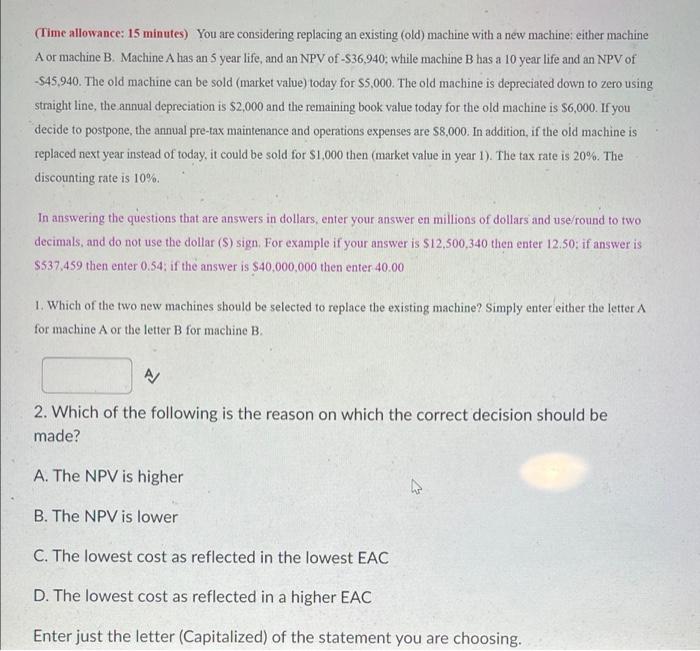

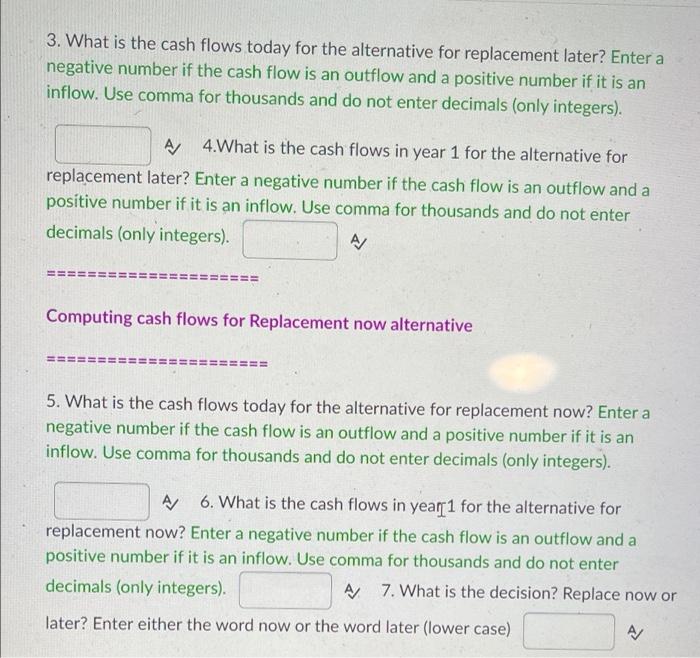

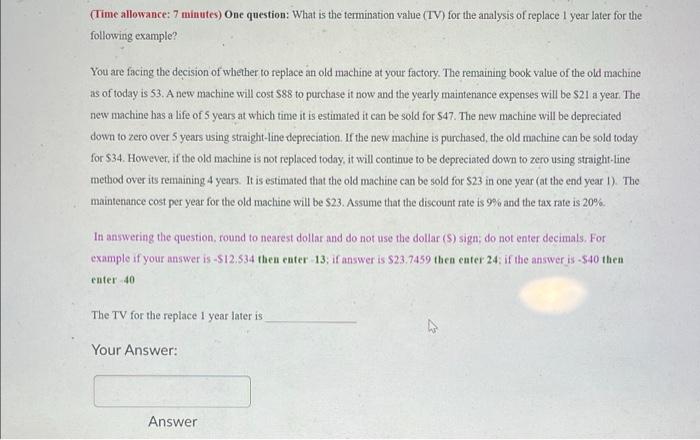

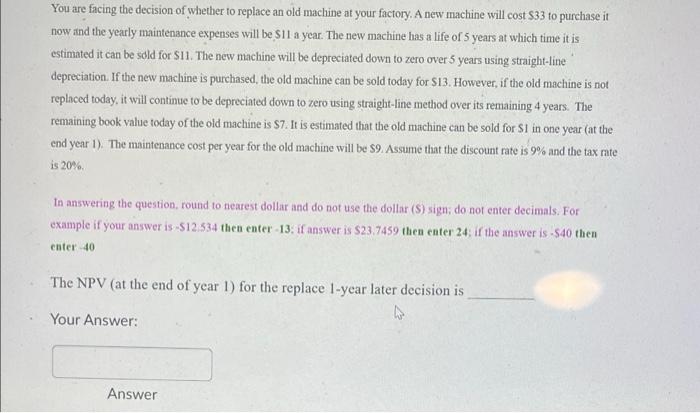

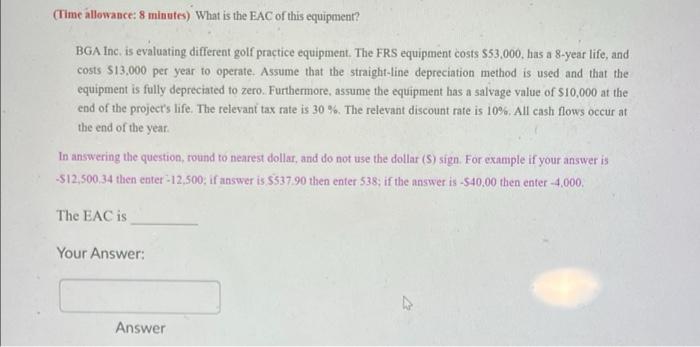

(Time allowance: 15 minutes) You are considering replacing an existing (old) machine with a new machine: either machine A or machine B. Machine A has an 5 year life, and an NPV of -$36,940; while machine B has a 10 year life and an NPV of -$45,940. The old machine can be sold (market value) today for $5,000. The old machine is depreciated down to zero using straight line, the annual depreciation is $2,000 and the remaining book value today for the old machine is $6,000. If you decide to postpone, the annual pre-tax maintenance and operations expenses are $8,000. In addition, if the old machine is replaced next year instead of today, it could be sold for $1,000 then (market value in year 1). The tax rate is 20%. The discounting rate is 10%. In answering the questions that are answers in dollars, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar (S) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 1. Which of the two new machines should be selected to replace the existing machine? Simply enter either the letter A for machine A or the letter B for machine B. A/ 2. Which of the following is the reason on which the correct decision should be made? A. The NPV is higher B. The NPV is lower C. The lowest cost as reflected in the lowest EAC D. The lowest cost as reflected in a higher EAC Enter just the letter (Capitalized) of the statement you are choosing. 3. What is the cash flows today for the alternative for replacement later? Enter a negative number if the cash flow is an outflow and a positive number if it is an inflow. Use comma for thousands and do not enter decimals (only integers). A 4.What is the cash flows in year 1 for the alternative for replacement later? Enter a negative number if the cash flow is an outflow and a positive number if it is an inflow. Use comma for thousands and do not enter decimals (only integers). A === Computing cash flows for Replacement now alternative === 5. What is the cash flows today for the alternative for replacement now? Enter a negative number if the cash flow is an outflow and a positive number if it is an inflow. Use comma for thousands and do not enter decimals (only integers). A 6. What is the cash flows in year1 for the alternative for replacement now? Enter a negative number if the cash flow is an outflow and a positive number if it is an inflow. Use comma for thousands and do not enter decimals (only integers). A 7. What is the decision? Replace now or later? Enter either the word now or the word later (lower case) (Time allowance: 7 minutes) One question: What is the termination value (TV) for the analysis of replace 1 year later for the following example? You are facing the decision of whether to replace an old machine at your factory. The remaining book value of the old machine as of today is 53. A