Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thanks for your help in advance! The following information for 2019 is avaliable for Marino Company: 1. The beginning inventory is $91,000. 2. Purchases returns

thanks for your help in advance!

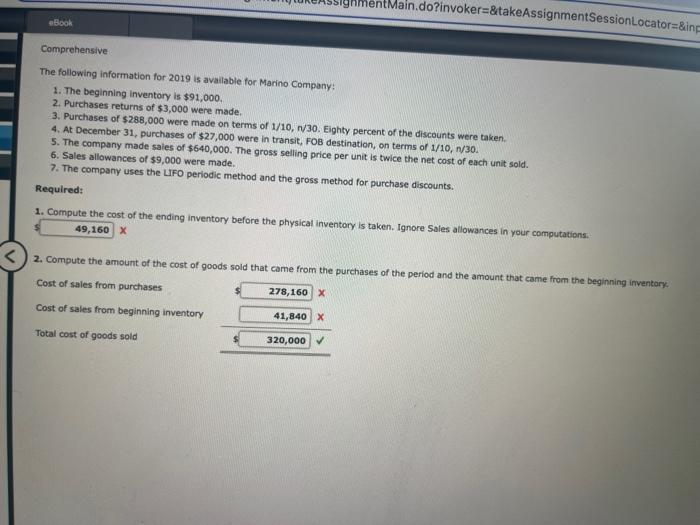

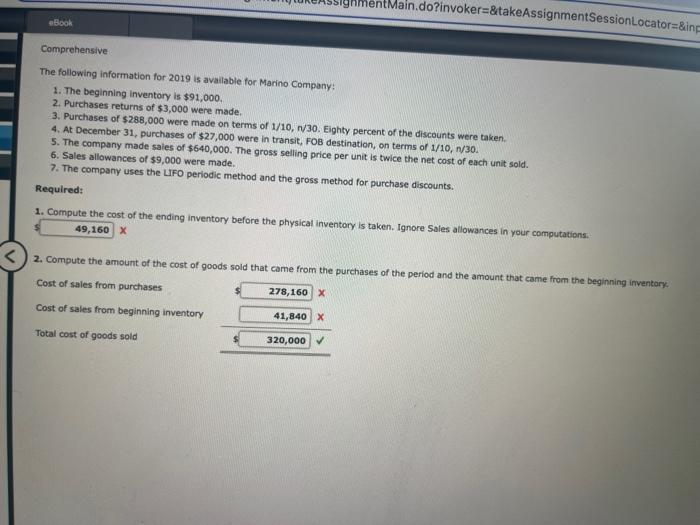

The following information for 2019 is avaliable for Marino Company: 1. The beginning inventory is $91,000. 2. Purchases returns of $3,000 were made. 3. Purchases of $288,000 were made on terms of 1/10,N/30. Eighty percent of the discounts were taken. 4. At December 31, purchases of $27,000 were in transit, FOB destination, on terms of 1/10,n/30. 5. The company made sales of $640,000. The gross selling price per unit is twice the net cost of each unit sold. 6. Sales allowances of $9,000 were made. 7. The company uses the UFO periodic method and the gross method for purchase discounts. Required: 1. Compute the cost of the ending inventory before the physical inventory is taken. Ignore Sales allowances in your computations. 2. Compute the amount of the cost of goods sold that came from the burchases of the period and the amount that came from the beginning inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started