Question

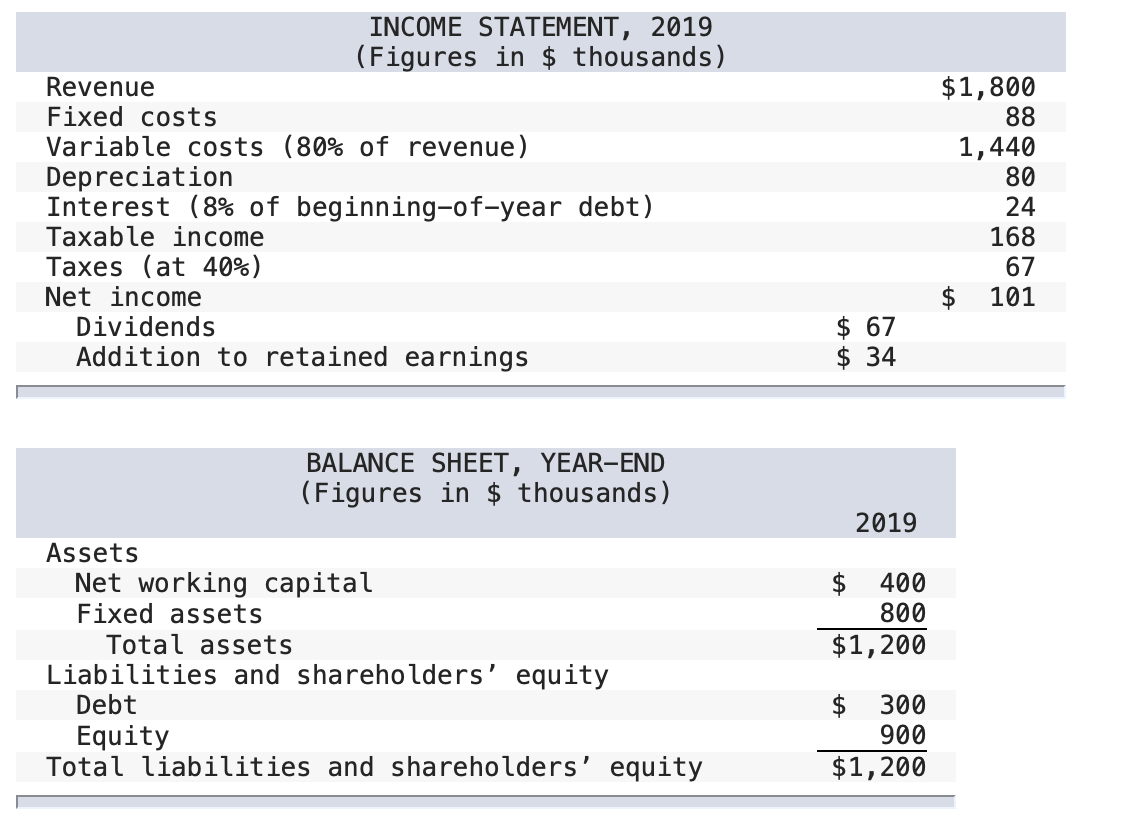

The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net

The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $88 and variable costs at 80% of revenue. The companys policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital

a1. Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets. (answer in following format)

a1. Produce an income statement for 2020. Assume that net working capital will equal 50% of fixed assets. (answer in following format)

INCOME STATEMENT, 2019 (Figures in $ thousands) Revenue Fixed costs Variable costs (80% of revenue) Depreciation Interest (8% of beginning-of-year debt) Taxable income Taxes (at 40%) Net income Dividends Addition to retained earnings $1,800 88 1,440 80 24 168 67 $ 101 $ 67 $ 34 BALANCE SHEET, YEAR-END (Figures in $ thousands) 2019 $ 400 800 $1,200 Assets Net working capital Fixed assets Total assets Liabilities and shareholders' equity Debt Equity Total liabilities and shareholders' equity $ 300 900 $1,200 Pro-Forma Income Statement 2020 INCOME STATEMENT, 2019 (Figures in $ thousands) Revenue Fixed costs Variable costs (80% of revenue) Depreciation Interest (8% of beginning-of-year debt) Taxable income Taxes (at 40%) Net income Dividends Addition to retained earnings $1,800 88 1,440 80 24 168 67 $ 101 $ 67 $ 34 BALANCE SHEET, YEAR-END (Figures in $ thousands) 2019 $ 400 800 $1,200 Assets Net working capital Fixed assets Total assets Liabilities and shareholders' equity Debt Equity Total liabilities and shareholders' equity $ 300 900 $1,200 Pro-Forma Income Statement 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started