Question

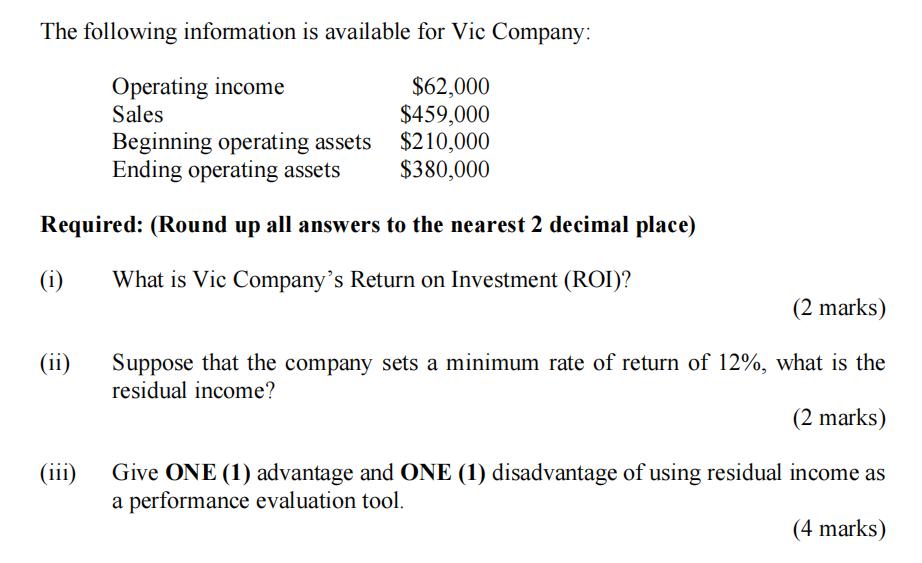

The following information is available for Vic Company: Operating income Sales Beginning operating assets Ending operating assets Required: (Round up all answers to the

The following information is available for Vic Company: Operating income Sales Beginning operating assets Ending operating assets Required: (Round up all answers to the nearest 2 decimal place) (i) What is Vic Company's Return on Investment (ROI)? (ii) (iii) $62,000 $459,000 $210,000 $380,000 (2 marks) Suppose that the company sets a minimum rate of return of 12%, what is the residual income? (2 marks) Give ONE (1) advantage and ONE (1) disadvantage of using residual income as a performance evaluation tool. (4 marks)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

i Vic Companys ROI can be calculated as ROI Operating income Beginning operating assets ROI 62000 21...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Management A Strategic Emphasis

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

8th Edition

1259917029, 978-1259917028

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App