Answered step by step

Verified Expert Solution

Question

1 Approved Answer

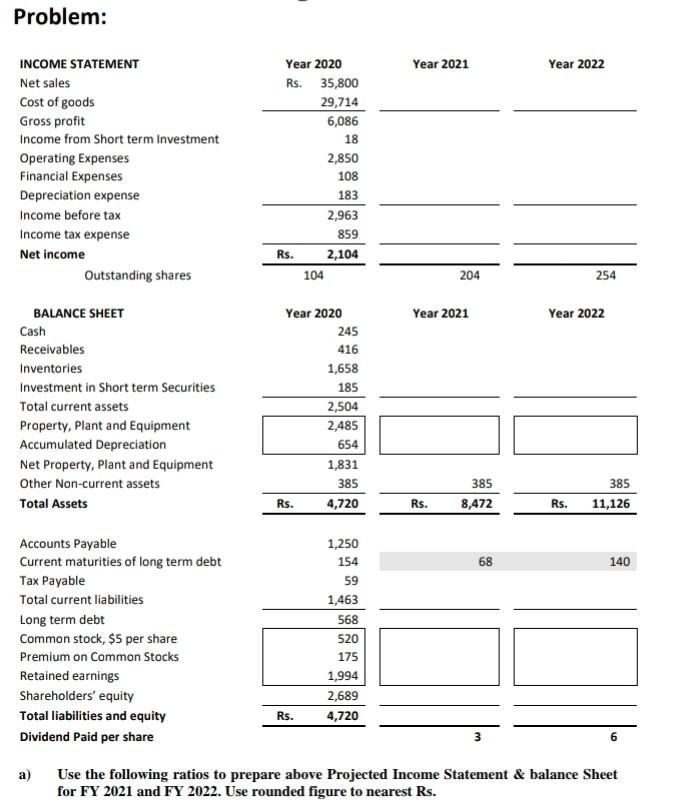

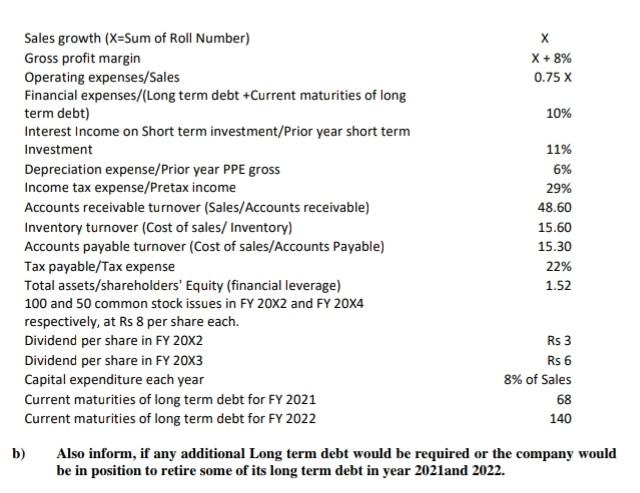

subject: Analysis of financial statements Note: Please solve full question and also share working notes.. this is full question Problem: INCOME STATEMENT Net sales Cost

subject: Analysis of financial statements Note: Please solve full question and also share working notes..

