Answered step by step

Verified Expert Solution

Question

1 Approved Answer

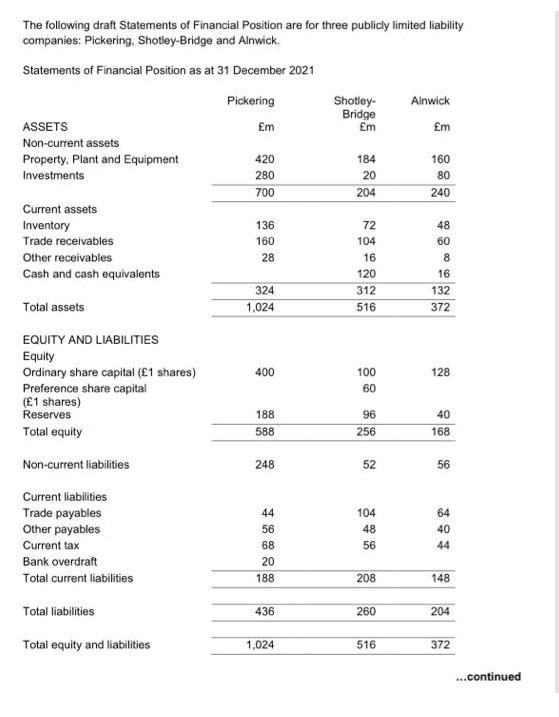

The following draft Statements of Financial Position are for three publicly limited liability companies: Pickering, Shotley-Bridge and Alnwick. Statements of Financial Position as at

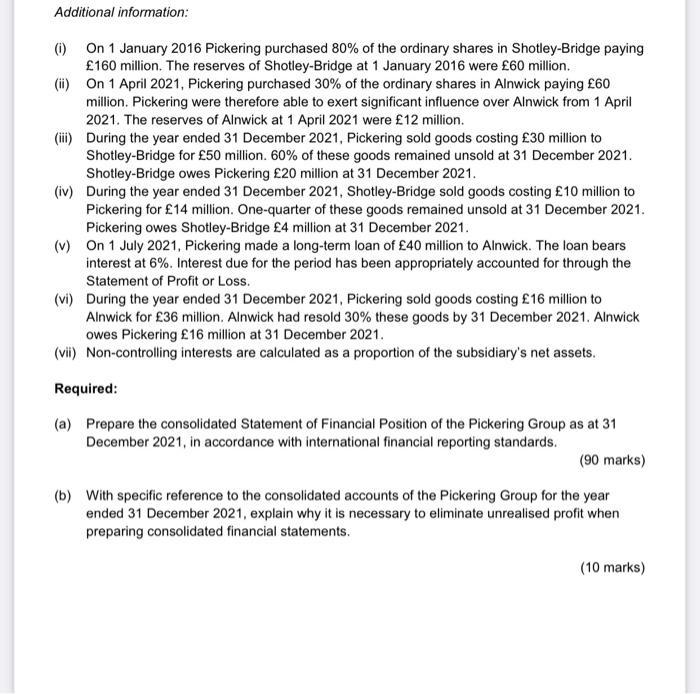

The following draft Statements of Financial Position are for three publicly limited liability companies: Pickering, Shotley-Bridge and Alnwick. Statements of Financial Position as at 31 December 2021 Pickering ASSETS Non-current assets Property. Plant and Equipment Investments Current assets Inventory Trade receivables Other receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Ordinary share capital (1 shares) Preference share capital (1 shares) Reserves Total equity Non-current liabilities Current liabilities Trade payables Other payables Current tax Bank overdraft Total current liabilities Total liabilities Total equity and liabilities m 420 280 700 136 160 28 324 1,024 400 188 588 248 44 56 68 20 188 436 1,024 Shotley- Bridge m 184 20 204 72 104 16 120 312 516 100 60 96 256 52 104 48 56 208 260 516 Alnwick m 160 80 240 48 60 8 16 132 372 128 40 168 56 64 40 44 148 204 372 ...continued Additional information: (ii) (1) On 1 January 2016 Pickering purchased 80% of the ordinary shares in Shotley-Bridge paying 160 million. The reserves of Shotley-Bridge at 1 January 2016 were 60 million. On 1 April 2021, Pickering purchased 30% of the ordinary shares in Alnwick paying 60 million. Pickering were therefore able to exert significant influence over Alnwick from 1 April 2021. The reserves of Alnwick at 1 April 2021 were 12 million. (iii) During the year ended 31 December 2021, Pickering sold goods costing 30 million to Shotley-Bridge for 50 million. 60% of these goods remained unsold at 31 December 2021. Shotley-Bridge owes Pickering 20 million at 31 December 2021. (iv) During the year ended 31 December 2021, Shotley-Bridge sold goods costing 10 million to Pickering for 14 million. One-quarter of these goods remained unsold at 31 December 2021. Pickering owes Shotley-Bridge 4 million at 31 December 2021. (v) On 1 July 2021, Pickering made a long-term loan of 40 million to Alnwick. The loan bears interest at 6%. Interest due for the period has been appropriately accounted for through the Statement of Profit or Loss. (vi) During the year ended 31 December 2021, Pickering sold goods costing 16 million to Alnwick for 36 million. Alnwick had resold 30% these goods by 31 December 2021. Alnwick owes Pickering 16 million at 31 December 2021. (vii) Non-controlling interests are calculated as a proportion of the subsidiary's net assets. Required: (a) Prepare the consolidated Statement of Financial Position of the Pickering Group as at 31 December 2021, in accordance with international financial reporting standards. (90 marks) (b) With specific reference to the consolidated accounts of the Pickering Group for the year ended 31 December 2021, explain why it is necessary to eliminate unrealised profit when preparing consolidated financial statements. (10 marks)

Step by Step Solution

★★★★★

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started