Answered step by step

Verified Expert Solution

Question

1 Approved Answer

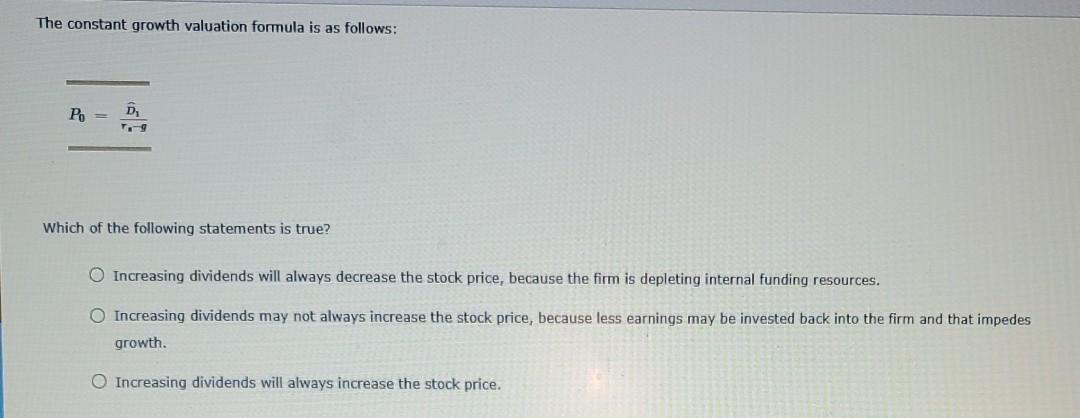

The constant growth valuation formula is as follows: Po = D 7.-9 Which of the following statements is true? O Increasing dividends will always decrease

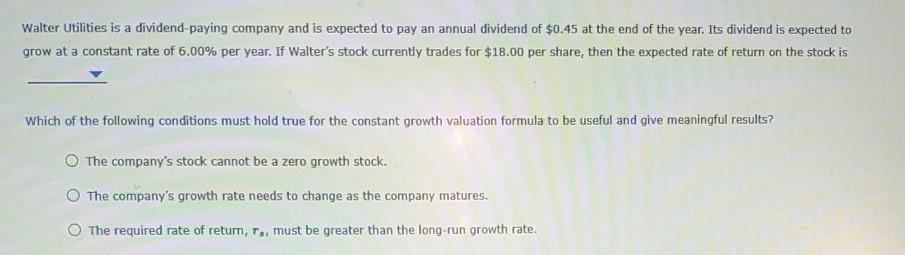

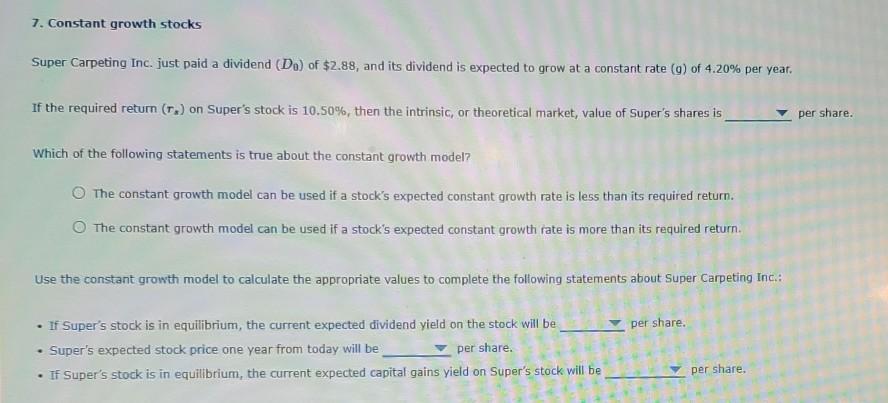

The constant growth valuation formula is as follows: Po = D 7.-9 Which of the following statements is true? O Increasing dividends will always decrease the stock price, because the firm is depleting internal funding resources. O Increasing dividends may not always increase the stock price, because less earnings may be invested back into the firm and that impedes growth. O Increasing dividends will always increase the stock price. Walter Utilities is a dividend paying company and is expected to pay an annual dividend of $0.45 at the end of the year. Its dividend is expected to grow at a constant rate of 6.00% per year. If Walter's stock currently trades for $18.00 per share, then the expected rate of return on the stock is Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? The company's stock cannot be a zero growth stock. The company's growth rate needs to change as the company matures. The required rate of retum, T., must be greater than the long-run growth rate. 7. Constant growth stocks Super Carpeting Inc. just paid a dividend (D) of $2.88, and its dividend is expected to grow at a constant rate () of 4.20% per year. If the required return (1.) on Super's stock is 10.50%, then the intrinsic, or theoretical market, value of Super's shares is per share. Which of the following statements is true about the constant growth model? The constant growth model can be used if a stock's expected constant growth rate is less than its required return. The constant growth model can be used if a stock's expected constant growth rate is more than its required return Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: per share. If Super's stock is in equilibrium, the current expected dividend yield on the stock will be Super's expected stock price one year from today will be per share. . If Super's stock is in equilibrium, the current expected capital gains yield on Super's stock will be per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started