this is full question

Problem: INCOME STATEMENT Net sales Cost of goods Gross profit Income from Short term Investment Operating Expenses Financial Expenses Depreciation expense Income before tax Income tax expense Net income Year 2020 Rs. 35,800 29,714 6,086 18 2,850 108 183 2,963 859 2,104 Rs. 104 Year 2020 Year 2021 Outstanding shares BALANCE SHEET Year 2022 Cash 245 Receivables 416 Inventories 1,658 Investment in Short term Securities 185 Total current assets 2,504 Property, Plant and Equipment 2,485 Accumulated Depreciation 654 Net Property, Plant and Equipment 1,831 Other Non-current assets 385 385 Total Assets 4,720 Rs. 11,126 Accounts Payable 1,250 Current maturities of long term debt 154 140 Tax Payable 59 Total current liabilities 1,463 Long term debt 568 Common stock, $5 per share 520 175 Premium on Common Stocks Retained earnings 1,994 Shareholders' equity 2,689 Total liabilities and equity Rs. 4,720 Dividend Paid per share 3 6 a) Use the following ratios to prepare above Projected Income Statement & balance Sheet for FY 2021 and FY 2022. Use rounded figure to nearest Rs. Rs. 204 Year 2021 Rs. Year 2022 385 8,472 68 254 X Sales growth (X=Sum of Roll Number) Gross profit margin X + 8% Operating expenses/Sales 0.75 X Financial expenses/(Long term debt +Current maturities of long term debt) 10% Interest Income on Short term investment/Prior year short term Investment 11% Depreciation expense/Prior year PPE gross 6% Income tax expense/Pretax income 29% 48.60 Accounts receivable turnover (Sales/Accounts receivable) Inventory turnover (Cost of sales/ Inventory) 15.60 15.30 Accounts payable turnover (Cost of sales/Accounts Payable) Tax payable/Tax expense 22% Total assets/shareholders' Equity (financial leverage) 1.52 100 and 50 common stock issues in FY 20X2 and FY 20X4 respectively, at Rs 8 per share each. Dividend per share in FY 20X2 Rs 3 Dividend per share in FY 20X3 Rs 6 Capital expenditure each year 8% of Sales Current maturities of long term debt for FY 2021 Current maturities of long term debt for FY 2022 68 140 b) Also inform, if any additional Long term debt would be required or the company would be in position to retire some of its long term debt in year 2021and 2022. Problem: INCOME STATEMENT Net sales Cost of goods Gross profit Income from Short term Investment Operating Expenses Financial Expenses Depreciation expense Income before tax Income tax expense Net income Year 2020 Rs. 35,800 29,714 6,086 18 2,850 108 183 2,963 859 2,104 Rs. 104 Year 2020 Year 2021 Outstanding shares BALANCE SHEET Year 2022 Cash 245 Receivables 416 Inventories 1,658 Investment in Short term Securities 185 Total current assets 2,504 Property, Plant and Equipment 2,485 Accumulated Depreciation 654 Net Property, Plant and Equipment 1,831 Other Non-current assets 385 385 Total Assets 4,720 Rs. 11,126 Accounts Payable 1,250 Current maturities of long term debt 154 140 Tax Payable 59 Total current liabilities 1,463 Long term debt 568 Common stock, $5 per share 520 175 Premium on Common Stocks Retained earnings 1,994 Shareholders' equity 2,689 Total liabilities and equity Rs. 4,720 Dividend Paid per share 3 6 a) Use the following ratios to prepare above Projected Income Statement & balance Sheet for FY 2021 and FY 2022. Use rounded figure to nearest Rs. Rs. 204 Year 2021 Rs. Year 2022 385 8,472 68 254 X Sales growth (X=Sum of Roll Number) Gross profit margin X + 8% Operating expenses/Sales 0.75 X Financial expenses/(Long term debt +Current maturities of long term debt) 10% Interest Income on Short term investment/Prior year short term Investment 11% Depreciation expense/Prior year PPE gross 6% Income tax expense/Pretax income 29% 48.60 Accounts receivable turnover (Sales/Accounts receivable) Inventory turnover (Cost of sales/ Inventory) 15.60 15.30 Accounts payable turnover (Cost of sales/Accounts Payable) Tax payable/Tax expense 22% Total assets/shareholders' Equity (financial leverage) 1.52 100 and 50 common stock issues in FY 20X2 and FY 20X4 respectively, at Rs 8 per share each. Dividend per share in FY 20X2 Rs 3 Dividend per share in FY 20X3 Rs 6 Capital expenditure each year 8% of Sales Current maturities of long term debt for FY 2021 Current maturities of long term debt for FY 2022 68 140 b) Also inform, if any additional Long term debt would be required or the company would be in position to retire some of its long term debt in year 2021and 2022Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started