Answered step by step

Verified Expert Solution

Question

1 Approved Answer

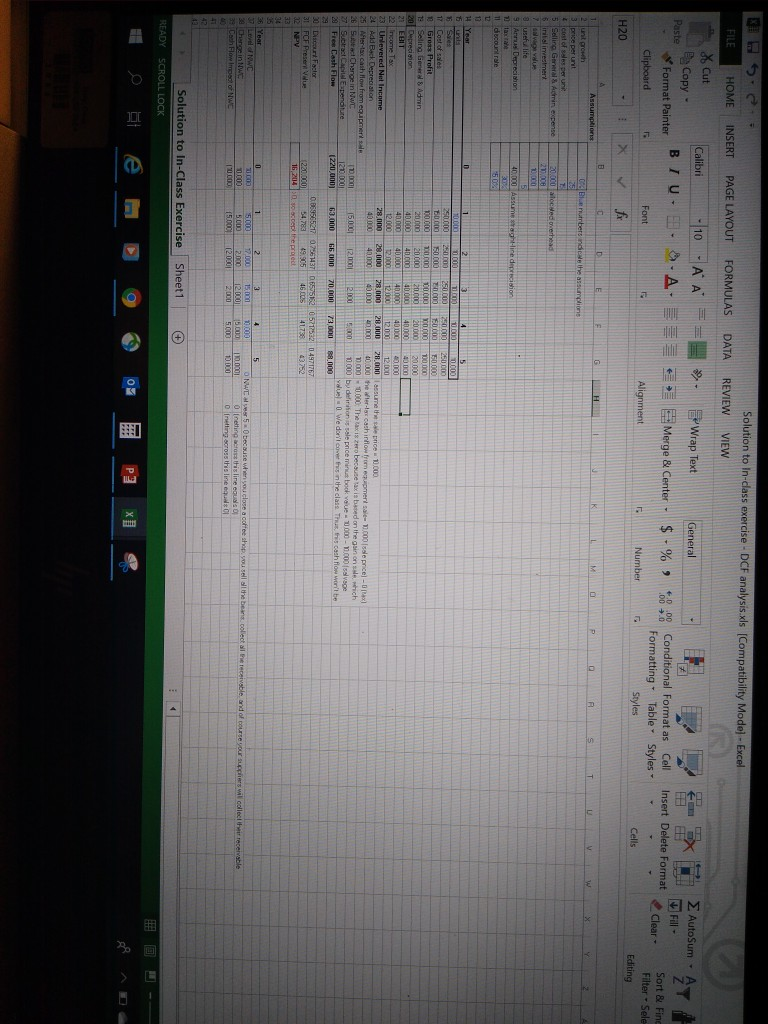

the company has a pre-existing line of shelves that for $25 per unit with the unit cost of $15 you estimate that sales for this

the company has a pre-existing line of shelves that for $25 per unit with the unit cost of $15 you estimate that sales for this pre-existing line will increase by $1,000 units per year as long as the new line of shells is in production. period what is the new npv?

