Answered step by step

Verified Expert Solution

Question

1 Approved Answer

single mistake 5 dislikes word file CE, Inc., leases large earth tunneling equipment. The net profit from the equipment for each of the last 4

single mistake 5 dislikes

word file

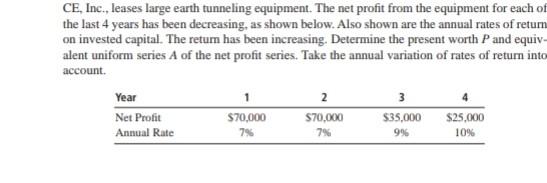

CE, Inc., leases large earth tunneling equipment. The net profit from the equipment for each of the last 4 years has been decreasing, as shown below. Also shown are the annual rates of return on invested capital. The retum has been increasing. Determine the present worth P and equiv- alent uniform series A of the net profit series. Take the annual variation of rates of return into account Year Net Profit Annual Rate $70,000 79 $70,000 7% $35,000 9% $25,000 10% Il cases the direction of the loan rate and the MARR will be the same. Using the tioned above, some loan rate considerations are as follows: Project risk: The loan rate may increase if there has been a noticeable downturn starts, thus reducing the need for the e-commerce connection. nvestment opportunity: The rate could increase if other companies offering vices have already applied for a loan at other BA branches regionally or nati Government intervention: The loan rate may decrease if the federal gover recently offered Federal Reserve loan money at low rates to banks. The interv be designed to boost the housing economic sector in an effort to offset a slowdown in new home construction. axes: If the state recently removed house construction materials from the li subject to sales tax, the rate might be lowered slightly. CE, Inc., leases large earth tunneling equipment. The net profit from the equipment for each of the last 4 years has been decreasing, as shown below. Also shown are the annual rates of return on invested capital. The retum has been increasing. Determine the present worth P and equiv- alent uniform series A of the net profit series. Take the annual variation of rates of return into account Year Net Profit Annual Rate $70,000 79 $70,000 7% $35,000 9% $25,000 10% Il cases the direction of the loan rate and the MARR will be the same. Using the tioned above, some loan rate considerations are as follows: Project risk: The loan rate may increase if there has been a noticeable downturn starts, thus reducing the need for the e-commerce connection. nvestment opportunity: The rate could increase if other companies offering vices have already applied for a loan at other BA branches regionally or nati Government intervention: The loan rate may decrease if the federal gover recently offered Federal Reserve loan money at low rates to banks. The interv be designed to boost the housing economic sector in an effort to offset a slowdown in new home construction. axes: If the state recently removed house construction materials from the li subject to sales tax, the rate might be lowered slightlyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started