Question

This is an exercise of Financial Statement Analysis. Thanks for your help. You have been provided with the following extract from the financial statements of

This is an exercise of Financial Statement Analysis. Thanks for your help.

You have been provided with the following extract from the financial statements of The Bay.

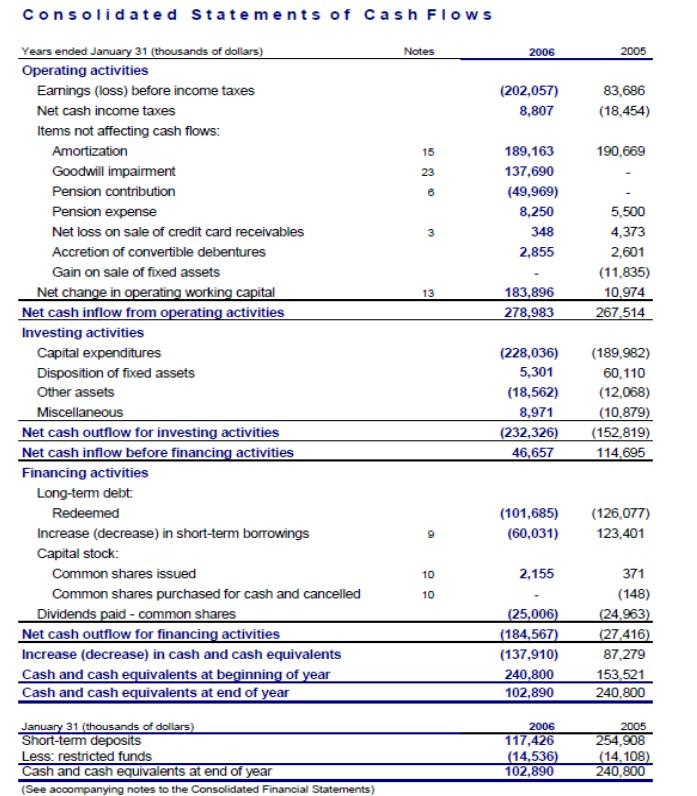

a) Compare The Bay's operating cash flow (OCF) of 2006 with that of 2005, what do you think is the major contributor to 2006's positive OCF? Briefly comment on The Bay's cash flow status.

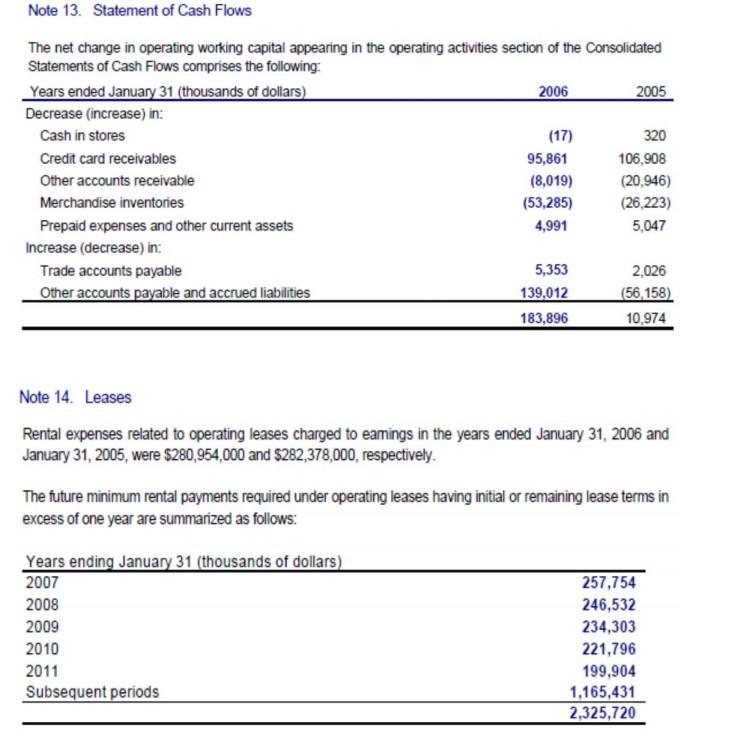

b) Calculate The Bay's 2006 operating cashflow, assuming the change of "Other accounts payable and accrued liabilities" is -56,158 rather than +139,012?

c) In the year of 2006, The Bay securitized 900,000 of their credit card receivables through the use of Variable Interest Entity (VIE). The Bay's managers decide to not consolidate this VIE, although The Bay is the primary beneficiary of this VIE. How would this decision affect the debt-to-equity ratio, operating cash flow and current ratio?

Consolidated statements of Cash Flows Financing activities Long-term debt Redeemed (101,685)(126,077) Increase (decrease) in short-term borrowings (60,031)123,401 Capital stock: Commonsharesissued102,155371 Common shares purchased for cash and cancelled 10 (148) \begin{tabular}{lcc} Dividends paid - common shares & (25,006) & (24,963) \\ \hline Net cash outflow for financing activities & (184,567) & (27,416) \\ \hline Increase (decrease) in cash and cash equivalents & (137,910) & 87,279 \\ Cash and cash equivalents at beginning of year & 240,800 & 153,521 \\ \hline Cash and cash equivalents at end of year & 102,890 & 240,800 \\ \hline \end{tabular} \begin{tabular}{lcc} January 31 (thousands of dollars) & 2006 & 2005 \\ \hline Short-term deposits & 117,426 & 254,908 \\ Less: restricted funds & (14,536) & (14,108) \\ \hline Cash and cash equivalents at end of year & 102,890 & 240,800 \\ \hline \end{tabular} (See acoompanying notes to the Consolidated Financial Statements) The net change in operating working capital appearing in the operating activities section of the Consolidated Statements of Cash Flows comprises the following: Note 14. Leases Rental expenses related to operating leases charged to eamings in the years ended January 31,2006 and January 31,2005 , were $280,954,000 and $282,378,000, respectively. The future minimum rental payments required under operating leases having initial or remaining lease terms in excess of one year are summarized as follows: Consolidated statements of Cash Flows Financing activities Long-term debt Redeemed (101,685)(126,077) Increase (decrease) in short-term borrowings (60,031)123,401 Capital stock: Commonsharesissued102,155371 Common shares purchased for cash and cancelled 10 (148) \begin{tabular}{lcc} Dividends paid - common shares & (25,006) & (24,963) \\ \hline Net cash outflow for financing activities & (184,567) & (27,416) \\ \hline Increase (decrease) in cash and cash equivalents & (137,910) & 87,279 \\ Cash and cash equivalents at beginning of year & 240,800 & 153,521 \\ \hline Cash and cash equivalents at end of year & 102,890 & 240,800 \\ \hline \end{tabular} \begin{tabular}{lcc} January 31 (thousands of dollars) & 2006 & 2005 \\ \hline Short-term deposits & 117,426 & 254,908 \\ Less: restricted funds & (14,536) & (14,108) \\ \hline Cash and cash equivalents at end of year & 102,890 & 240,800 \\ \hline \end{tabular} (See acoompanying notes to the Consolidated Financial Statements) The net change in operating working capital appearing in the operating activities section of the Consolidated Statements of Cash Flows comprises the following: Note 14. Leases Rental expenses related to operating leases charged to eamings in the years ended January 31,2006 and January 31,2005 , were $280,954,000 and $282,378,000, respectively. The future minimum rental payments required under operating leases having initial or remaining lease terms in excess of one year are summarized as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started