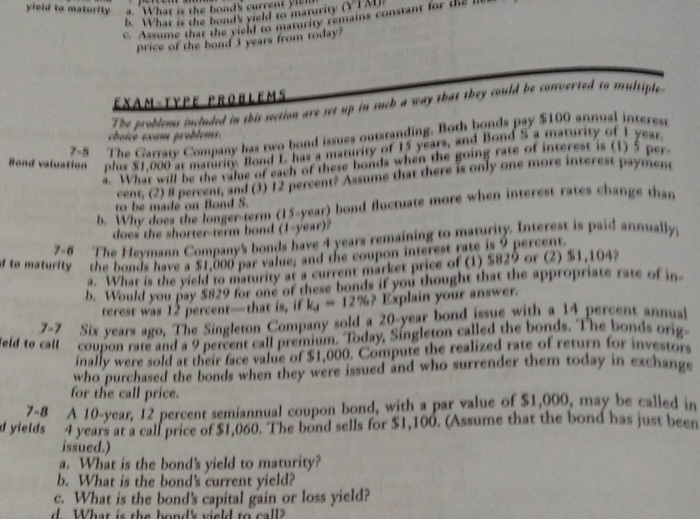

The Garrary Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1, 000 at maturity. Bond L has a maturity of 15 years, and Bond S a.maturity of 1 year What will be the value of each of these bonds when the going rate of interest is (1) 5 percent, (2) 8 percent, and (3) 12 percent? Assume that there is only one more interest payment to be made on Bond S. Why does the longer-term (15-year) bond fluctuate more when interest rates change chan does the shorter-team bond (1-year)? The Heymann Company's bonds have 4 years remaining to maturity. Interest is paid annually; the bonds have a $1, 000 per value; and the coupon interest rate is 9 percent. What is the yield to maturity at a current market price of (1) $829 or (2) $1, 104? Would you pay $829 for one of these bonds if you though that the appropriate rate of interest was 12 percent that is, if K_d = 12%? Explain your answer. Six years ago, The singleton Company sold a 20-year bond issue with a 14 percent annual coupon rate and a 9 percent call premium. Today, Singleton called the bonds. The bonds originally were sold at their face value of $1, 000. Compute the realized rate of return for investors who purchased the bonds when they were issued and who surrender them today in exchange for the call price. A 10-year, 12 percent semiannual coupon bond, with a per value of $1, 000, may be called in 4 years at a call price of $1, 060. The bond sells for $1, 100. (Assume that the bond has just been issued.)What is the bond's yield to maturity? What is the bond's current yield? What is the bond's capital gain or loss yield? What is the bond's yield to call The Garrary Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1, 000 at maturity. Bond L has a maturity of 15 years, and Bond S a.maturity of 1 year What will be the value of each of these bonds when the going rate of interest is (1) 5 percent, (2) 8 percent, and (3) 12 percent? Assume that there is only one more interest payment to be made on Bond S. Why does the longer-term (15-year) bond fluctuate more when interest rates change chan does the shorter-team bond (1-year)? The Heymann Company's bonds have 4 years remaining to maturity. Interest is paid annually; the bonds have a $1, 000 per value; and the coupon interest rate is 9 percent. What is the yield to maturity at a current market price of (1) $829 or (2) $1, 104? Would you pay $829 for one of these bonds if you though that the appropriate rate of interest was 12 percent that is, if K_d = 12%? Explain your answer. Six years ago, The singleton Company sold a 20-year bond issue with a 14 percent annual coupon rate and a 9 percent call premium. Today, Singleton called the bonds. The bonds originally were sold at their face value of $1, 000. Compute the realized rate of return for investors who purchased the bonds when they were issued and who surrender them today in exchange for the call price. A 10-year, 12 percent semiannual coupon bond, with a per value of $1, 000, may be called in 4 years at a call price of $1, 060. The bond sells for $1, 100. (Assume that the bond has just been issued.)What is the bond's yield to maturity? What is the bond's current yield? What is the bond's capital gain or loss yield? What is the bond's yield to call