Question

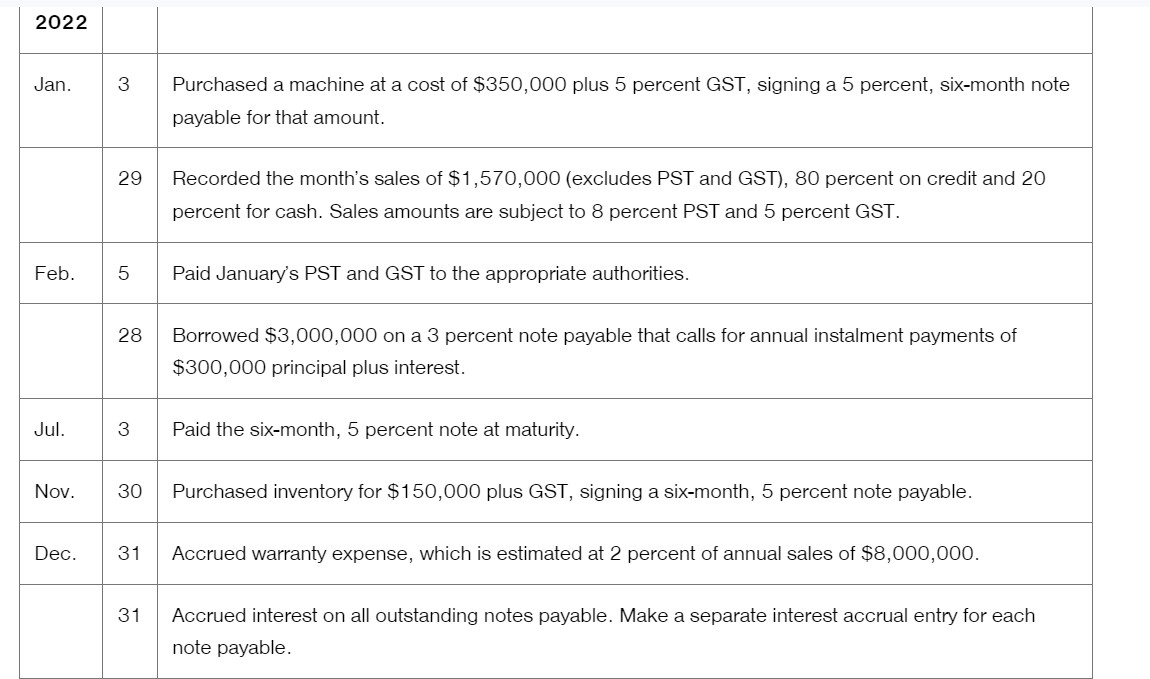

The following selected transactions of Golden Bear Construction occurred during 2022 and 2023. The companys year end is December 31. Answer: General Journal Date 2022

The following selected transactions of Golden Bear Construction occurred during 2022 and 2023. The companys year end is December 31.

Answer: General Journal Date 2022 Account Titles and Explanations Post. Ref. Debit Credit Jan. 3 Machine 350,000 GST Recoverable 17,500 Note Payable, Short-Term 367,500 29 Cash* 354,820 Accounts Receivable** 1,419,280 Sales Revenue 1,570,000 Sales Tax Payable*** 125,600 GST Payable 78,500 Feb. 5 Sales Tax Payable 125,600 GST Payable 78,500 GST Recoverable 17,500 Cash 186,600 28 Cash 3,000,000 Note Payable, Long-Term 3,000,000 Jul. 3 Note Payable, Short-Term 367,500 -------------- I dont understand how I can get this $367,500. Plz share with me the formula !!!! Interest Expense 9,112 Cash 376,612 Nov. 30 Inventory 150,000 GST Recoverable 7,500 Note Payable, Short-Term 157,500 Dec. 31 Warranty Expense 160,000 Estimated Warranty Payable 160,000

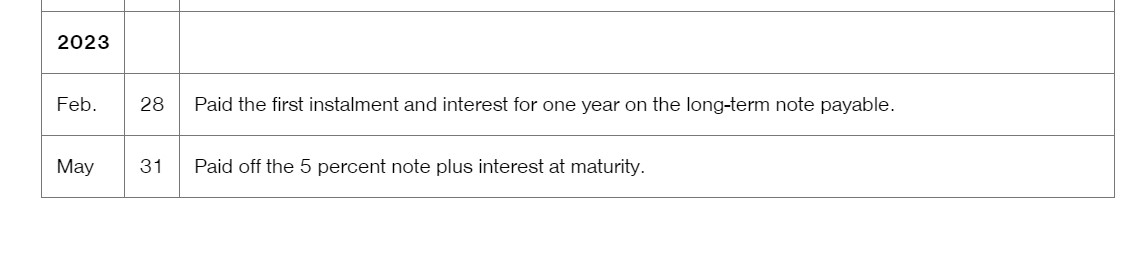

\begin{tabular}{|l|l|l|} \hline 2023 & & \\ \hline Feb. & 28 & Paid the first instalment and interest for one year on the long-term note payable. \\ \hline May & 31 & Paid off the 5 percent note plus interest at maturity. \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started