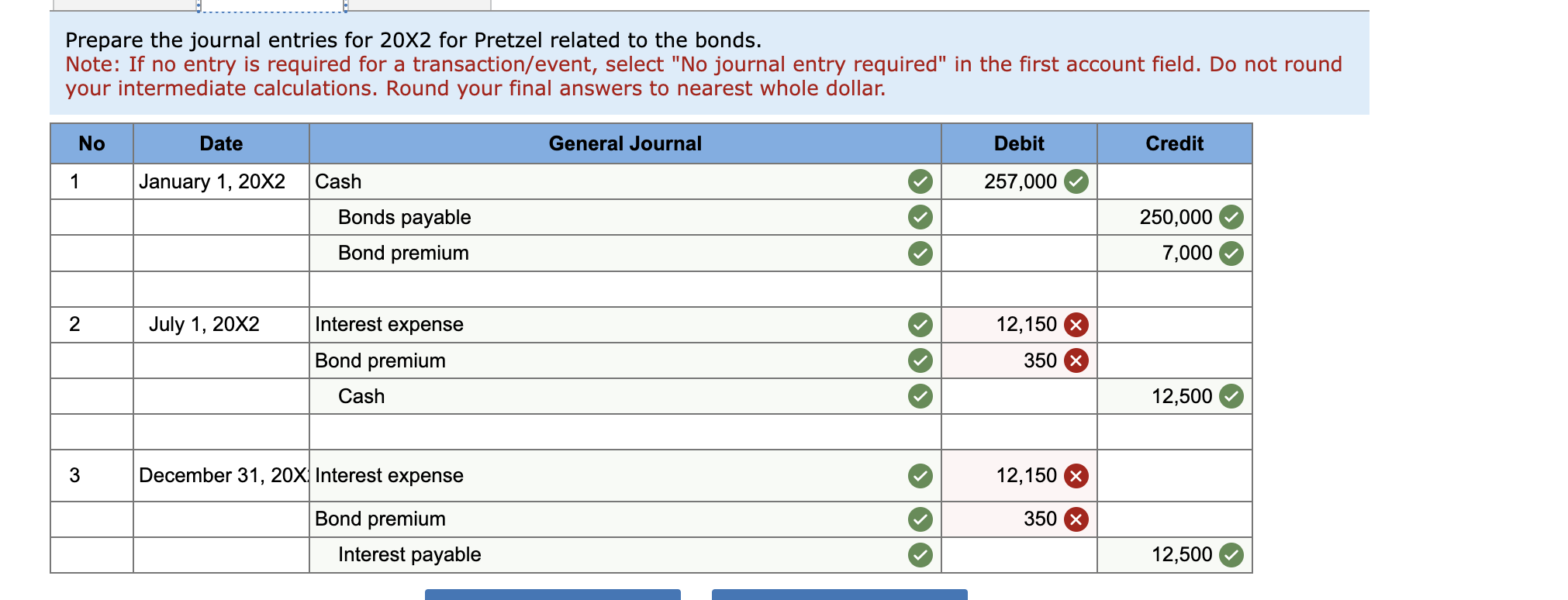

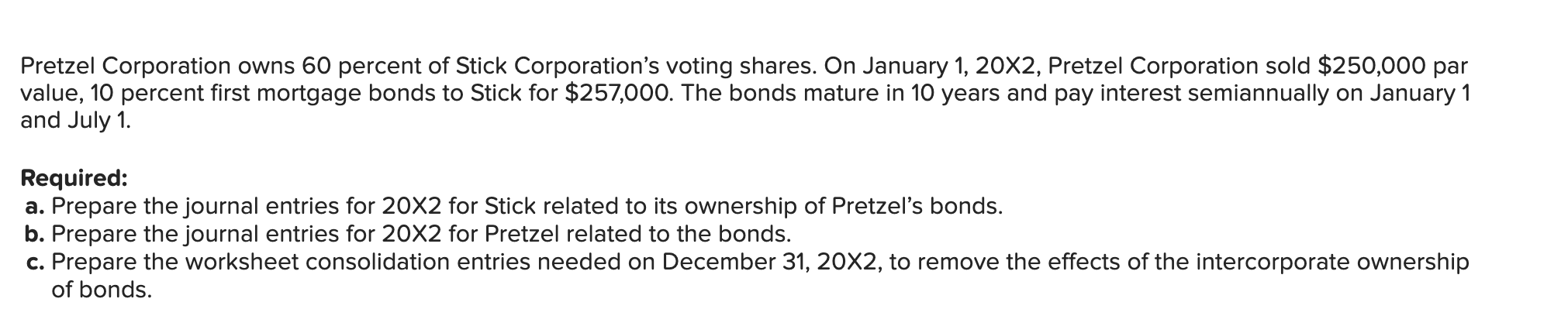

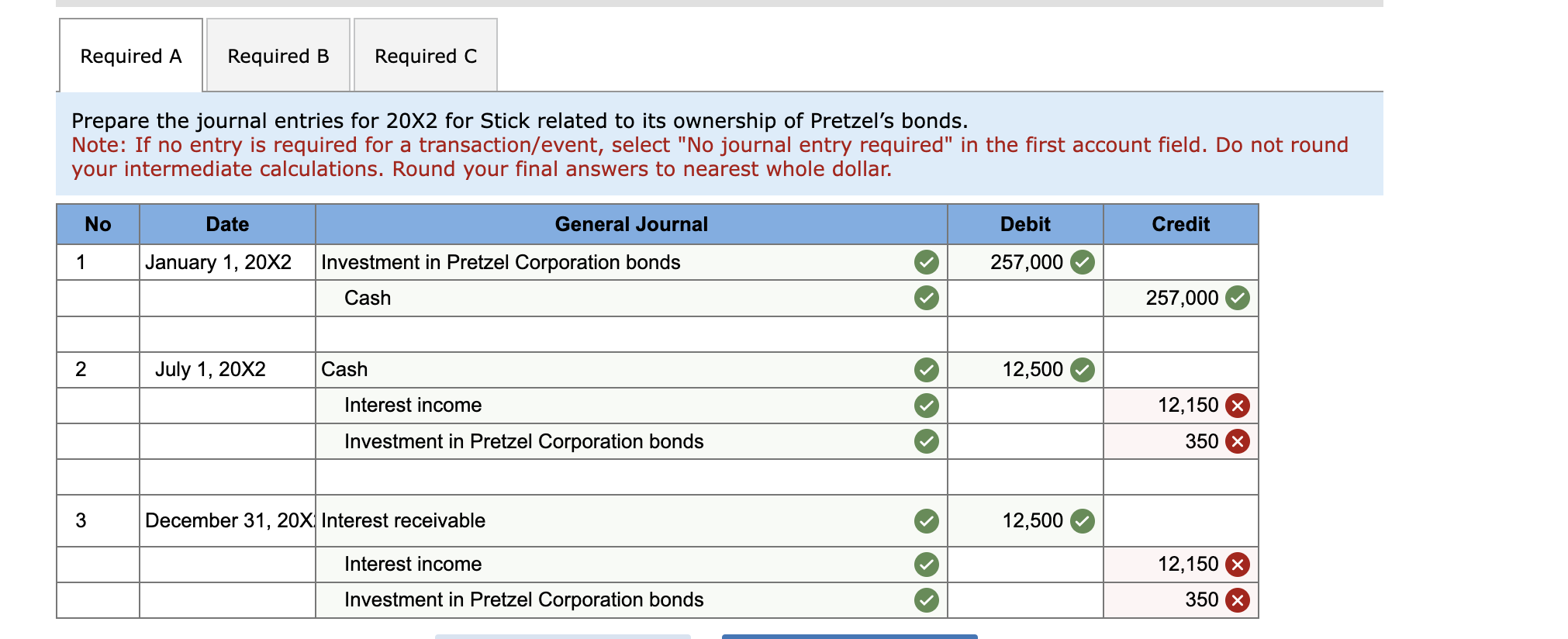

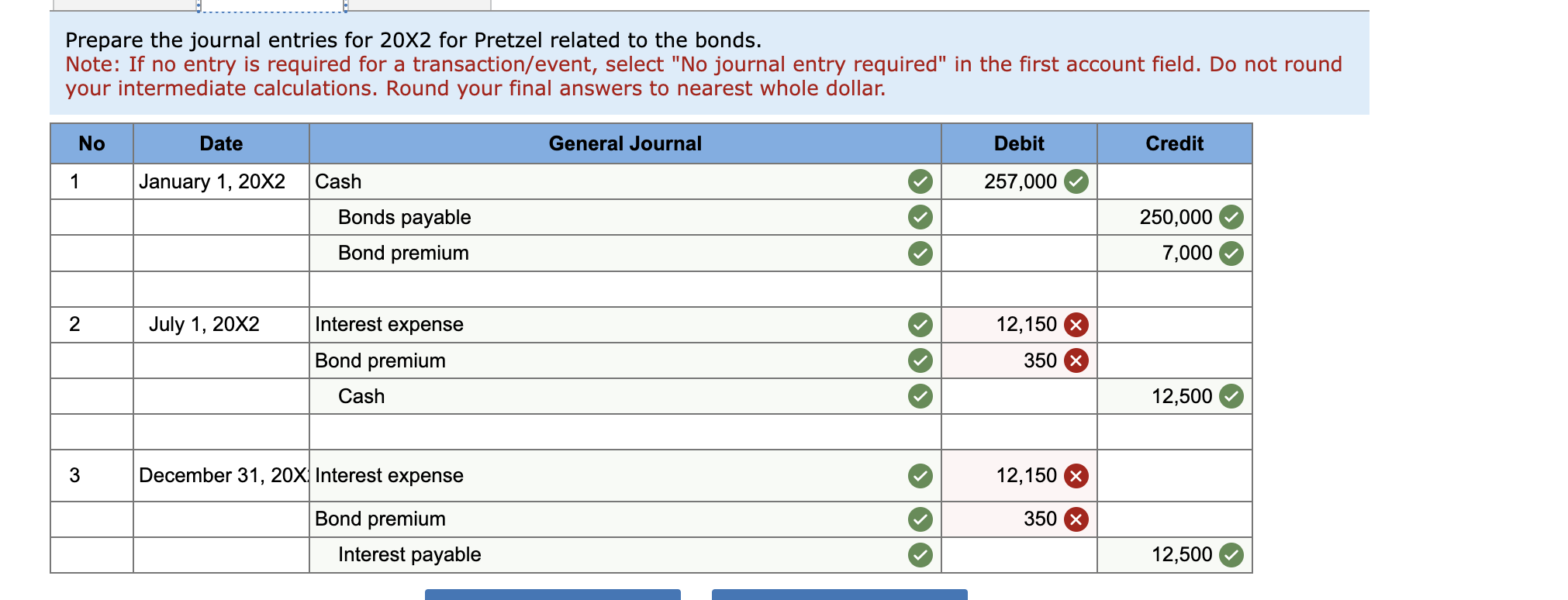

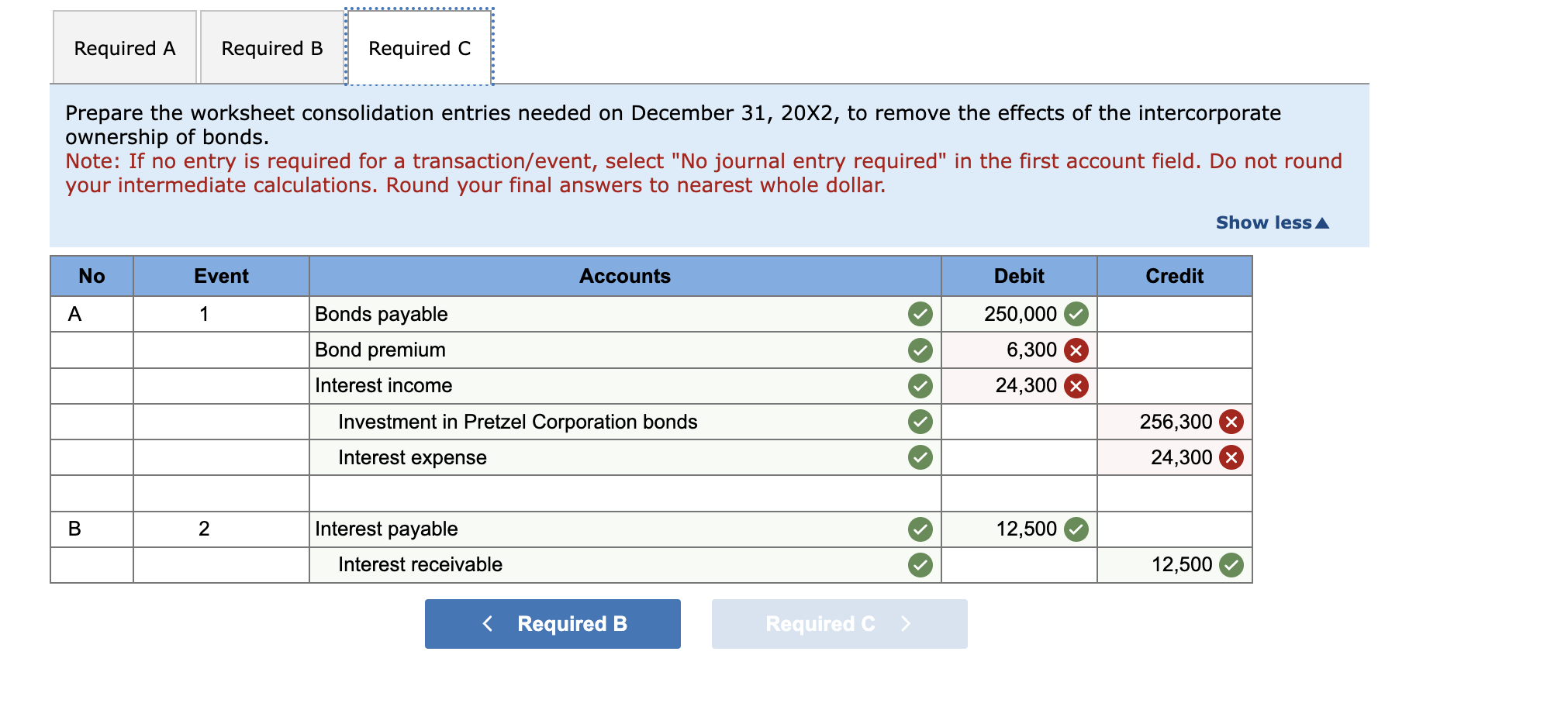

Pretzel Corporation owns 60 percent of Stick Corporation's voting shares. On January 1,202, Pretzel Corporation sold $250,000 par value, 10 percent first mortgage bonds to Stick for $257,000. The bonds mature in 10 years and pay interest semiannually on January 1 and July 1. Required: a. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. b. Prepare the journal entries for 202 for Pretzel related to the bonds. c. Prepare the worksheet consolidation