Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This problem is based on the 2020 annual report of Campbell Soup Company. Answer the following questions. Refer to the Selected financial data (see page

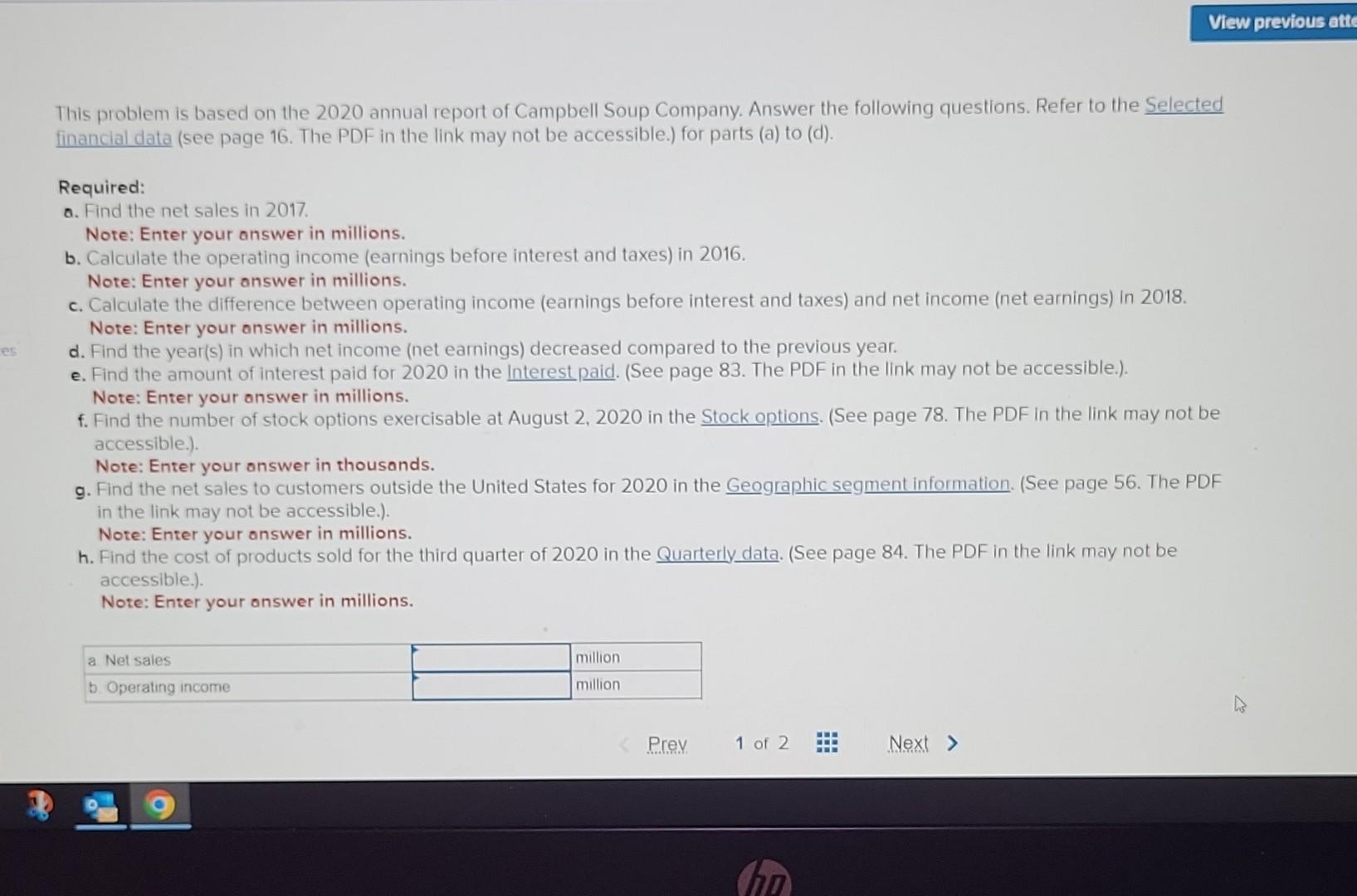

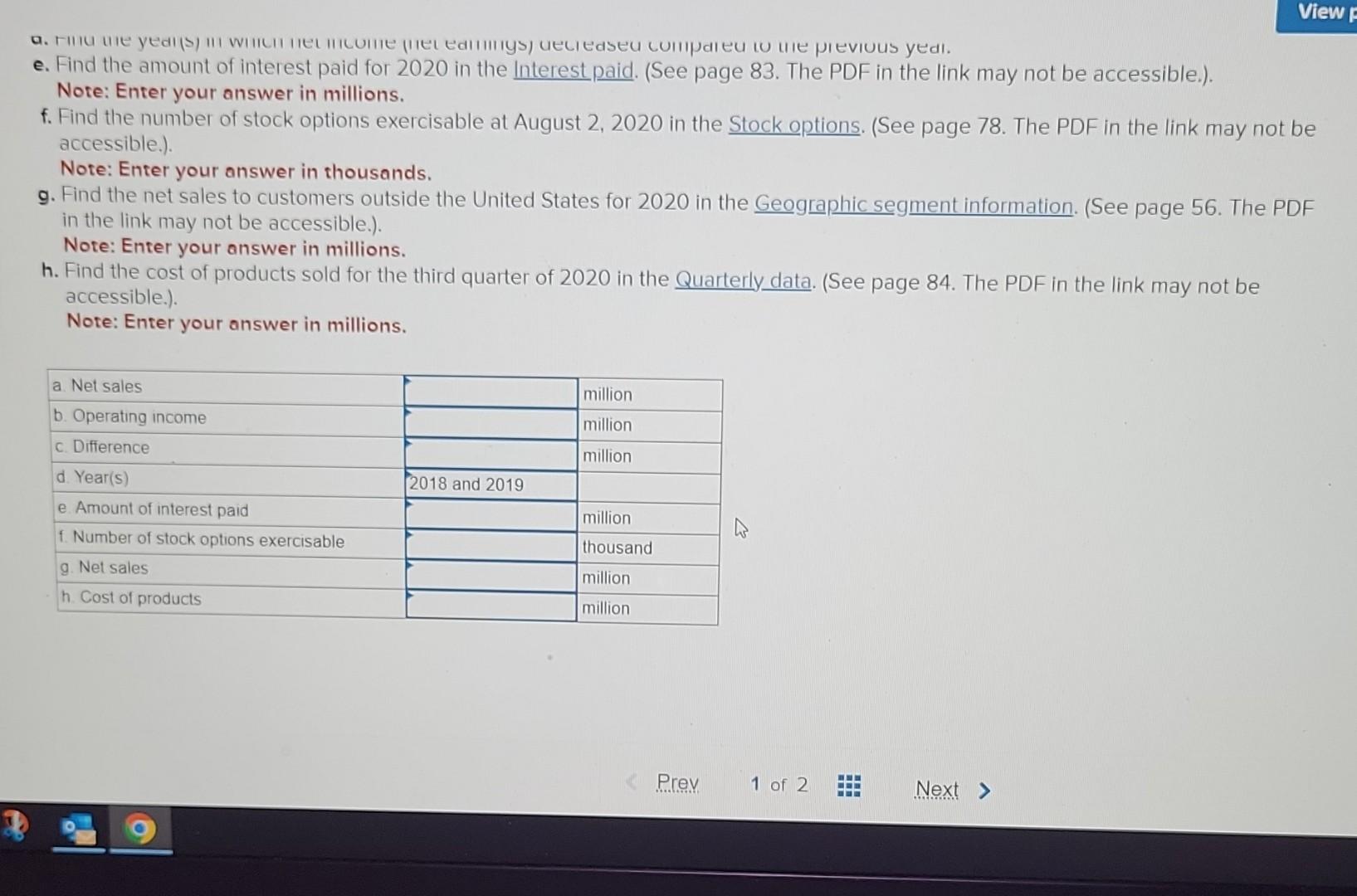

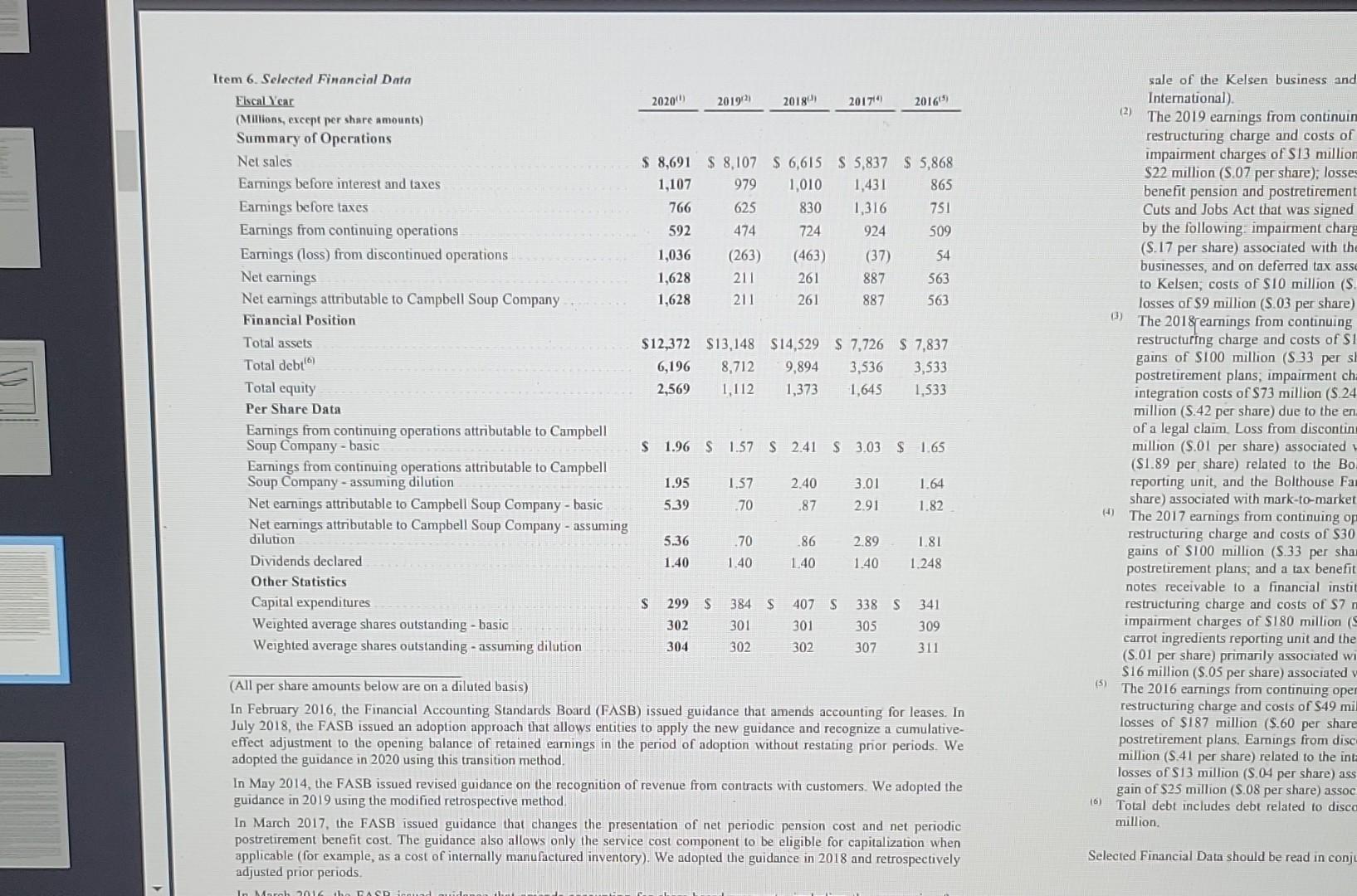

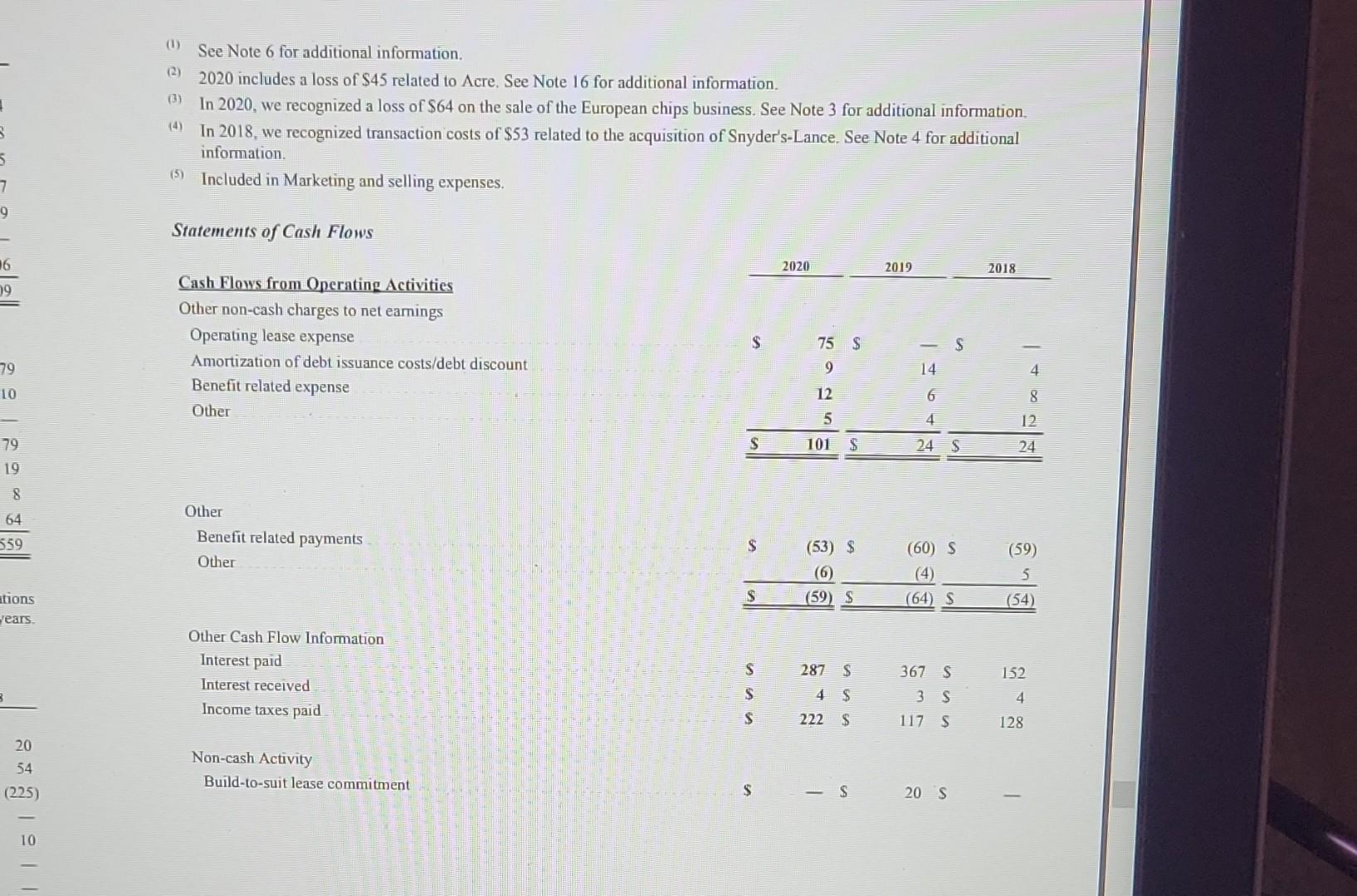

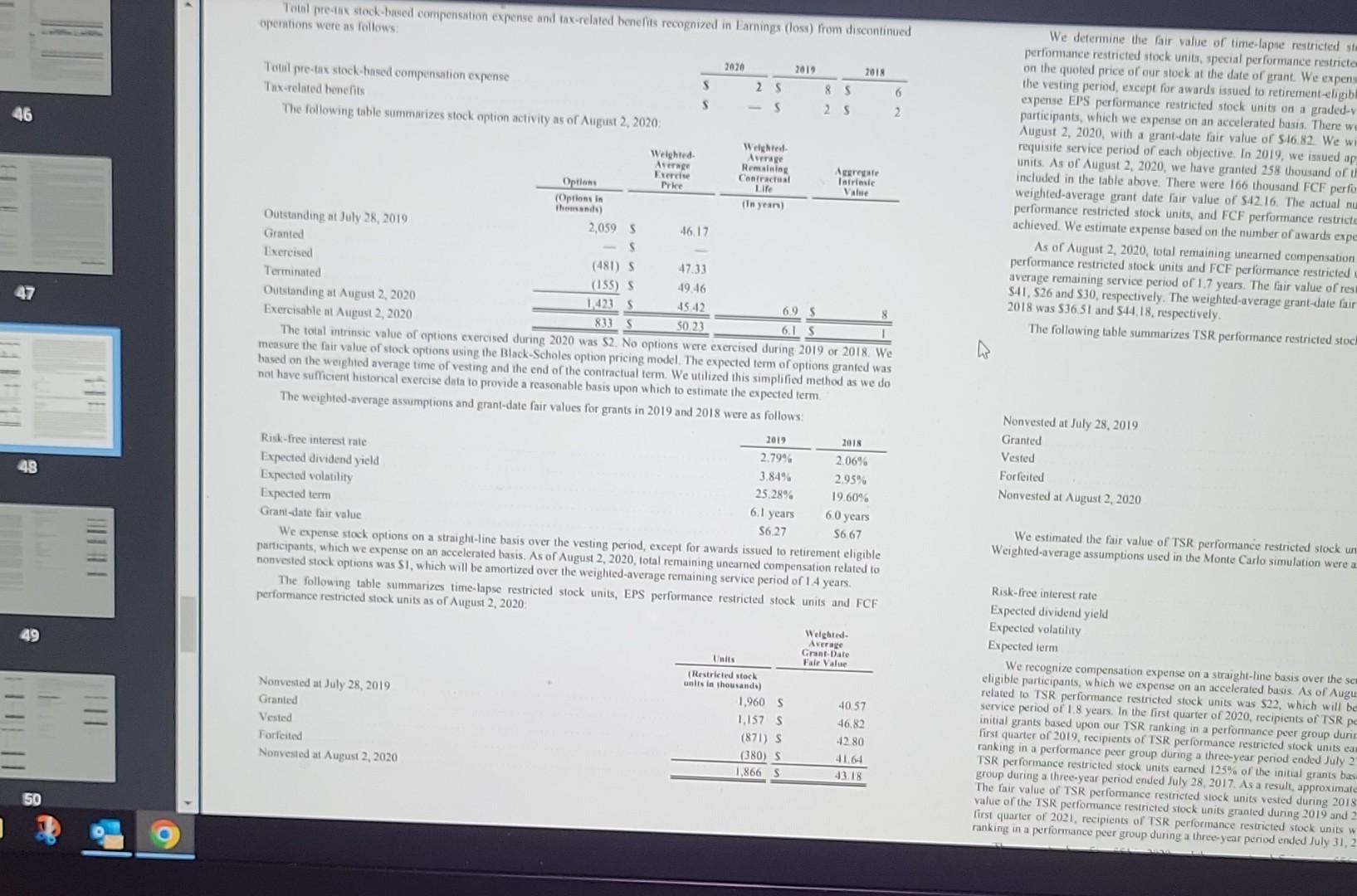

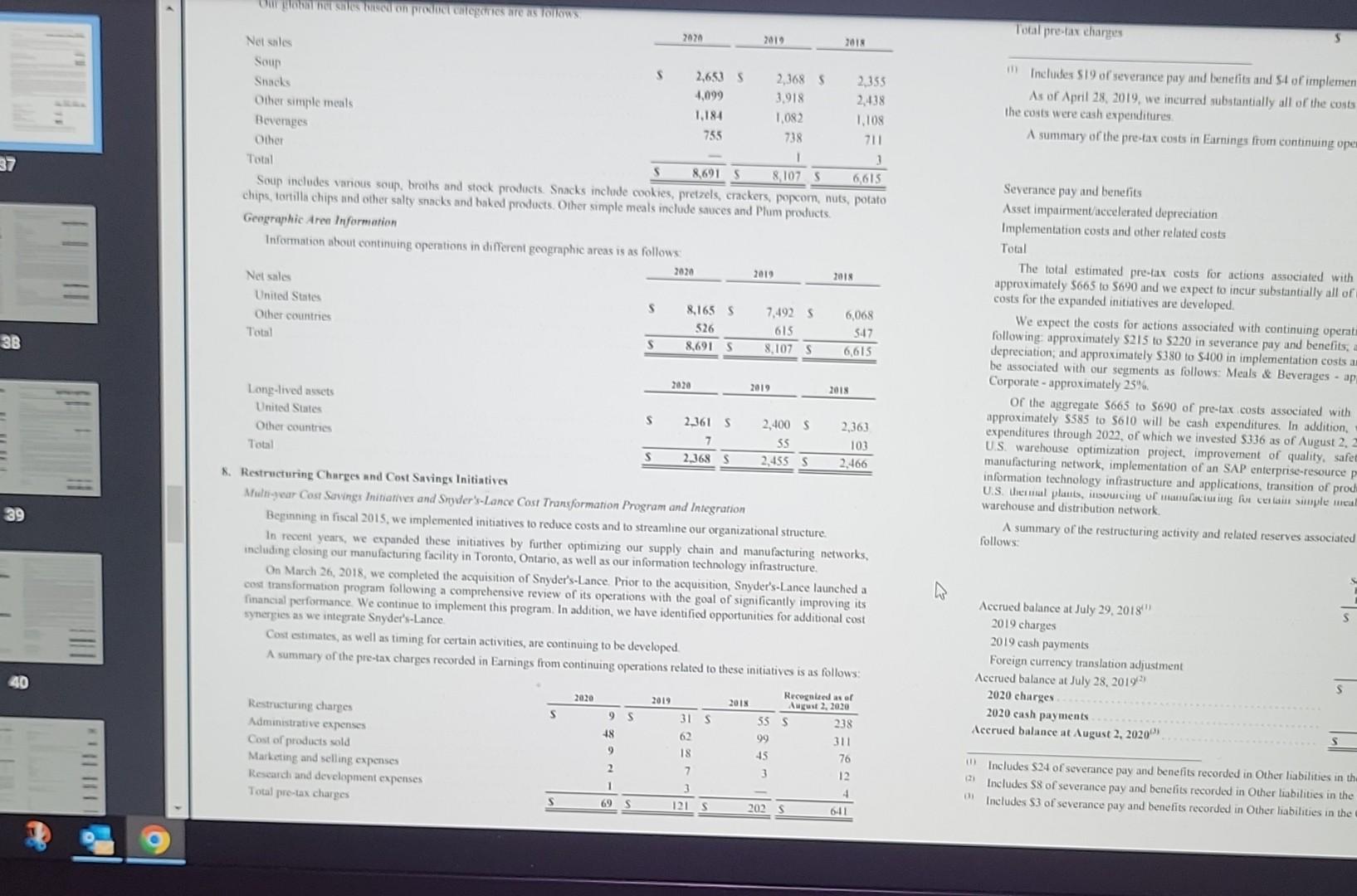

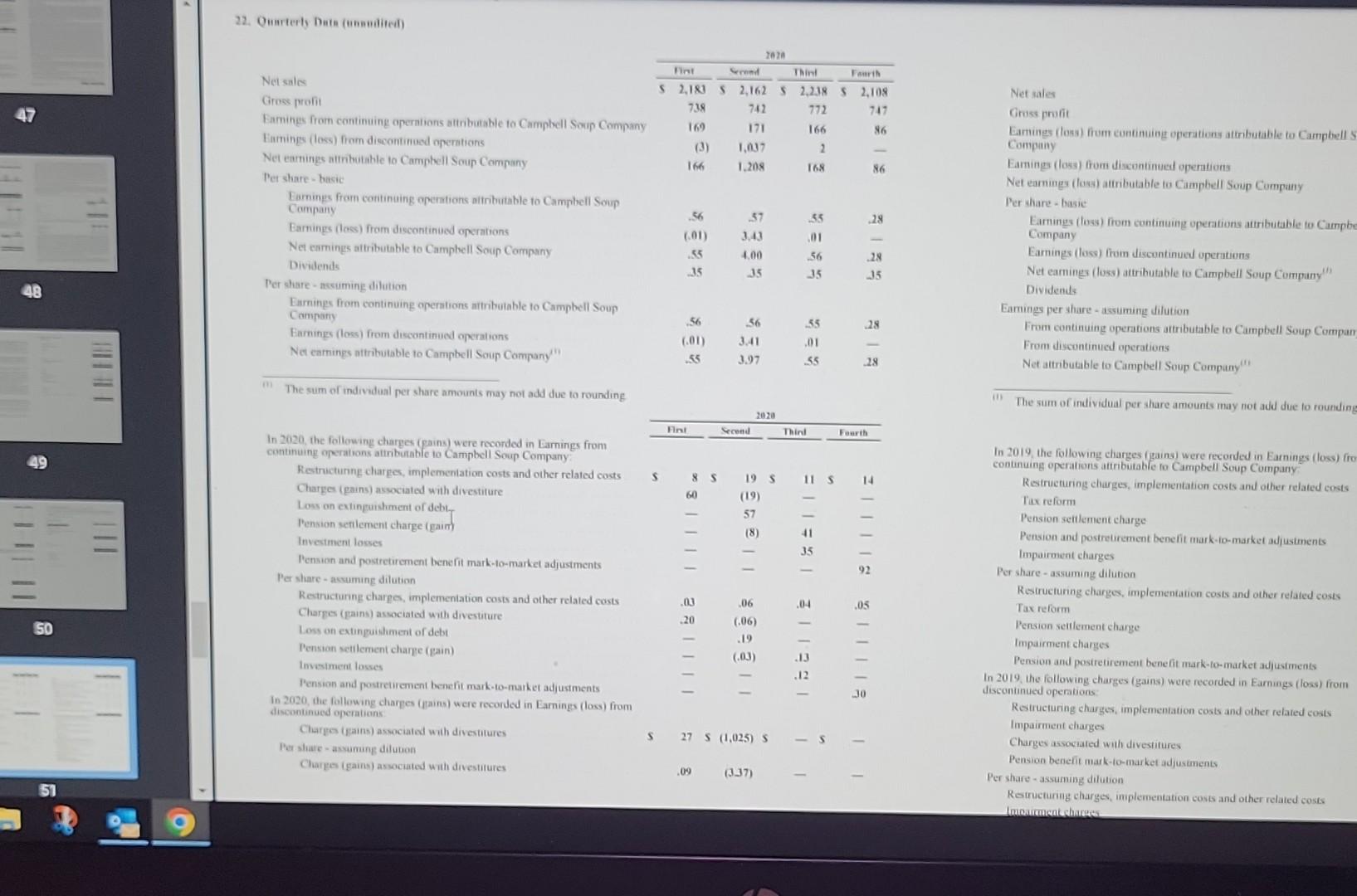

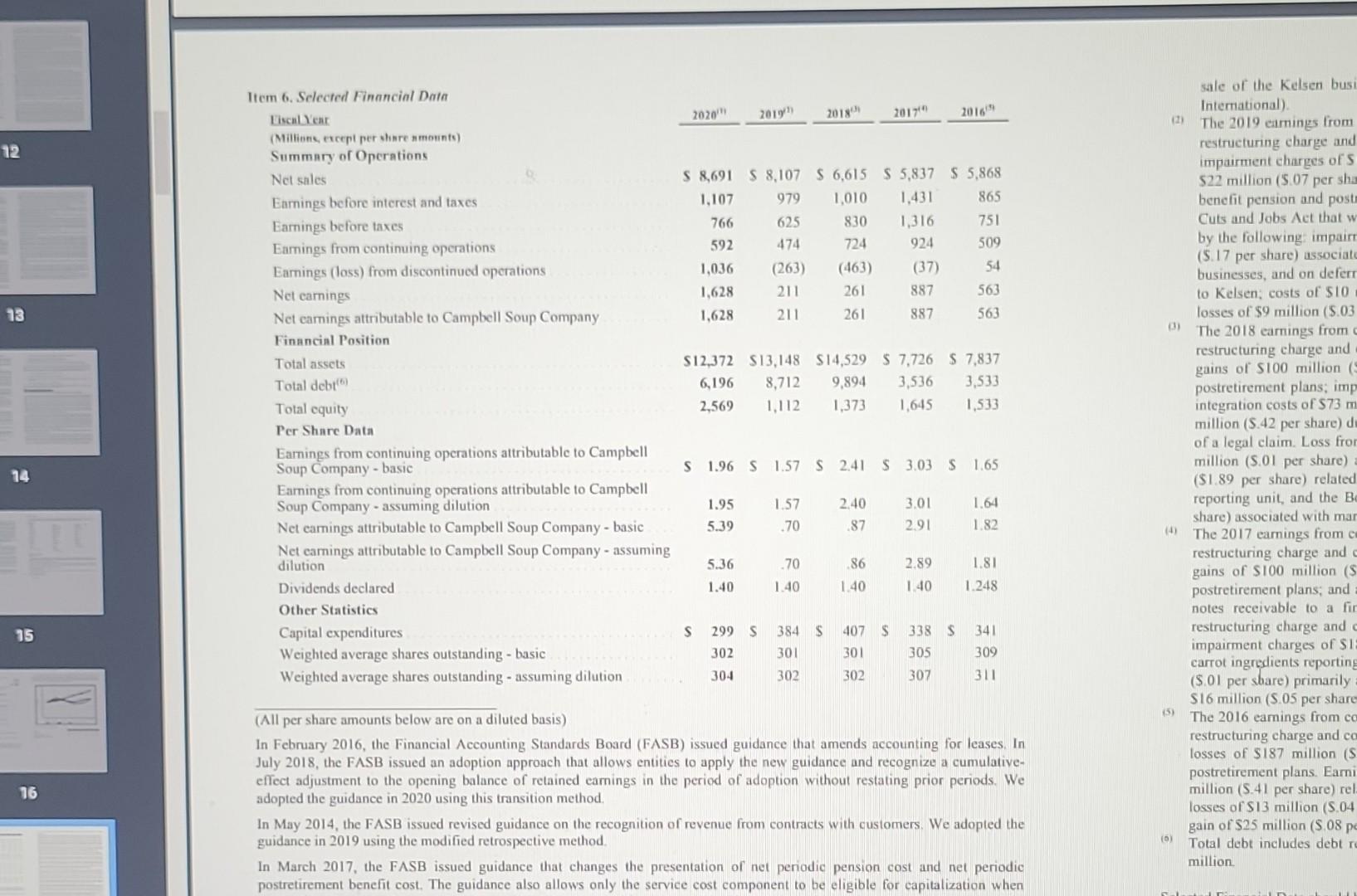

This problem is based on the 2020 annual report of Campbell Soup Company. Answer the following questions. Refer to the Selected financial data (see page 16. The PDF in the link may not be accessible.) for parts (a) to (d). Required: 0. Find the net sales in 2017. Note: Enter your onswer in millions. b. Calculate the operating income (earnings before interest and taxes) in 2016. Note: Enter your answer in millions. c. Calculate the difference between operating income (earnings before interest and taxes) and net income (net earnings) in 2018. Note: Enter your onswer in millions. d. Find the year(s) in which net income (net earnings) decreased compared to the previous year. e. Find the amount of interest paid for 2020 in the Interest paid. (See page 83. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. f. Find the number of stock options exercisable at August 2, 2020 in the Stock options. (See page 78. The PDF in the link may not be accessible.). Note: Enter your onswer in thousands. g. Find the net sales to customers outside the United States for 2020 in the Geographic segment information. (See page 56. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. h. Find the cost of products sold for the third quarter of 2020 in the Quarterly data. (See page 84. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. e. Find the amount of interest paid for 2020 in the Interest paid. (See page 83. The PDF in the link may not be accessible.). Note: Enter your answer in millions. f. Find the number of stock options exercisable at August 2, 2020 in the Stock options. (See page 78. The PDF in the link may not be accessible.). Note: Enter your answer in thousands. g. Find the net sales to customers outside the United States for 2020 in the Geographic segment information. (See page 56. The PDF in the link may not be accessible.). Note: Enter your answer in millions. h. Find the cost of products sold for the third quarter of 2020 in the Quarterly data. (See page 84. The PDF in the link may not be accessible.). Note: Enter your answer in millions. sale of the Kelsen business and International). (2) The 2019 earnings from continuin restructuring charge and costs of impairment charges of S13 million \$22 million (\$.07 per share); losse: benefit pension and postretirement Cuts and Jobs Act that was signed by the following: impairment charg (\$.17 per share) associated with the businesses, and on deferred tax ass to Kelsen; costs of $10 million (\$. losses of $9 million (\$.03 per share) (3) The 2018 [eamings from continuing restructuring charge and costs of $1 gains of S100 million (S.33 per si postretirement plans; impairment ch integration costs of \$73 million (\$.24 million ( 5.42 per share) due to the en of a legal claim. Loss from discontin million ( $.01 per share) associated (\$1.89 per share) related to the Bo reporting unit, and the Bolthouse Fa share) associated with mark-to-market (t) The 2017 earnings from continuing op restructuring charge and costs of $30 gains of $100 million ( $.33 per sha postretirement plans; and a tax benefit notes receivable to a financial instit restructuring charge and costs of 57n impairment charges of $180 million (s carrot ingredients reporting unit and the ( $.01 per share) primarily