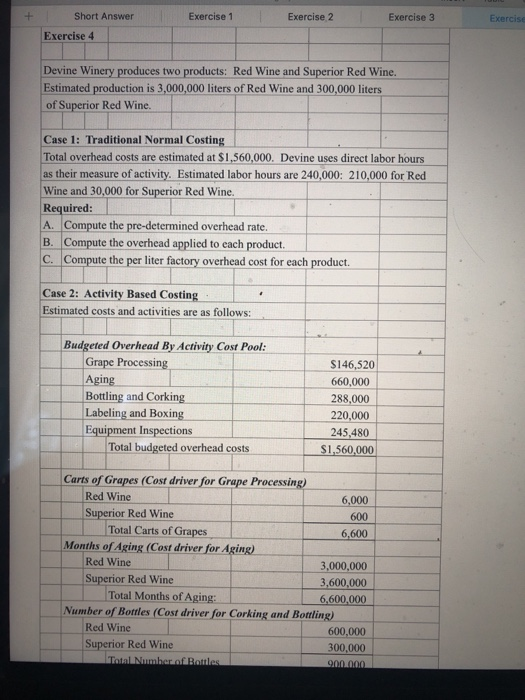

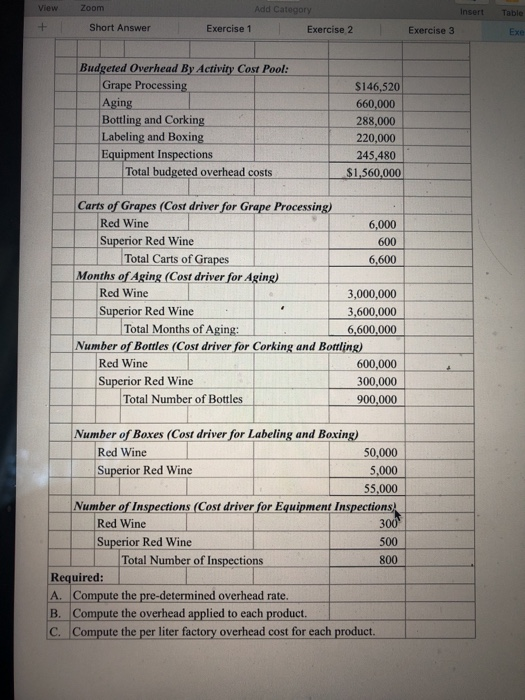

Short Answer Exercise 1 Exercise 2 Exercise 3 Exercise Exercise 4 Devine Winery produces two products: Red Wine and Superior Red Wine. Estimated production is 3,000,000 liters of Red Wine and 300,000 liters of Superior Red Wine Case 1: Traditional Normal Costing Total overhead costs are estimated at $1,560,000. Devine uses direct labor hours as their measure of activity. Estimated labor hours are 240,000: 210,000 for Red Wine and 30,000 for Superior Red Wine Required: A. Compute the pre-determined overhead rate. B. Compute the overhead applied to each product. c. Compute the per liter factory overhead cost for each product. Case 2: Activity Based Costing Estimated costs and activities are as follows: Budgeted Overhead By Activity Cost Pool: Grape Processing Aging Bottling and Corking Labeling and Boxing Equipment Inspections Total budgeted overhead costs $146,520 660,000 288,000 220,000 245,480 $1,560,000 Carts of Grapes (Cost driver for Grape Processing) Red Wine 6,000 Superior Red Wine 600 Total Carts of Grapes 6,600 Months of Aging (Cost driver for Aging) Red Wine 3,000,000 Superior Red Wine 3,600,000 Total Months of Aging: 6,600,000 Number of Bottles (Cost driver for Corking and Bottling) Red Wine 600,000 Superior Red Wine 300,000 Total Number of Battles 900.000 View Zoom Insert Add Category Exercise 1 Exercise 2 Table + Short Answer Exercise 3 Exe Budgeted Overhead By Activity Cost Pool: Grape Processing Aging Bottling and Corking Labeling and Boxing Equipment Inspections Total budgeted overhead costs $146.520 660,000 288,000 220,000 245,480 $1,560,000 Carts of Grapes (Cost driver for Grape Processing) Red Wine 6,000 Superior Red Wine 600 Total Carts of Grapes 6,600 Months of Aging (Cost driver for Aging) Red Wine 3,000,000 Superior Red Wine 3,600,000 Total Months of Aging: 6,600,000 Number of Bottles (Cost driver for Corking and Bottling) Red Wine 600,000 Superior Red Wine 300,000 Total Number of Bottles 900,000 Number of Boxes (Cost driver for Labeling and Boxing) Red Wine 50,000 Superior Red Wine 5,000 55,000 Number of Inspections (Cost driver for Equipment Inspections Red Wine 300 Superior Red Wine 500 Total Number of Inspections 800 Required: A. Compute the pre-determined overhead rate. B. Compute the overhead applied to each product. C. Compute the per liter factory overhead cost for each product