Solution to in-class exercise - DCF analysis.xls (Compatibility Mode] - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW X. Cut Calibri -10 -A A 9 EWrap Text General Copy - Paste FH- BIU Format Painter 8.A. Merge & Center - $ - % Conditional Format as Cell Formatting Table Styles - Clipboard Font Alignment Number Styles H20 > for X 47 6.000 000 Insert Delete Format AutoSum- Fill - Clear Sort & Find Filter - Sele Editing Cells D E G K M B S v Hubers nee the assumption Assumptions unt growth 3 price per un cost of per un Selline General Adminexpense iriliresimerk oswe useful life Annus Depreciahon 70 taxa Il discountrale 20.000 towed overhead 277.000 10.000 40,000 Assumeghine deprecision 30 502 H Year und Sie Gross Profit 18 Selina General Admin 20 Depreciation EHIT 22 Income To 23 Unlevered Net Income 2. Add Back Depreciation 25 Wiertax cash flow from equipment 26 Stact Change in NWC Subtract Capital Expenditure Free Cash Flow T2 113 6 rem 41 1002 non 10.00 10000 250.000 280.00 250.000 250.000 250000 10000 150.000 ZOO 150000 50000 100.000 0.000 LUCO 0.000 2000 20.000 20.000 20.000 20.000 20000 4000 40.000000 40.000 40 000 400 4000 40.000 G00000000 12.000 12.000 12000 12.00 12 000 28 000 28.000 28 000 28.000 28,000 turn the price 10.000 40.000 40.000 40.000 200 20.000 heter-tax cash flow from experts 1.000 se price - pax 1.000 - 10.000 The acis zero because taxis bed on the gain ons which 15.000 12.000 12.000 5.000 10.000 by definition is sale price minus book value 0.000 - 10.000 salvage value - 0 We don't covet this in the class. Thus, this cash flow won't be 63.000 65.000 70.000 73.000 88.000 12.00 1270.000 (220,000) Discount Factor FCF Presere Value NPV 220.000 16204 0.869565217 07561437 0.650562 05717532 04971767 54783 49.905 46.2 4173 43752 soccept the project 36 Year 1 5.COM 15.00 2.000 12.000 15.000 12000 2,000 4 10.000 15.000 5.000 5 NWC er 50 because when you close a coffee shop, you sell all the beans collect all the receivable and of course your suppliers will collect their receivable 10.0001 0 [netting cross this lire equals 10,000 o netting across the line equal Cash Flow most of NWE 10.000 Solution to In-Class Exercise Sheet1 READY SCROLL LOCK EF e 0 FFF P2 x Colors Solution to in-class exercise - DCF analysis.xls (Compatibility Mode] - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW X. Cut Calibri -10 -A A 9 EWrap Text General Copy - Paste FH- BIU Format Painter 8.A. Merge & Center - $ - % Conditional Format as Cell Formatting Table Styles - Clipboard Font Alignment Number Styles H20 > for X 47 6.000 000 Insert Delete Format AutoSum- Fill - Clear Sort & Find Filter - Sele Editing Cells D E G K M B S v Hubers nee the assumption Assumptions unt growth 3 price per un cost of per un Selline General Adminexpense iriliresimerk oswe useful life Annus Depreciahon 70 taxa Il discountrale 20.000 towed overhead 277.000 10.000 40,000 Assumeghine deprecision 30 502 H Year und Sie Gross Profit 18 Selina General Admin 20 Depreciation EHIT 22 Income To 23 Unlevered Net Income 2. Add Back Depreciation 25 Wiertax cash flow from equipment 26 Stact Change in NWC Subtract Capital Expenditure Free Cash Flow T2 113 6 rem 41 1002 non 10.00 10000 250.000 280.00 250.000 250.000 250000 10000 150.000 ZOO 150000 50000 100.000 0.000 LUCO 0.000 2000 20.000 20.000 20.000 20.000 20000 4000 40.000000 40.000 40 000 400 4000 40.000 G00000000 12.000 12.000 12000 12.00 12 000 28 000 28.000 28 000 28.000 28,000 turn the price 10.000 40.000 40.000 40.000 200 20.000 heter-tax cash flow from experts 1.000 se price - pax 1.000 - 10.000 The acis zero because taxis bed on the gain ons which 15.000 12.000 12.000 5.000 10.000 by definition is sale price minus book value 0.000 - 10.000 salvage value - 0 We don't covet this in the class. Thus, this cash flow won't be 63.000 65.000 70.000 73.000 88.000 12.00 1270.000 (220,000) Discount Factor FCF Presere Value NPV 220.000 16204 0.869565217 07561437 0.650562 05717532 04971767 54783 49.905 46.2 4173 43752 soccept the project 36 Year 1 5.COM 15.00 2.000 12.000 15.000 12000 2,000 4 10.000 15.000 5.000 5 NWC er 50 because when you close a coffee shop, you sell all the beans collect all the receivable and of course your suppliers will collect their receivable 10.0001 0 [netting cross this lire equals 10,000 o netting across the line equal Cash Flow most of NWE 10.000 Solution to In-Class Exercise Sheet1 READY SCROLL LOCK EF e 0 FFF P2 x Colors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started