associated wi (All per share amounts below are on a diluted basis) In February 2016, the Financial Accounting Standards Board (FASB) issued guidance that amends accounting for leases. In July 2018, the FASB issued an adoption approach that allows entities to apply the new guidance and recognize a cumulativeeffect adjustment to the opening balance of retained eamings in the period of adoption without restating prior periods. We adopted the guidance in 2020 using this transition method. In May 2014, the FASB issued revised guidance on the recognition of revenue from contracts with customers. We adopted the guidance in 2019 using the modified retrospective method. In March 2017, the FASB issued guidance that changes the presentation of net periodic pension cost and net periodic postretirement benefit cost. The guidance also allows only the service cost component to be eligible for capitalization when applicable (for example, as a cost of internally manufactured inventory). We adopted the guidance in 2018 and retrospectively adjusted prior periods. \$1 6 million ( $.05 per share) associated v (5) The 2016 earnings from continuing ope restructuring charge and costs of $49mi losses of $187 million ( $.60 per share postretirement plans, Earnings from disc million ( $.41 per share) related to the int losses of 513 million ( $.04 per share) ass gain of $25 million ( $.08 per share) assoc (6) Total debt includes debt related to disco million. Selected Financial Data should be read in conj (1) See Note 6 for additional information. (2) 2020 includes a loss of $45 related to Acre. See Note 16 for additional information. (3) In 2020, we recognized a loss of $64 on the sale of the European chips business. See Note 3 for additional information. (4) In 2018, we recognized transaction costs of \$53 related to the acquisition of Snyder's-Lance. See Note 4 for additional information. (5) Included in Marketing and selling expenses. Totil pre-tax stock-based compensalion expense and lax-related benefits recogenized in Eamings (loss) from discontinued operations were as follows: We defermine the fair value of time-lapse resicicted Totil pre-tax stock-hased compensation expense Thx-related benefits performance resiricted stock units, special performance restricte on the quoted price of our stock at the date of grant. We expen the vesting period, except for awards issued to refirement-eligib expense EPS performance reatricted stock units on a graded-v participants, which we expense on an accelerated basis. There w August 2, 2020, with a grant-date fair value of 5.16.82. We wi requisife service period of each objective. In 2019 , we issued ap units. As of August 2, 2020, we have granted 258 thousand of t included in the table above. There were 166 thousand FCF perfo weighted-average grant date fair value of 542.16 . The actual nu performance restricted stock units, and FCF performance restrict achieved. We estimate expense based on the number of awards expe As of August 2, 2020, total remaining uneamed compensation performance restricted stock units and FCF performance restricted average remaining service period of 1.7 years. The fair value of res $41,526 and 530 , respectively. The weighted-average grant-date fair 2018 was 53651 and 544,18 , respectively. measure the fair value of stock options using the Black-Scholes was 82 . No options were exercised during 2019 or 2018 . We based on the weighted average time of vesting and the end of the controctual term. We expected term of options granted was not have suficient historical exercise data to provide a reasonable basis upon which to estimate the expected term. The weighted-average assumptions and grant-date fair values for grants in 2019 and 2018 were as follows: participants, which we optons on a