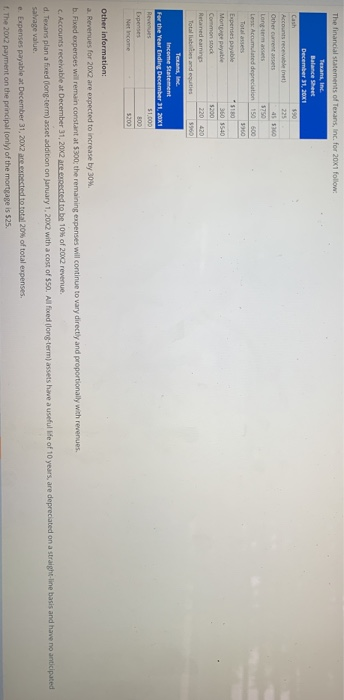

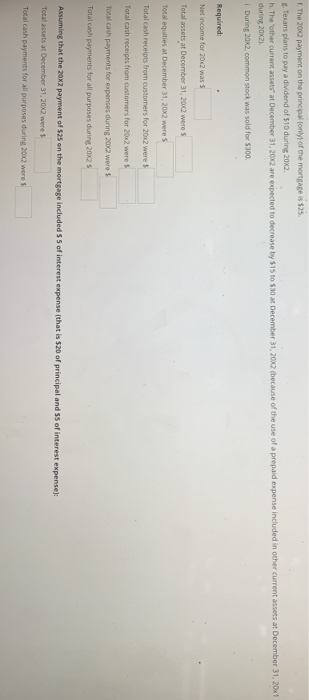

The financial statements of Texans, Inc. for 20x1 follow Total libes and equities 59 for the Year Ending December 31, 20X1 Other information: a. Revenues for 20X2 are expected to increase by 30%. b. Fixed expenses will remain constant at $300: the remaining expenses will continue to vary directly and proportionally with revenues. c. Accounts receivable at December 31, 20x2 are expected to be 10% of 20/2 revenue. d. Texans plan a faced long-term) asset addition on January 1, 20x2 with a cost of $50. All fored long term assets have a useful life of 10 years, are depreciated on a straight-line basis and have no anticipated salvage value. e. Expenses payable at December 31, 20X2 are expected to total 20% of total expenses. 1. The 2002 payment on the principal fonly of the mortgage is $25. f. The 2000 payment on the principal only of the mortgage is $25. Texans plans to pay a dividend of $10 during 20x2. h. The other current assets at December 31, 2012 are expected to decrease by $15 to $30 during 20K2). During 2012. common stock was sold for $300 December 31, 2002 because of the use of a prepaid expense included in other current assets at December 31, 20x1 Required: Net income for 20x2 vass Total assets at December 31, 2012 were $ Total equities at December 31, 20x2 were Total cash receipts from customers for 20x2 were 5 Total cash receipts from customers for 20x2 were Total cash payments for expenses during 2002 were Total cash payments for all purposes during 20X2 Assuming that the 20x2 payment of $25 on the mortgage included $5 of interest expense (that is $20 of principal and 55 of interest expense): Total assets at December 31, 20X2 were Total cash payments for all purposes during 20x2 were The financial statements of Texans, Inc. for 20x1 follow Total libes and equities 59 for the Year Ending December 31, 20X1 Other information: a. Revenues for 20X2 are expected to increase by 30%. b. Fixed expenses will remain constant at $300: the remaining expenses will continue to vary directly and proportionally with revenues. c. Accounts receivable at December 31, 20x2 are expected to be 10% of 20/2 revenue. d. Texans plan a faced long-term) asset addition on January 1, 20x2 with a cost of $50. All fored long term assets have a useful life of 10 years, are depreciated on a straight-line basis and have no anticipated salvage value. e. Expenses payable at December 31, 20X2 are expected to total 20% of total expenses. 1. The 2002 payment on the principal fonly of the mortgage is $25. f. The 2000 payment on the principal only of the mortgage is $25. Texans plans to pay a dividend of $10 during 20x2. h. The other current assets at December 31, 2012 are expected to decrease by $15 to $30 during 20K2). During 2012. common stock was sold for $300 December 31, 2002 because of the use of a prepaid expense included in other current assets at December 31, 20x1 Required: Net income for 20x2 vass Total assets at December 31, 2012 were $ Total equities at December 31, 20x2 were Total cash receipts from customers for 20x2 were 5 Total cash receipts from customers for 20x2 were Total cash payments for expenses during 2002 were Total cash payments for all purposes during 20X2 Assuming that the 20x2 payment of $25 on the mortgage included $5 of interest expense (that is $20 of principal and 55 of interest expense): Total assets at December 31, 20X2 were Total cash payments for all purposes during 20x2 were