Answered step by step

Verified Expert Solution

Question

1 Approved Answer

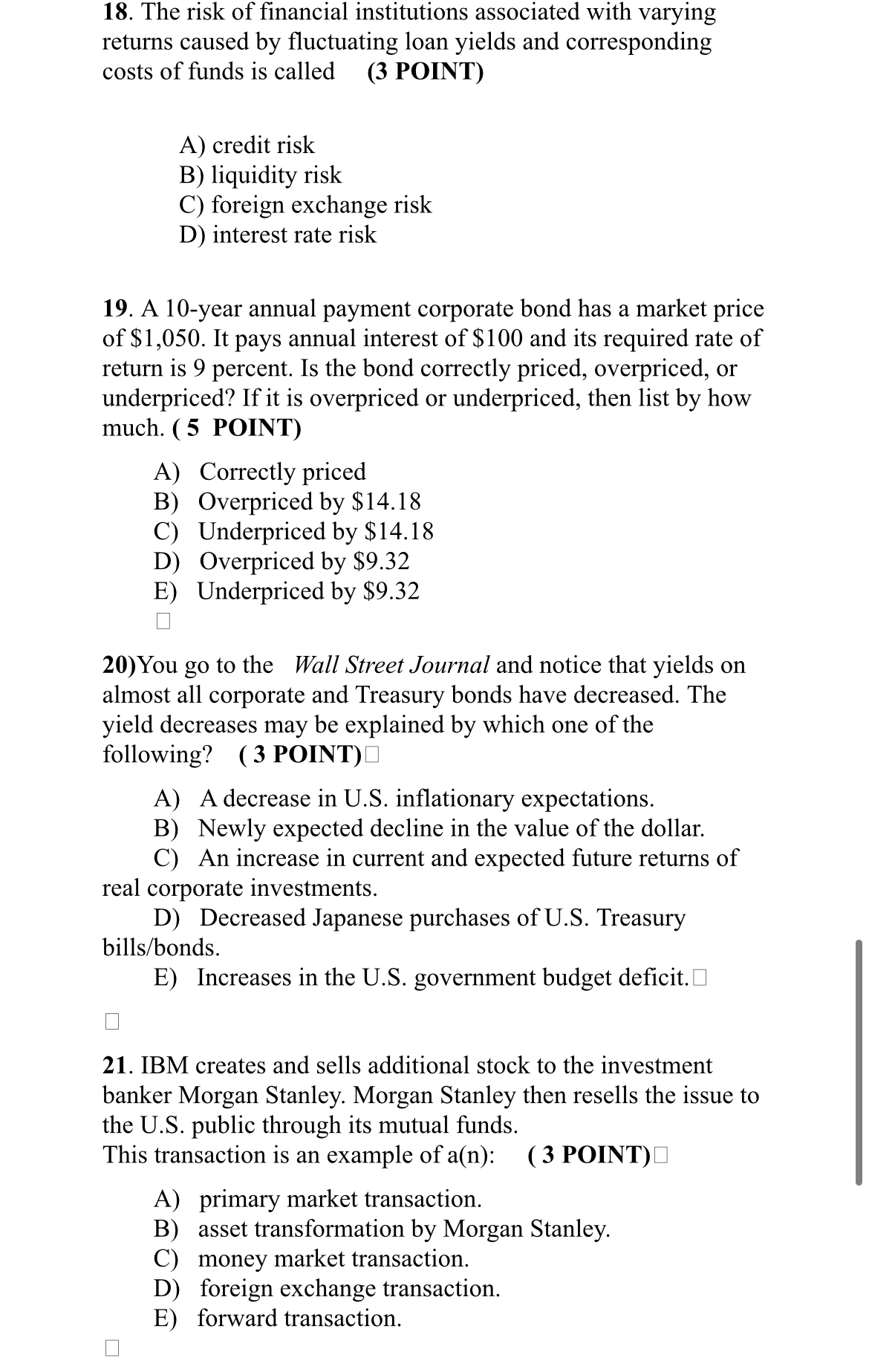

The risk of financial institutions associated with varying returns caused by fluctuating loan yields and corresponding costs of funds is called ( 3 POINT )

The risk of financial institutions associated with varying returns caused by fluctuating loan yields and corresponding costs of funds is called

POINT

A credit risk

B liquidity risk

C foreign exchange risk

D interest rate risk

A year annual payment corporate bond has a market price of $ It pays annual interest of $ and its required rate of return is percent. Is the bond correctly priced, overpriced, or underpriced? If it is overpriced or underpriced, then list by how much. POINT

A Correctly priced

B Overpriced by $

C Underpriced by $

D Overpriced by $

E Underpriced by $

You go to the Wall Street Journal and notice that yields on almost all corporate and Treasury bonds have decreased. The yield decreases may be explained by which one of the following? POINT

A A decrease in US inflationary expectations.

B Newly expected decline in the value of the dollar.

C An increase in current and expected future returns of real corporate investments.

D Decreased Japanese purchases of US Treasury billsbonds

E Increases in the US government budget deficit.

IBM creates and sells additional stock to the investment banker Morgan Stanley. Morgan Stanley then resells the issue to the US public through its mutual funds.

This transaction is an example of :

POINT

A primary market transaction.

B asset transformation by Morgan Stanley.

C money market transaction.

D foreign exchange transaction.

E forward transaction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started