straight-line basis over the vesting period, except for awands issued to retirement eligible nonvested stack options was SI, which accelerated basis. As of August 2, 2020, Iotal remaining unearned compensation related to . performance restricted stock units as of August 2,2020: The following table summarizes TSR performance restricted stoc We estimated the fair value of TSR performance restricted stock un Weighted-average assumptions used in the Monte Carlo simulation were a Risk-free interest rate Expected dividend yield Expected volatility Expected lerm We recognize compensation expense on a straight-line basis over the se eligible participants, which we expense on an accelerated basis. As of Augu related to TSR performance restricted stock units was 522 , which will be initial grants based upon our TSR ranking in a performance peer group durit first quarter of 2019, recipients of TSR performance restricted stock units ea ranking in a performance peer group during a three-year period ended July 2 TSR performance restricled stock units earned 125% of the initial grants bas group during a three-year period ended July 28, 2017. As a result, approximate The fair value of TSR performance restricted slock units vested during 2018 value of the TSR performance restricied slock units granted during 2019 and 2 first quarter of 2021, recipients of TSR performance restricted stock units w ranking in a performance peer group during a three-year peniod ended July 31,2 chips, tortilla chips anous soup, broths and stock products. Snacks include cookies, pretzels, crackers, popcom, nuts, potato Geographic Aren Information Information about continuing operations in different geographic areas is as follows: 8. Restructuring Charges and Cost Savings Initiatives Mhulti-y var Cost Savings Initiativer and Spover's-Lance Cost Transformation Program and Integnation Beqinning in fiscal 2015, we implemented initiatives to reduce costs and to streamline our organizational structure In recent years, we expanded these initiatives by further optimizing our supply chain and manufacturing networks, including closing our manufacturing facility in Toronto, Ontario, as well as our information technology infrastructure. On March 26, 2018, we completed the acquisition of Snyder's-Lance. Prior to the acquisition, Snyder's-Lance launched a cost transformation program following a comprehensive review of its operations with the goal of significantly improving its financial performance. We continue to implement this program. In addition, we have identified opportunities for additional cost synergies as we integrate Snyder's-Lance. Cost estimates, as well as timing for certain activities, are continuing to be developed. A summary of the pre-tax charges recorded in Earnings from continuing operations related to these initiatives is as follows: Severance pay and benefits Asset impairmentaccelerated depreciation Implementation costs and other related costs Total The total estimated pretax costs for actions associated with approximately $665 to $690 and we expect to incur substantially all of costs for the expanded initiatives are developed. We expect the costs for actions associated with continuing operat following: approximately $215 to $220 in severance pay and benefits. depreciation; and approximately $380 to $400 in implementation costs a be associated with our segments as follows: Meals \& Beverages - ap Corporate - approximately 25%. Of the aggregate $665 to $690 of pre-tax costs associated with approximately $585 to $610 will be cash expenditures. In addition, expenditures through 2022, of which we invested 5336 as of August 2,2 U.S. warehouse optimization project, improvement of quality, safe manufacturing network, implementation of an SAP enterprise-resource information