Answered step by step

Verified Expert Solution

Question

1 Approved Answer

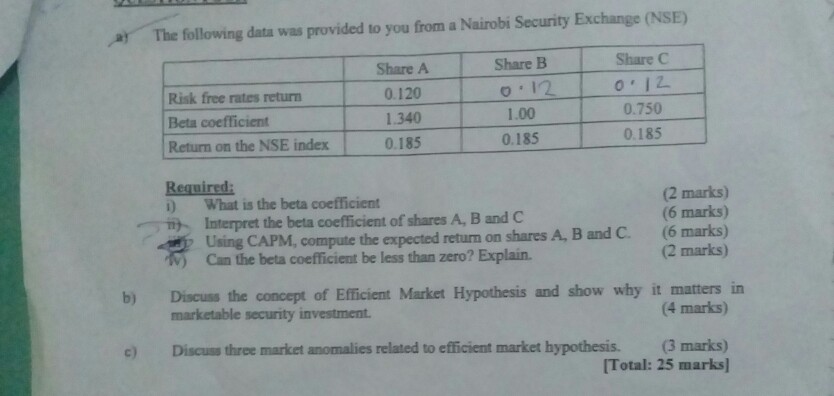

The following data was provided to you from a Nairobi Security Exchange (NSE) a Share C 012 0.750 0.185 Share A Share B Risk free

The following data was provided to you from a Nairobi Security Exchange (NSE) a Share C 012 0.750 0.185 Share A Share B Risk free rates return Beta coefficient Return on the NSE index 0.120 1.340 185 0.185 1.00 0.185 Reguired i) What is the beta coefficient Try. Interpret the beta coefficient of shares A, B and C (2 marks) (6 marks) (6 marks) (2 marks) Using CAPM, compute the expected return on shares A, B and C. ) Can the beta coefficient be less than zero? Explain. b) Discuss the concept of Efficient Market Hypothesis and show why it matters in (4 marks) marketable security investment Discuss three market anomalies related to efficient market hypothesis. (3 marks) Total: 25 marks] c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started