Answered step by step

Verified Expert Solution

Question

1 Approved Answer

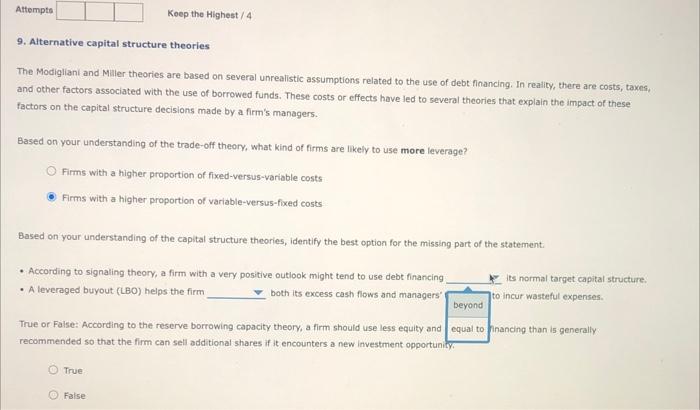

thank you Attempts Keep the Highest/4 9. Alternative capital structure theories The Modigliani and Miller theories are based on several unrealistic assumptions related to the

thank you

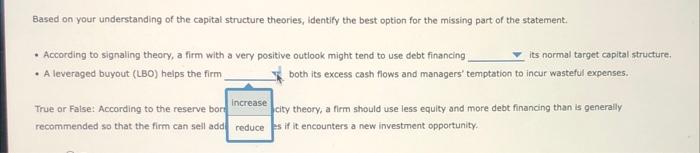

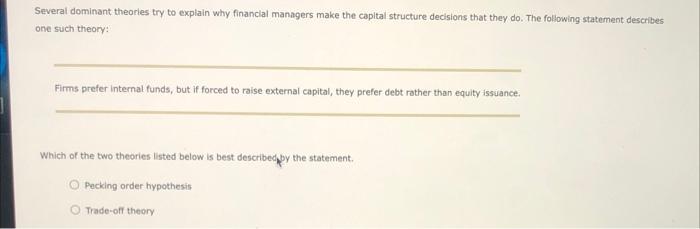

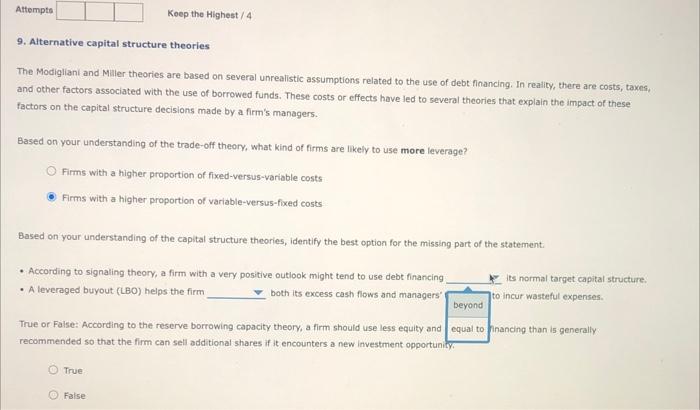

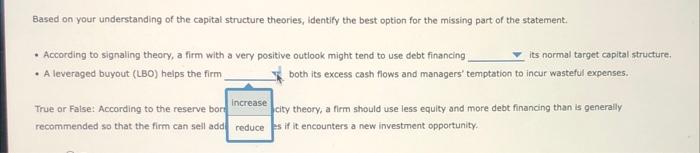

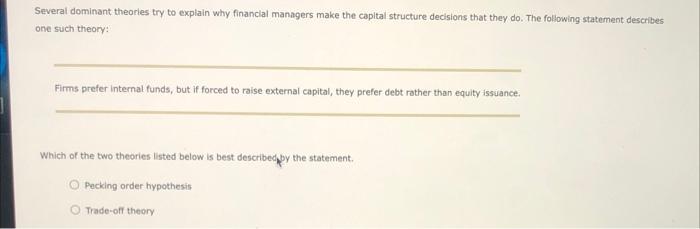

Attempts Keep the Highest/4 9. Alternative capital structure theories The Modigliani and Miller theories are based on several unrealistic assumptions related to the use of debt financing. In reality, there are costs, taxes, and other factors associated with the use of borrowed funds. These costs or effects have led to several theories that explain the impact of these factors on the capital structure decisions made by a firm's managers. Based on your understanding of the trade-off theory, what kind of firms are likely to use more leverage? Firms with a higher proportion of fixed-versus-variable costs Firms with a higher proportion of variable-versus-fixed costs Based on your understanding of the capital structure theories, identify the best option for the missing part of the statement According to signaling theory, a firm with a very positive outlook might tend to use debt financing Its normal target capital structure. A leveraged buyout (LBO) helps the firm both its excess cash flows and managers to incur wasteful expenses. beyond True or False: According to the reserve borrowing capacity theory, a firm should use less equity and equal to financing than is generally recommended so that the firm can sell additional shares if it encounters a new investment opportunity True False Based on your understanding of the capital structure theories, identify the best option for the missing part of the statement. According to signaling theory, a firm with a very positive outlook might tend to use debt financing its normal target capital structure A leveraged buyout (LBO) helps the firm both its excess cash flows and managers' temptation to incur wasteful expenses. increase True or False: According to the reserve bord city theory, a firm should use less equity and more debt financing than is generally recommended so that the firm can sell add reduces if it encounters a new investment opportunity Several dominant theories try to explain why financial managers make the capital structure decisions that they do. The following statement describes one such theory: Firms prefer Internal funds, but if forced to raise external capital, they prefer debt rather than equity issuanct. Which of the two theories listed below is best described by the statement O Pecking order hypothesis Trade-off theory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started