technology infrastructure and applications, transition of prod warchouse and distribution network. A summary of the restructuring activity and related reserves associated follows: (1) (1) Includes $24 of severance pay and benefits recorded in Other liabilities in th (2) Includes $8 of severance pay and benefits recorded in Other liabilities in the (1) Includes $3 of severance pay and benefits recorded in Other liabilities in the Net sales Gruss profit Eamings (loss) frum cuntinuing operations at tributable to Campbell s Company Eamings (loss) from discontinued opentions Net earmuga (loss) attributable to Campbell Soup Company Per share - basic Earnings (loss) from contimuing operations attributable to Campb Company Earnings (loss) from discontinusd operntions Net earnings (loss) attrihutable to Campbell Soup Company 113 Dividends Eamings per share - assuming dilution From continuing openations attributable to Campbell Soup Compan From discontinued operations Net attributable to Campbell Soup Company (1) (1) The sum of individual per share amounts may not add due to rounding (11) The sum of individual per share amounts may not add due to rounding In 2019, the following charges (gains) were recorded in Earnings (loss) fro continuing operations attributable to Campbell Soup Company Restructuring charges, implementation costs and other related costs Tiex reform Pension setilement charge Pension and postretirement benefit mark-io-market adjusiments Impairment charges Per share - assuming dilution Restructuning charges, implementation costs and other related costs Tax reform Pension setlement charge tmpairment charges Pension and posiretirement benefit mark-to-market adjusiments In 2019, the following charges (gains) were recorded in Earnings (loss) from discontinued operations: Restructuring charges, implementation costs and other related costs Impairment charges Charges associated with divestitures Pension benefit mark-to-market adjustments Per share - assuming dilution Retructuring charges, implementation costs and other relaied costs (1) Intermational). 2) The 2019 eamings from restructuring charge and impairment charges of 5 $22 million (\$.07 per sha benefit pension and post Cuts and Jobs Aet that w by the following: impair (5.17 per share) associat businesses, and on defer to Kelsen; costs of $10 losses of $9 million ( $.03 (3) The 2018 earnings from restructuring charge and gains of 5100 million postretirement plans; imp integration costs of 573m million ( $.42 per share) di of a legal claim. Loss fror million ( $.01 per share) (\$1.89 per share) related reporting unit, and the B share) associated with mar (4) The 2017 earnings from c restructuring charge and gains of $100 million ($ postretirement plans; and notes receivable to a fir restructuring charge and impairment charges of $1 carrot ingredients reporting ( $.01 per share) primarily S16 million ( 5.05 per share (AIl per share amounts below are on a diluted basis) In February 2016, the Financial Accounting Standards Board (FASB) issued guidance that amends accounting for leases. In July 2018, the FASB issued an adoption approach that allows entities to apply the new guidance and recognize a cumulativeeffect adjustment to the opening balance of retained earnings in the period of adoption without restating prior periods. We adopted the guidance in 2020 using this transition method. In May 2014, the FASB issued revised guidance on the recognition of revenue from contracts with customers. We adopted the guidance in 2019 using the modified retrospective method. In March 2017, the FASB issued guidance that changes the presentation of net periodic pension cost and net periodic postretirement benefit cost. The guidance also allows only the service cost component to be eligible for