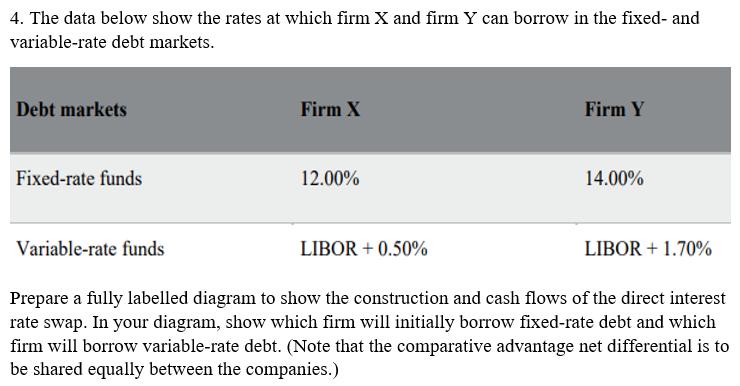

Question: 4. The data below show the rates at which firm X and firm Y can borrow in the fixed- and variable-rate debt markets. Debt

4. The data below show the rates at which firm X and firm Y can borrow in the fixed- and variable-rate debt markets. Debt markets Fixed-rate funds Variable-rate funds Firm X 12.00% LIBOR + 0.50% Firm Y 14.00% LIBOR + 1.70% Prepare a fully labelled diagram to show the construction and cash flows of the direct interest rate swap. In your diagram, show which firm will initially borrow fixed-rate debt and which firm will borrow variable-rate debt. (Note that the comparative advantage net differential is to be shared equally between the companies.)

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Debt Market Firm X Firm Y Differential Fixed Rate Fund 12 ... View full answer

Get step-by-step solutions from verified subject matter experts