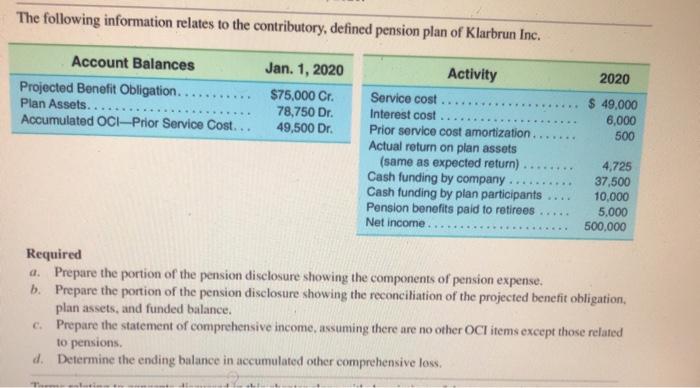

Question: The following information relates to the contributory, defined pension plan of Klarbrun Inc. Account Balances Jan. 1, 2020 Activity 2020 Projected Benefit Obligation.. Plan

The following information relates to the contributory, defined pension plan of Klarbrun Inc. Account Balances Jan. 1, 2020 Activity 2020 Projected Benefit Obligation.. Plan Assets.. Accumulated OCI-Prior Service Cost... $75,000 Cr. 78,750 Dr. 49,500 Dr. Service cost. Interest cost Prior service cost amortization. $ 49,000 6,000 500 ........ .... ..... Actual return on plan assets (same as expected return) Cash funding by company Cash funding by plan participants Pension benefits paid to retirees Net income... 4,725 37,500 10,000 5,000 500,000 ... ... Required a. Prepare the portion of the pension disclosure showing the components of pension expense. b. Prepare the portion of the pension disclosure showing the reconciliation of the projected benefit obligation, plan assets, and funded balance. c. Prepare the statement of comprchensive income, assuming there are no other OCI items except those related to pensions. d. Determine the ending balance in accumulated other comprehensive loss.

Step by Step Solution

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts