Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The managers of Setia Sdn Bhd are investigating a potential RM25 million investment with a joint venture company in this new region. RM9 million

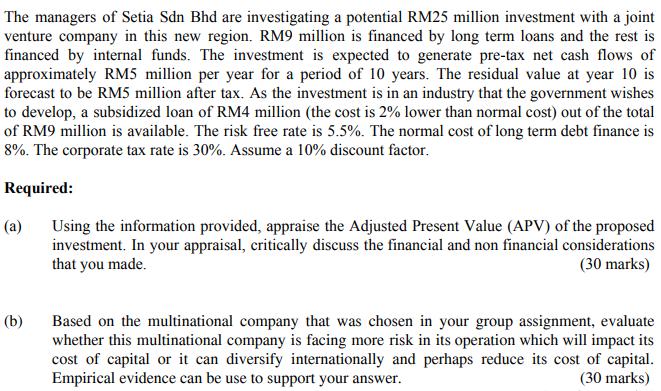

The managers of Setia Sdn Bhd are investigating a potential RM25 million investment with a joint venture company in this new region. RM9 million is financed by long term loans and the rest is financed by internal funds. The investment is expected to generate pre-tax net cash flows of approximately RM5 million per year for a period of 10 years. The residual value at year 10 is forecast to be RM5 million after tax. As the investment is in an industry that the government wishes to develop, a subsidized loan of RM4 million (the cost is 2% lower than normal cost) out of the total of RM9 million is available. The risk free rate is 5.5%. The normal cost of long term debt finance is 8%. The corporate tax rate is 30%. Assume a 10% discount factor. Required: (a) Using the information provided, appraise the Adjusted Present Value (APV) of the proposed investment. In your appraisal, critically discuss the financial and non financial considerations that you made. (30 marks) (b) Based on the multinational company that was chosen in your group assignment, evaluate whether this multinational company is facing more risk in its operation which will impact its cost of capital or it can diversify internationally and perhaps reduce its cost of capital. Empirical evidence can be use to support your answer. (30 marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 djusted NV Unlevered Firm Vlue Ne Net effet f debt s the sh flws re unlevered re tx ie ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started