capitalization when (5) The 2016 eamings from co restructuring charge and co losses of $187 million (S postretirement plans. Earni million (\$.41 per share) rel losses of $13 million (S.04 gain of \$25 million (\$.08 p (0) million. This problem is based on the 2020 annual report of Campbell Soup Company. Answer the following questions. Refer to the Selected financial data (see page 16. The PDF in the link may not be accessible.) for parts (a) to (d). Required: 0. Find the net sales in 2017. Note: Enter your onswer in millions. b. Calculate the operating income (earnings before interest and taxes) in 2016. Note: Enter your answer in millions. c. Calculate the difference between operating income (earnings before interest and taxes) and net income (net earnings) in 2018. Note: Enter your onswer in millions. d. Find the year(s) in which net income (net earnings) decreased compared to the previous year. e. Find the amount of interest paid for 2020 in the Interest paid. (See page 83. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. f. Find the number of stock options exercisable at August 2, 2020 in the Stock options. (See page 78. The PDF in the link may not be accessible.). Note: Enter your onswer in thousands. g. Find the net sales to customers outside the United States for 2020 in the Geographic segment information. (See page 56. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. h. Find the cost of products sold for the third quarter of 2020 in the Quarterly data. (See page 84. The PDF in the link may not be accessible.). Note: Enter your onswer in millions. e. Find the amount of interest paid for 2020 in the Interest paid. (See page 83. The PDF in the link may not be accessible.). Note: Enter your answer in millions. f. Find the number of stock options exercisable at August 2, 2020 in the Stock options. (See page 78. The PDF in the link may not be accessible.). Note: Enter your answer in thousands. g. Find the net sales to customers outside the United States for 2020 in the Geographic segment information. (See page 56. The PDF in the link may not be accessible.). Note: Enter your answer in millions. h. Find the cost of products sold for the third quarter of 2020 in the Quarterly data. (See page 84. The PDF in the link may not be accessible.). Note: Enter your answer in millions. sale of the Kelsen business and International). (2) The 2019 earnings from continuin restructuring charge and costs of impairment charges of S13 million \$22 million (\$.07 per share); losse: benefit pension and postretirement Cuts and Jobs Act that was signed by the following: impairment charg (\$.17 per share) associated with the businesses, and on deferred tax ass to Kelsen; costs of $10 million (\$. losses of $9 million (\$.03 per share) (3) The 2018 [eamings from continuing restructuring charge and costs of $1 gains of S100 million (S.33 per si postretirement plans; impairment ch integration costs of \$73 million (\$.24 million ( 5.42 per share) due to the en of a legal claim. Loss from discontin million ( $.01 per share) associated (\$1.89 per share) related to the Bo reporting unit, and the Bolthouse Fa share) associated with mark-to-market (t) The 2017 earnings from continuing op restructuring charge and costs of $30 gains of $100 million ( $.33 per sha postretirement plans; and a tax benefit notes receivable to a financial instit restructuring charge and costs of 57n impairment charges of $180 million (s carrot ingredients reporting unit and the ( $.01 per share) primarily associated wi (All per share amounts below are on a diluted basis) In February 2016, the Financial Accounting Standards Board (FASB) issued guidance that amends accounting for leases. In July 2018, the FASB issued an adoption approach that allows entities to apply the new guidance and recognize a cumulativeeffect adjustment to the opening balance of retained eamings in the period of adoption without restating prior periods. We adopted the guidance in 2020 using this transition method. In May 2014, the FASB issued revised guidance on the recognition of revenue from contracts with customers. We adopted the guidance in 2019 using the modified retrospective method. In March 2017, the FASB issued guidance that changes the presentation of net periodic pension cost and net periodic postretirement benefit cost. The guidance also allows only the service cost component to be eligible for capitalization when applicable (for example, as a cost of internally manufactured inventory). We adopted the guidance in 2018 and retrospectively adjusted prior periods. \$1 6 million ( $.05 per share) associated v (5) The 2016 earnings from continuing ope restructuring charge and costs of $49mi losses of $187 million ( $.60 per share postretirement plans, Earnings from disc million ( $.41 per share) related to the int losses of 513 million ( $.04 per share) ass gain of $25 million ( $.08 per share) assoc (6) Total debt includes debt related to disco million. Selected Financial Data should be read in conj (1) See Note 6 for additional information. (2) 2020 includes a loss of $45 related to Acre. See Note 16 for additional information. (3) In 2020, we recognized a loss of $64 on the sale of the European chips business. See Note 3 for additional information. (4) In 2018, we recognized transaction costs of \$53 related to the acquisition of Snyder's-Lance. See Note 4 for additional information. (5) Included in Marketing and selling expenses. Totil pre-tax stock-based compensalion expense and lax-related benefits recogenized in Eamings (loss) from discontinued operations were as follows: We defermine the fair value of time-lapse resicicted Totil pre-tax stock-hased compensation expense Thx-related benefits performance resiricted stock units, special performance restricte on the quoted price of our stock at the date of grant. We expen the vesting period, except for awards issued to refirement-eligib expense EPS performance reatricted stock units on a graded-v participants, which we expense on an accelerated basis. There w August 2, 2020, with a grant-date fair value of 5.16.82. We wi requisife service period of each objective. In 2019 , we issued ap units. As of August 2, 2020, we have granted 258 thousand of t included in the table above. There were 166 thousand FCF perfo weighted-average grant date fair value of 542.16 . The actual nu performance restricted stock units, and FCF performance restrict achieved. We estimate expense based on the number of awards expe As of August 2, 2020, total remaining uneamed compensation performance restricted stock units and FCF performance restricted average remaining service period of 1.7 years. The fair value of res $41,526 and 530 , respectively. The weighted-average grant-date fair 2018 was 53651 and 544,18 , respectively. measure the fair value of stock options using the Black-Scholes was 82 . No options were exercised during 2019 or 2018 . We based on the weighted average time of vesting and the end of the controctual term. We expected term of options granted was not have suficient historical exercise data to provide a reasonable basis upon which to estimate the expected term. The weighted-average assumptions and grant-date fair values for grants in 2019 and 2018 were as follows: participants, which we optons on a straight-line basis over the vesting period, except for awands issued to retirement eligible nonvested stack options was SI, which accelerated basis. As of August 2, 2020, Iotal remaining unearned compensation related to . performance restricted stock units as of August 2,2020: The following table summarizes TSR performance restricted stoc We estimated the fair value of TSR performance restricted stock un Weighted-average assumptions used in the Monte Carlo simulation were a Risk-free interest rate Expected dividend yield Expected volatility Expected lerm We recognize compensation expense on a straight-line basis over the se eligible participants, which we expense on an accelerated basis. As of Augu related to TSR performance restricted stock units was 522 , which will be initial grants based upon our TSR ranking in a performance peer group durit first quarter of 2019, recipients of TSR performance restricted stock units ea ranking in a performance peer group during a three-year period ended July 2 TSR performance restricled stock units earned 125% of the initial grants bas group during a three-year period ended July 28, 2017. As a result, approximate The fair value of TSR performance restricted slock units vested during 2018 value of the TSR performance restricied slock units granted during 2019 and 2 first quarter of 2021, recipients of TSR performance restricted stock units w ranking in a performance peer group during a three-year peniod ended July 31,2 chips, tortilla chips anous soup, broths and stock products. Snacks include cookies, pretzels, crackers, popcom, nuts, potato Geographic Aren Information Information about continuing operations in different geographic areas is as follows: 8. Restructuring Charges and Cost Savings Initiatives Mhulti-y var Cost Savings Initiativer and Spover's-Lance Cost Transformation Program and Integnation Beqinning in fiscal 2015, we implemented initiatives to reduce costs and to streamline our organizational structure In recent years, we expanded these initiatives by further optimizing our supply chain and manufacturing networks, including closing our manufacturing facility in Toronto, Ontario, as well as our information technology infrastructure. On March 26, 2018, we completed the acquisition of Snyder's-Lance. Prior to the acquisition, Snyder's-Lance launched a cost transformation program following a comprehensive review of its operations with the goal of significantly improving its financial performance. We continue to implement this program. In addition, we have identified opportunities for additional cost synergies as we integrate Snyder's-Lance. Cost estimates, as well as timing for certain activities, are continuing to be developed. A summary of the pre-tax charges recorded in Earnings from continuing operations related to these initiatives is as follows: Severance pay and benefits Asset impairmentaccelerated depreciation Implementation costs and other related costs Total The total estimated pretax costs for actions associated with approximately $665 to $690 and we expect to incur substantially all of costs for the expanded initiatives are developed. We expect the costs for actions associated with continuing operat following: approximately $215 to $220 in severance pay and benefits. depreciation; and approximately $380 to $400 in implementation costs a be associated with our segments as follows: Meals \& Beverages - ap Corporate - approximately 25%. Of the aggregate $665 to $690 of pre-tax costs associated with approximately $585 to $610 will be cash expenditures. In addition, expenditures through 2022, of which we invested 5336 as of August 2,2 U.S. warehouse optimization project, improvement of quality, safe manufacturing network, implementation of an SAP enterprise-resource information technology infrastructure and applications, transition of prod warchouse and distribution network. A summary of the restructuring activity and related reserves associated follows: (1) (1) Includes $24 of severance pay and benefits recorded in Other liabilities in th (2) Includes $8 of