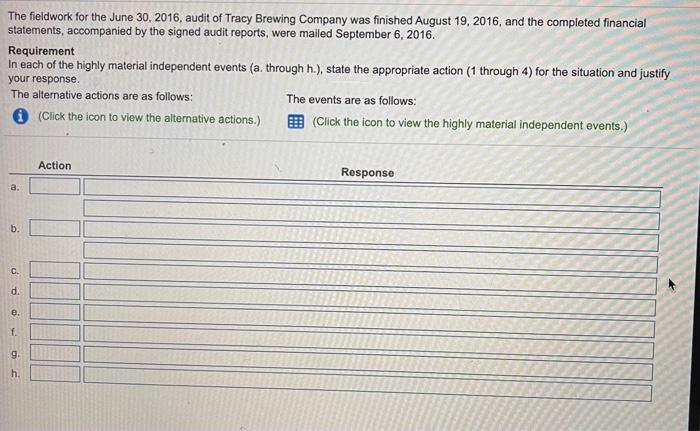

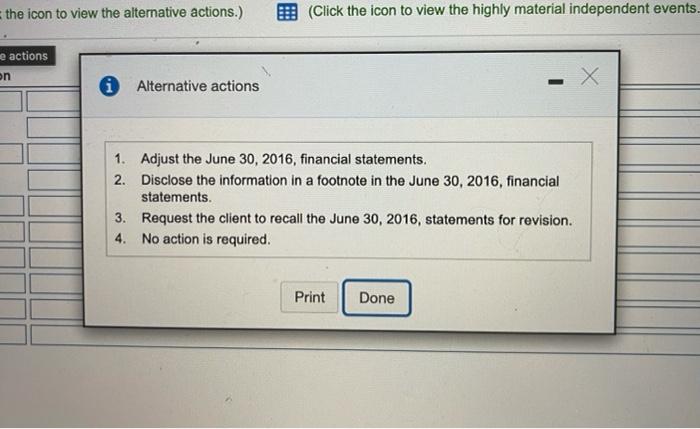

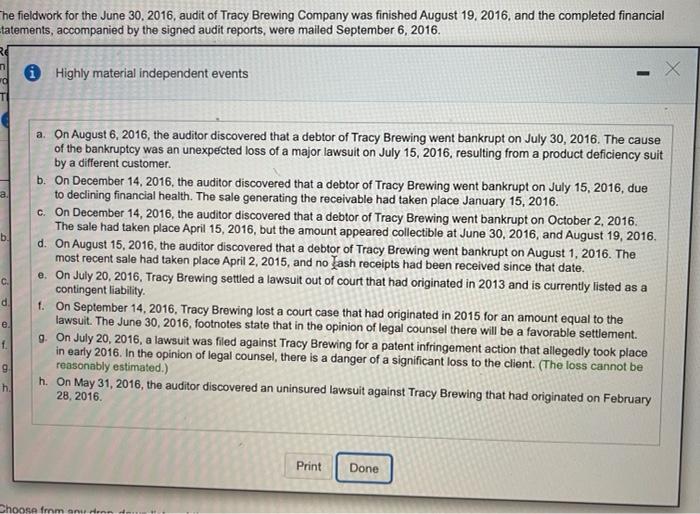

The fieldwork for the June 30, 2016, audit of Tracy Brewing Company was finished August 19, 2016, and the completed financial statements, accompanied by the signed audit reports, were mailed September 6, 2016. Requirement In each of the highly material independent events (a. through h.), state the appropriate action (1 through 4) for the situation and justify your response. The alternative actions are as follows: The events are as follows: (Click the icon to view the alternative actions.) (Click the icon to view the highly material independent events.) Action Response a. b. c. d. e f. 9 h the fieldwork for the June 30, 2016, audit of Tracy Brewing Company was finished August 19, 2016, and the completed financial tatements, accompanied by the signed audit reports, were mailed September 6, 2016. Highly material independent events - a b. a. On August 6, 2016, the auditor discovered that a debtor of Tracy Brewing went bankrupt on July 30, 2016. The cause of the bankruptcy was an unexpected loss of a major lawsuit on July 15, 2016, resulting from a product deficiency suit by a different customer. b. On December 14, 2016, the auditor discovered that a debtor of Tracy Brewing went bankrupt on July 15, 2016, due to declining financial health. The sale generating the receivable had taken place January 15, 2016. c. On December 14, 2016, the auditor discovered that a debtor of Tracy Brewing went bankrupt on October 2, 2016 The sale had taken place April 15, 2016, but the amount appeared collectible at June 30, 2016, and August 19, 2016, d. On August 15, 2016, the auditor discovered that a debtor of Tracy Brewing went bankrupt on August 1, 2016. The most recent sale had taken place April 2, 2015, and no Jash receipts had been received since that date. e. On July 20, 2016, Tracy Brewing settled a lawsuit out of court that had originated in 2013 and is currently listed as a contingent liability 1. On September 14, 2016. Tracy Brewing lost a court case that had originated in 2015 for an amount equal to the lawsuit. The June 30, 2016, footnotes state that in the opinion of legal counsel there will be a favorable settlement. g. On July 20, 2016, a lawsuit was filed against Tracy Brewing for a patent infringement action that allegedly took place in early 2016. In the opinion of legal counsel, there is a danger of a significant loss to the client. (The loss cannot be reasonably estimated.) h. On May 31, 2016, the auditor discovered an uninsured lawsuit against Tracy Brewing that had originated on February 28, 2016. c. d e f 9 h Print Done Choose from anu Hann