new machine will cost $88 to purchase it now and the yearly maintenance expenses will be $21 a year. The new machine has a life of 5 years at which time it is estimated it can be sold for $47. The new machine will be depreciated down to zero over 5 years using straight-line depreciation. If the new machine is purchased, the old machine can be sold today for $34. However, if the old machine is not replaced today, it will continue to be depreciated down to zero using straight-line method over its remaining 4 years. It is estimated that the old machine can be sold for $23 in one year (at the end year 1). The maintenance cost per year for the old machine will be $23. Assume that the discount rate is 9% and the tax rate is 20%. In answering the question, round to nearest dollar and do not use the dollar (S) sign; do not enter decimals. For example if your answer is -$12.534 then enter-13; if answer is $23.7459 then enter 24: if the answer is -$40 then enter 40 The TV for the replace 1 year later is Your Answer: Answer You are facing the decision of whether to replace an old machine at your factory. A new machine will cost $33 to purchase it now and the yearly maintenance expenses will be $11 a year. The new machine has a life of 5 years at which time it is estimated it can be sold for $11. The new machine will be depreciated down to zero over 5 years using straight-line depreciation. If the new machine is purchased, the old machine can be sold today for $13. However, if the old machine is not replaced today, it will continue to be depreciated down to zero using straight-line method over its remaining 4 years. The remaining book value today of the old machine is $7. It is estimated that the old machine can be sold for $1 in one year (at the end year 1). The maintenance cost per year for the old machine will be $9. Assume that the discount rate is 9% and the tax rate is 20%. In answering the question, round to nearest dollar and do not use the dollar (S) sign; do not enter decimals. For example if your answer is -$12.534 then enter-13; if answer is $23.7459 then enter 24; if the answer is -$40 then enter 40 The NPV (at the end of year 1) for the replace 1-year later decision is Your Answer: Answer (Time allowance: 8 minutes) What is the EAC of this equipment? BGA Inc. is evaluating different golf practice equipment. The FRS equipment costs $53,000, has a 8-year life, and costs $13,000 per year to operate. Assume that the straight-line depreciation method is used and that the equipment is fully depreciated to zero. Furthermore, assume the equipment has a salvage value of $10,000 at the end of the project's life. The relevant tax rate is 30 %. The relevant discount rate is 10%. All cash flows occur at the end of the year. In answering the question, round to nearest dollar, and do not use the dollar (S) sign. For example if your answer is -$12,500.34 then enter -12,500; if answer is $537.90 then enter 538; if the answer is -$40,00 then enter -4,000. The EAC is Your