severance pay and benefits recorded in Other liabilities in the (1) Includes $3 of severance pay and benefits recorded in Other liabilities in the Net sales Gruss profit Eamings (loss) frum cuntinuing operations at tributable to Campbell s Company Eamings (loss) from discontinued opentions Net earmuga (loss) attributable to Campbell Soup Company Per share - basic Earnings (loss) from contimuing operations attributable to Campb Company Earnings (loss) from discontinusd operntions Net earnings (loss) attrihutable to Campbell Soup Company 113 Dividends Eamings per share - assuming dilution From continuing openations attributable to Campbell Soup Compan From discontinued operations Net attributable to Campbell Soup Company (1) (1) The sum of individual per share amounts may not add due to rounding (11) The sum of individual per share amounts may not add due to rounding In 2019, the following charges (gains) were recorded in Earnings (loss) fro continuing operations attributable to Campbell Soup Company Restructuring charges, implementation costs and other related costs Tiex reform Pension setilement charge Pension and postretirement benefit mark-io-market adjusiments Impairment charges Per share - assuming dilution Restructuning charges, implementation costs and other related costs Tax reform Pension setlement charge tmpairment charges Pension and posiretirement benefit mark-to-market adjusiments In 2019, the following charges (gains) were recorded in Earnings (loss) from discontinued operations: Restructuring charges, implementation costs and other related costs Impairment charges Charges associated with divestitures Pension benefit mark-to-market adjustments Per share - assuming dilution Retructuring charges, implementation costs and other relaied costs (1) Intermational). 2) The 2019 eamings from restructuring charge and impairment charges of 5 $22 million (\$.07 per sha benefit pension and post Cuts and Jobs Aet that w by the following: impair (5.17 per share) associat businesses, and on defer to Kelsen; costs of $10 losses of $9 million ( $.03 (3) The 2018 earnings from restructuring charge and gains of 5100 million postretirement plans; imp integration costs of 573m million ( $.42 per share) di of a legal claim. Loss fror million ( $.01 per share) (\$1.89 per share) related reporting unit, and the B share) associated with mar (4) The 2017 earnings from c restructuring charge and gains of $100 million ($ postretirement plans; and notes receivable to a fir restructuring charge and impairment charges of $1 carrot ingredients reporting ( $.01 per share) primarily S16 million ( 5.05 per share (AIl per share amounts below are on a diluted basis) In February 2016, the Financial Accounting Standards Board (FASB) issued guidance that amends accounting for leases. In July 2018, the FASB issued an adoption approach that allows entities to apply the new guidance and recognize a cumulativeeffect adjustment to the opening balance of retained earnings in the period of adoption without restating prior periods. We adopted the guidance in 2020 using this transition method. In May 2014, the FASB issued revised guidance on the recognition of revenue from contracts with customers. We adopted the guidance in 2019 using the modified retrospective method. In March 2017, the FASB issued guidance that changes the presentation of net periodic pension cost and net periodic postretirement benefit cost. The guidance also allows only the service cost component to be eligible for capitalization when (5) The 2016 eamings from co restructuring charge and co losses of $187 million (S postretirement plans. Earni million (\$.41 per share) rel losses of $13 million (S.04 gain of \$25 million (\$.08 p (0) million

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started