entries needed on December 31, 202, to remove the effects of the intercorporate ownership of bonds. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not roun your intermediate calculations. Round your final answers to nearest whole dollar. Prepare the journal entries for 202 for Pretzel related to the bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not rour your intermediate calculations. Round your final answers to nearest whole dollar. Prepare the worksheet consolidation entries needed on December 31,202, to remove the effects of the intercorporate ownership of bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not roun your intermediate calculations. Round your final answers to nearest whole dollar. Pretzel Corporation owns 60 percent of Stick Corporation's voting shares. On January 1,202, Pretzel Corporation sold $250,000 par value, 10 percent first mortgage bonds to Stick for $257,000. The bonds mature in 10 years and pay interest semiannually on January 1 and July 1. Required: a. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. b. Prepare the journal entries for 202 for Pretzel related to the bonds. c. Prepare the worksheet consolidation entries needed on December 31, 202, to remove the effects of the intercorporate ownership of bonds. Prepare the journal entries for 202 for Stick related to its ownership of Pretzel's bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not roun your intermediate calculations. Round your final answers to nearest whole dollar. Prepare the journal entries for 202 for Pretzel related to the bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not rour your intermediate calculations. Round your final answers to nearest whole dollar. Prepare the worksheet consolidation entries needed on December 31,202, to remove the effects of the intercorporate ownership of bonds. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not roun your intermediate calculations. Round your final answers to nearest whole dollar