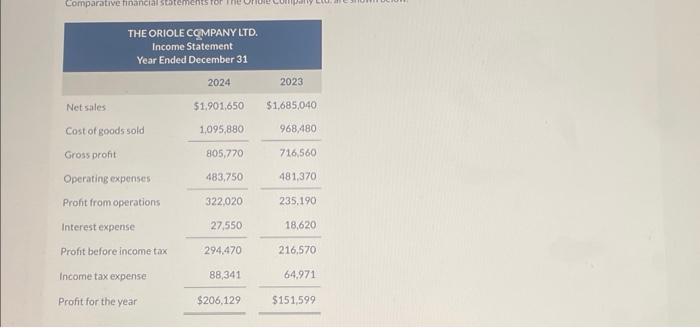

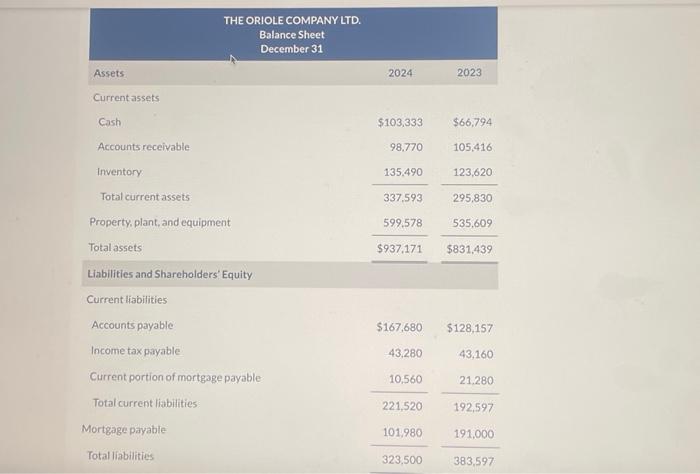

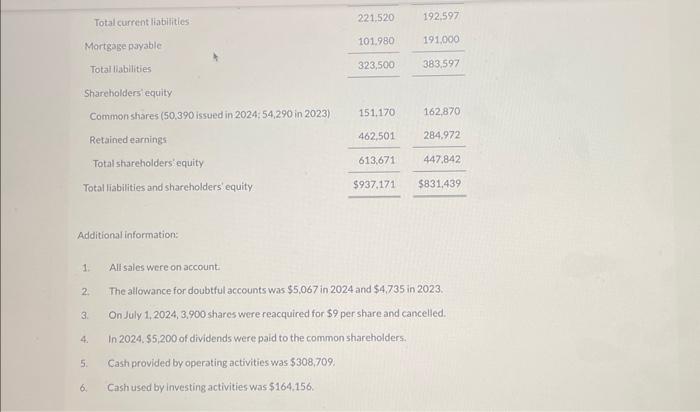

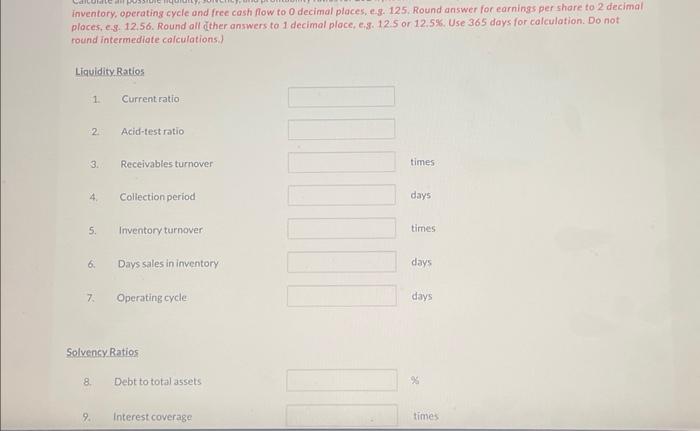

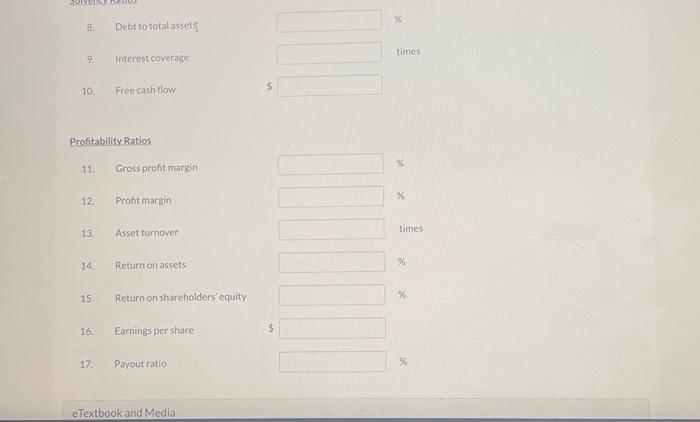

THE ORIOLE COMPANY ITD. Income Statement Year Ended December 31 \begin{tabular}{|c|c|c|} \hline & 2024 & 2023 \\ \hline Net sales & $1,901,650 & $1,685,040 \\ \hline Cost of goods sold & 1,095,880 & 968,480 \\ \hline Gross profit: & 805,770 & 716,560 \\ \hline Operating expenses & 483,750 & 481,370 \\ \hline Profit from operations & 322,020 & 235,190 \\ \hline Interest expense & 27,550 & 18,620 \\ \hline Profit before income tax & 294,470 & 216,570 \\ \hline Income tax expense & 88,341 & 64,971 \\ \hline Profit for the year & $206,129 & $151,599 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{\begin{tabular}{l} THE ORIOLE COMPANY LTD. \\ Balance Sheet \\ December 31 \end{tabular}} \\ \hline Assets & 2024 & 2023 \\ \hline \multicolumn{3}{|l|}{ Current assets } \\ \hline Cash & $103,333 & $66,794 \\ \hline Accounts receivable & 98.770 & 105,416 \\ \hline Inventory & 135,490 & 123,620 \\ \hline Total current assets & 337.593 & 295,830 \\ \hline Property, plant, and equipment & 599.578 & 535,609 \\ \hline Total assets & $937.171 & $831,439 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Shareholders' Equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Accounts payable & $167,680 & $128,157 \\ \hline Income tax payable: & 43,280 & 43,160 \\ \hline Current portion of mortgage payable & 10,560 & 21.280 \\ \hline Total current liabilities & 221,520 & 192,597 \\ \hline Mortgage payable & 101,980 & 191,000 \\ \hline Total liabilities & 323,500 & 383,597 \\ \hline \end{tabular} 1. All sales were on account: 2. The attowance for doubtfut accounts was $5,067 in 2024 and $4,735 in 2023 . 3. On July 1,2024,3,900 shares were reacquired for $9 per share and cancelled. 4. In 2024, 55,200 of dividends were paid to the common shareholders: 5. Cash provided by operating activities was $308,709. 6. Cashused by investing activities was $164156 inventory, operating cycle and free cash flow to 0 decimal places, es. 125. Round answer for earnings per share to 2 decimal places, es. 12.56. Round all ther answers to 1 decimat pfoce, e.g. 12.5 or 12.5%. Use 365 doys for colculation. Do not round intermedlate calculations.) 8. Debt to totalassetof 9. Interestcoverage times 10. Freecash flow Profitability Ratios 11. Gross profit margin 12. Profit margin % 13. Asset turnover times 14. Return on assets % 15. Returnon shareholders' equity \& 16. Earnings per share 5 17. Payout ratio % eTextbook and Media